Complex Will with Credit Shelter Marital Trust for Large Estates Idaho Form

Understanding the Complex Will With Credit Shelter Marital Trust For Large Estates Idaho

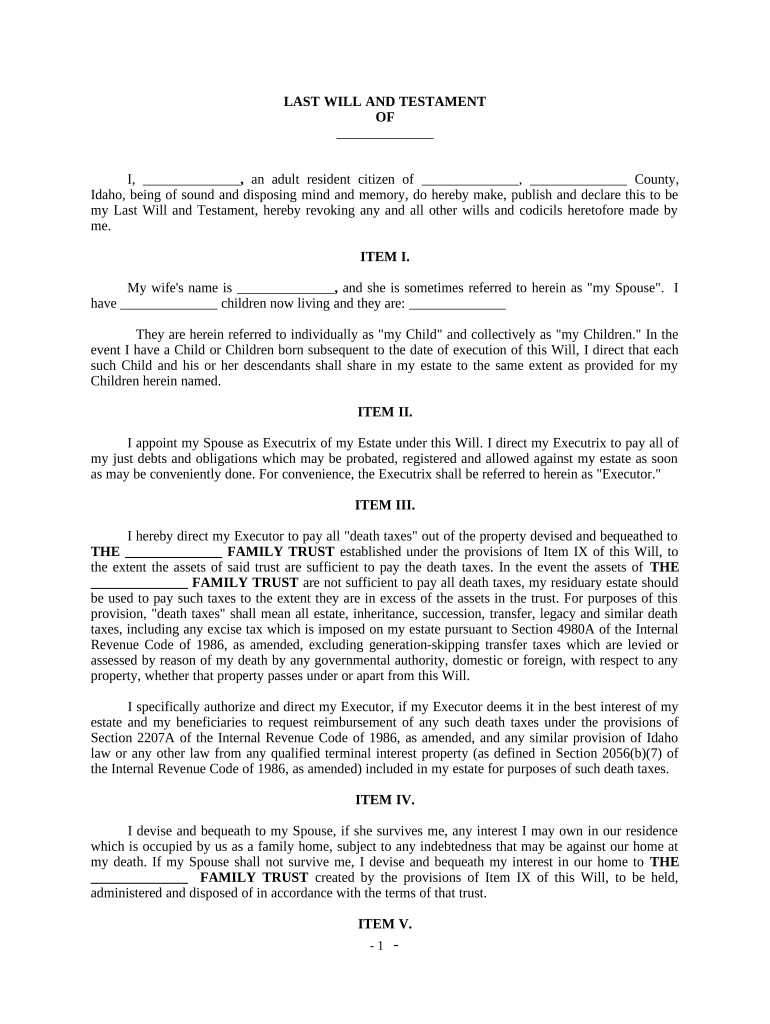

The Complex Will With Credit Shelter Marital Trust for Large Estates in Idaho is a legal document designed to help individuals manage their estate planning effectively. This type of will incorporates a credit shelter trust, which allows a married couple to maximize their estate tax exemptions. By doing so, it can help preserve wealth for heirs while minimizing tax liabilities. This trust structure is particularly beneficial for large estates, as it can protect assets from excessive taxation upon the death of the first spouse.

Steps to Complete the Complex Will With Credit Shelter Marital Trust For Large Estates Idaho

Completing the Complex Will With Credit Shelter Marital Trust involves several important steps:

- Gather Information: Collect all necessary financial and personal information, including assets, debts, and family details.

- Consult an Attorney: Work with an estate planning attorney who specializes in trusts and estates to ensure compliance with Idaho laws.

- Draft the Will: Create a draft of the will, including specific provisions for the credit shelter trust.

- Review and Revise: Review the draft with your attorney, making any necessary revisions based on legal advice.

- Execute the Will: Sign the will in front of witnesses as required by Idaho law to ensure its validity.

Legal Use of the Complex Will With Credit Shelter Marital Trust For Large Estates Idaho

The legal use of the Complex Will With Credit Shelter Marital Trust in Idaho is governed by state laws regarding wills and trusts. This document must meet specific legal requirements to be enforceable. It is essential to ensure that the will is properly executed, which typically involves signing in the presence of at least two witnesses. Additionally, the trust provisions must comply with Idaho's trust laws to effectively manage and distribute assets according to the testator's wishes.

Key Elements of the Complex Will With Credit Shelter Marital Trust For Large Estates Idaho

Several key elements define the Complex Will With Credit Shelter Marital Trust:

- Trust Creation: Establishes a credit shelter trust to hold assets for the benefit of the surviving spouse and heirs.

- Tax Benefits: Utilizes estate tax exemptions to minimize tax burdens on the estate.

- Asset Protection: Protects assets from creditors and potential estate taxes upon the death of the first spouse.

