Living Trust Property Record Idaho Form

What is the Living Trust Property Record Idaho

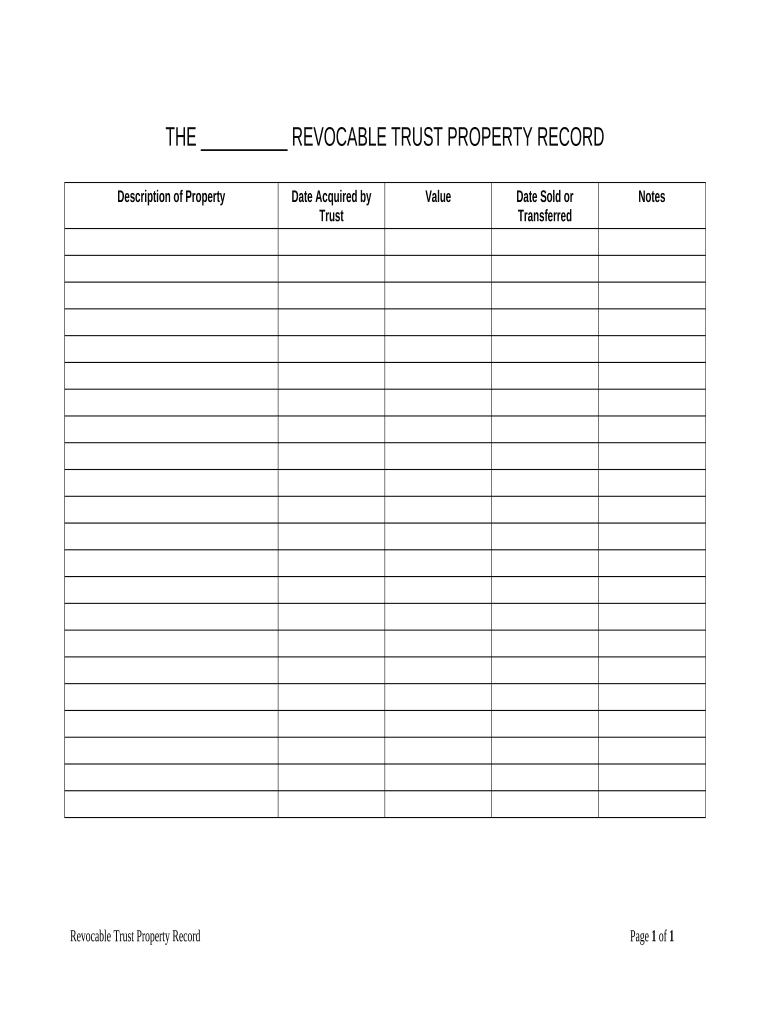

The Living Trust Property Record in Idaho is a legal document that outlines the assets held in a living trust. This record serves as a formal declaration of the property included in the trust and is essential for managing and distributing assets according to the trustor's wishes. It provides clarity on ownership and can help avoid probate, ensuring a smoother transition of assets upon the trustor's passing. This document is particularly important for individuals looking to protect their estate and provide for their beneficiaries without the complexities of traditional probate processes.

How to use the Living Trust Property Record Idaho

Using the Living Trust Property Record in Idaho involves several steps. First, gather all necessary information about the assets you wish to include in the trust, such as real estate, bank accounts, and personal property. Next, fill out the record accurately, ensuring that all details are correct and complete. Once the form is filled out, it should be signed and dated by the trustor. Depending on the specific requirements, it may also need to be notarized to ensure its legal validity. Finally, keep the completed record in a safe place and provide copies to relevant parties, such as trustees or beneficiaries.

Steps to complete the Living Trust Property Record Idaho

Completing the Living Trust Property Record in Idaho involves a systematic approach:

- Identify and list all assets that will be included in the trust.

- Obtain the official Living Trust Property Record form from a reliable source.

- Fill in the required information, ensuring all asset details are accurate.

- Review the completed form for any errors or omissions.

- Sign and date the document in the presence of a notary, if required.

- Store the document securely and distribute copies as necessary.