- Distribution Instructions: Clearly outlines how assets will be distributed among beneficiaries after both spouses pass away.

State-Specific Rules for the Complex Will With Credit Shelter Marital Trust For Large Estates Idaho

Idaho has specific rules that govern the creation and execution of wills and trusts. For the Complex Will With Credit Shelter Marital Trust, it is important to adhere to the following:

- Witness Requirements: The will must be signed by the testator and at least two witnesses who are not beneficiaries.

- Notarization: While notarization is not required for the will to be valid, it can help in proving its authenticity.

- Trust Registration: Certain trusts may need to be registered with the state, depending on the assets involved.

How to Obtain the Complex Will With Credit Shelter Marital Trust For Large Estates Idaho

To obtain a Complex Will With Credit Shelter Marital Trust in Idaho, individuals should consider the following steps:

- Consultation: Schedule a consultation with an estate planning attorney to discuss specific needs and goals.

- Document Preparation: Work with the attorney to prepare the necessary documents, ensuring they reflect your wishes accurately.

- Review Process: Carefully review all documents before finalizing to ensure clarity and compliance with legal standards.

- Execution: Sign the documents in accordance with Idaho laws, ensuring all legal requirements are met.

Quick guide on how to complete complex will with credit shelter marital trust for large estates idaho

Complete Complex Will With Credit Shelter Marital Trust For Large Estates Idaho effortlessly on any device

Managing documents online has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly, without any hold-ups. Handle Complex Will With Credit Shelter Marital Trust For Large Estates Idaho on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Complex Will With Credit Shelter Marital Trust For Large Estates Idaho with ease

- Download Complex Will With Credit Shelter Marital Trust For Large Estates Idaho and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of missing or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device you choose. Edit and eSign Complex Will With Credit Shelter Marital Trust For Large Estates Idaho and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Complex Will With Credit Shelter Marital Trust For Large Estates in Idaho?

A Complex Will With Credit Shelter Marital Trust For Large Estates in Idaho is a sophisticated estate planning tool used to minimize taxes and protect assets for high net-worth individuals. This type of will allows you to allocate assets effectively within a marital trust, ensuring that both spouses can benefit from estate tax exemptions.

-

How can airSlate SignNow assist with creating a Complex Will With Credit Shelter Marital Trust For Large Estates in Idaho?

airSlate SignNow offers an intuitive platform that simplifies the process of drafting and eSigning documents, including a Complex Will With Credit Shelter Marital Trust For Large Estates in Idaho. Our solution ensures all necessary legal language is included, saving you time and reducing errors during the signing process.

-

What are the benefits of using a Complex Will With Credit Shelter Marital Trust For Large Estates in Idaho?

Utilizing a Complex Will With Credit Shelter Marital Trust For Large Estates in Idaho helps ensure that your estate is managed according to your wishes while minimizing tax liabilities. This tool also provides peace of mind and financial security for your surviving spouse and heirs by leveraging available tax exemptions.

-

Is there a cost associated with preparing a Complex Will With Credit Shelter Marital Trust For Large Estates in Idaho through airSlate SignNow?

While airSlate SignNow offers an affordable pricing model for its eSignature services, the cost of preparing a Complex Will With Credit Shelter Marital Trust For Large Estates in Idaho may vary based on the complexity of your needs. We recommend consulting with a legal professional for a detailed estimate based on your specific situation.

-

Can I integrate airSlate SignNow with other platforms for managing my estate planning documents?

Absolutely! airSlate SignNow integrates seamlessly with a variety of platforms, making it easier to manage your estate planning documents like a Complex Will With Credit Shelter Marital Trust For Large Estates in Idaho. This feature ensures that you can access and share documents efficiently across your preferred tools.

-

How does airSlate SignNow ensure the security of my Complex Will With Credit Shelter Marital Trust For Large Estates in Idaho?

Security is a top priority at airSlate SignNow. We employ industry-standard encryption and security protocols to safeguard your Complex Will With Credit Shelter Marital Trust For Large Estates in Idaho from unauthorized access, ensuring that your sensitive information remains confidential.

-

What if I need to make changes to my Complex Will With Credit Shelter Marital Trust For Large Estates in Idaho?

Making changes to your Complex Will With Credit Shelter Marital Trust For Large Estates in Idaho is simple with airSlate SignNow. You will be able to revise your documents and eSign the updates easily, ensuring your estate plan remains current and reflects your wishes.

Get more for Complex Will With Credit Shelter Marital Trust For Large Estates Idaho

- Progressive test answers form

- Blue shield of california provider identification number application form

- Rf12 form 100425693

- Physiotherapy report template form

- Indiana cna license renewal form

- Credit slip sample form

- Form ccf 55 the north carolina court system nccourts

- Tennessee eviction notice forms process and laws pdf

Find out other Complex Will With Credit Shelter Marital Trust For Large Estates Idaho

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free