Legal use of the Living Trust Property Record Idaho

The Living Trust Property Record in Idaho is legally binding when completed correctly. It serves as evidence of the trustor's intent to place specific assets into the trust. To ensure its legal standing, it must comply with Idaho state laws regarding trust documentation. This includes proper execution, which may involve notarization and adherence to any state-specific requirements. Failure to follow these legal guidelines could result in challenges to the trust's validity, potentially complicating asset distribution.

State-specific rules for the Living Trust Property Record Idaho

Idaho has specific regulations governing the creation and use of living trusts. It is important to ensure that the Living Trust Property Record adheres to these rules. For instance, the trust must be established during the trustor's lifetime, and the trustor must have the legal capacity to create the trust. Additionally, Idaho law requires that the trust document clearly outline the terms and conditions of the trust, including the identification of beneficiaries and the management of assets. Understanding these state-specific rules is crucial for the proper execution and enforcement of the living trust.

Required Documents

To complete the Living Trust Property Record in Idaho, certain documents are necessary. These typically include:

- A completed Living Trust Property Record form.

- Proof of ownership for the assets being placed in the trust, such as deeds or titles.

- Identification documents for the trustor, which may include a driver's license or passport.

- Any existing wills or estate planning documents that may impact the trust.

Quick guide on how to complete living trust property record idaho

Prepare Living Trust Property Record Idaho seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage Living Trust Property Record Idaho on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Living Trust Property Record Idaho effortlessly

- Obtain Living Trust Property Record Idaho and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Living Trust Property Record Idaho to maintain clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust Property Record in Idaho?

A Living Trust Property Record in Idaho refers to the documentation that outlines assets placed within a living trust. This record is essential for managing your estate and ensuring a smooth transition of assets upon your passing. With airSlate SignNow, you can easily eSign these documents, ensuring that your Living Trust Property Record is secure and legally binding in Idaho.

-

How can airSlate SignNow help with my Living Trust Property Record in Idaho?

airSlate SignNow offers an easy-to-use platform that allows you to create, send, and eSign documents related to your Living Trust Property Record in Idaho. This ensures that all necessary paperwork is managed efficiently, reducing the chances of errors or delays. You can streamline your estate planning process with our reliable digital signing solutions.

-

What are the pricing options for airSlate SignNow when creating Living Trust Property Records in Idaho?

Our flexible pricing plans for airSlate SignNow are designed to meet the needs of different users, whether you're an individual or a business. You can explore affordable subscription plans that allow you to create and manage your Living Trust Property Record in Idaho without breaking the bank. Check our website for the latest pricing details and features.

-

What features does airSlate SignNow offer for managing Living Trust Property Records in Idaho?

airSlate SignNow includes features such as customizable document templates, secure eSignatures, and document tracking specifically for your Living Trust Property Record in Idaho. These features ensure that you have complete control over your documents, making it easier to manage and share your estate planning paperwork seamlessly.

-

Is airSlate SignNow legally recognized for Living Trust Property Records in Idaho?

Yes, airSlate SignNow is fully compliant with the legal standards for electronic signatures in Idaho, making it a trustworthy solution for your Living Trust Property Record. Our platform ensures that your signed documents are secure and admissible in court, providing peace of mind as you manage your estate planning.

-

Can I integrate airSlate SignNow with other tools while managing my Living Trust Property Record in Idaho?

Absolutely! airSlate SignNow offers integrations with various productivity tools and software, enhancing your ability to manage your Living Trust Property Record in Idaho efficiently. This means you can connect our eSigning solution with your favorite apps, making the entire estate planning process quicker and more convenient.

-

What benefits does using airSlate SignNow provide for my Living Trust Property Record in Idaho?

Using airSlate SignNow to manage your Living Trust Property Record in Idaho ensures a seamless, fast, and secure process. You can easily track document statuses, store files digitally, and eliminate the hassle of printing and faxing, ultimately saving you time and effort in your estate planning journey.

Get more for Living Trust Property Record Idaho

- Metroplus eft enrollment form

- Optional form 522

- California dmv reduced fee form dl 937 download california dmv reduced fee form dl 937 download

- Returning resident vaf4b december form

- Circle the noun form

- Blood pressure home monitoring service patient log sheet crossdeepsurgery co form

- Next of kin nok identification identification des plus form

- Impressed current cathodic protection system 60day inspection log for year ust owners and operators must inspect impressed form

Find out other Living Trust Property Record Idaho

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile