Idaho Incorporation Form

What is the Idaho Incorporation

The Idaho incorporation process involves legally establishing a business entity within the state of Idaho. This process allows individuals to create various types of business structures, such as corporations or limited liability companies (LLCs). Incorporating in Idaho provides several benefits, including limited liability protection for owners, potential tax advantages, and enhanced credibility with customers and suppliers. Understanding the specifics of Idaho incorporation is essential for anyone looking to start a business in the state.

How to obtain the Idaho Incorporation

To obtain Idaho incorporation, you need to follow a series of steps that ensure compliance with state regulations. Begin by selecting a unique business name that complies with Idaho naming requirements. Next, prepare and file the necessary formation documents with the Idaho Secretary of State. This typically includes the Articles of Incorporation for corporations or the Certificate of Organization for LLCs. Additionally, you may need to obtain an Employer Identification Number (EIN) from the IRS for tax purposes. Finally, ensure that you meet any local licensing and zoning requirements.

Steps to complete the Idaho Incorporation

Completing the Idaho incorporation process involves several key steps:

- Choose a unique business name that adheres to Idaho regulations.

- Select a registered agent who will receive legal documents on behalf of the business.

- Prepare and file the Articles of Incorporation or Certificate of Organization with the Idaho Secretary of State.

- Pay the required filing fees, which vary depending on the business type.

- Obtain an EIN from the IRS for tax identification.

- Establish internal governance documents, such as bylaws for corporations or an operating agreement for LLCs.

- Comply with any local business licenses and permits.

Key elements of the Idaho Incorporation

When incorporating in Idaho, several key elements must be addressed to ensure the process is legally sound:

- Business Name: Must be unique and not infringe on existing trademarks.

- Registered Agent: A designated individual or business entity responsible for receiving legal documents.

- Articles of Incorporation: Essential documents that outline the business structure and purpose.

- Filing Fees: Fees vary based on the type of entity being formed.

- Compliance with State Laws: Adherence to Idaho laws governing business operations.

Legal use of the Idaho Incorporation

The legal use of Idaho incorporation provides businesses with a framework to operate within the law. Incorporation establishes the business as a separate legal entity, which can enter contracts, sue, and be sued independently of its owners. This separation offers liability protection, meaning personal assets are generally shielded from business debts and legal actions. Additionally, incorporated businesses must comply with state regulations, including filing annual reports and maintaining proper records, to retain their legal status.

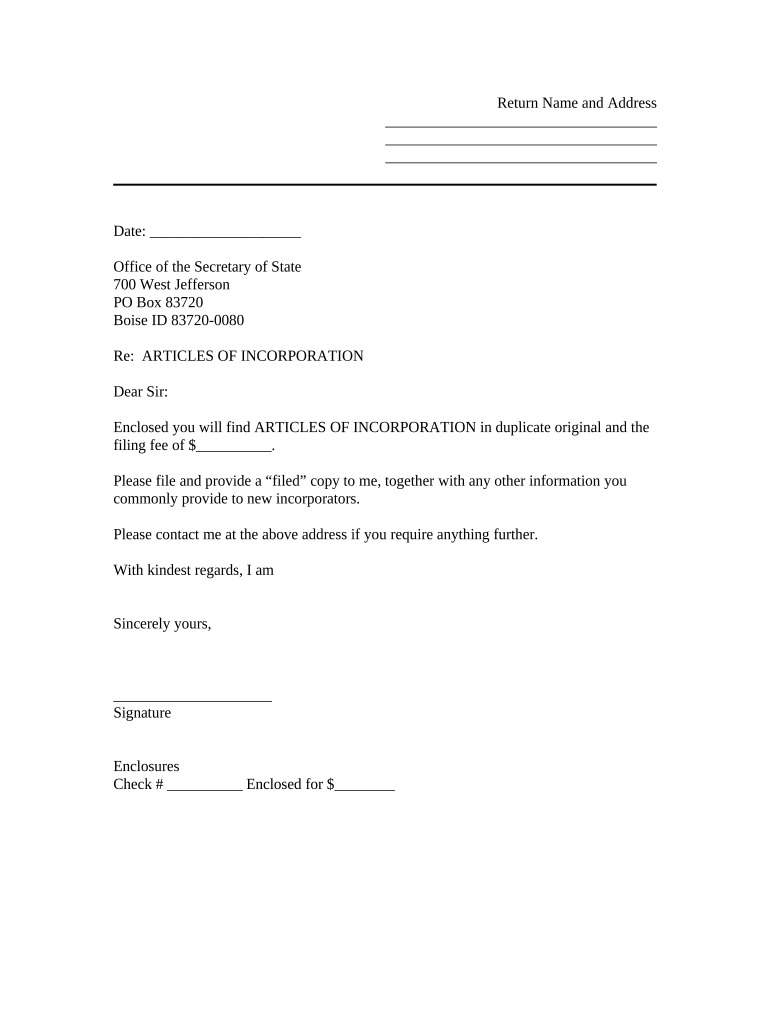

Form Submission Methods (Online / Mail / In-Person)

When submitting the necessary forms for Idaho incorporation, there are several methods available:

- Online Submission: The Idaho Secretary of State's website allows for electronic filing of incorporation documents, which is often the quickest method.

- Mail Submission: Forms can be printed, completed, and mailed to the Secretary of State's office with the appropriate filing fee.

- In-Person Submission: Individuals may also deliver their documents in person at the Secretary of State's office, which can expedite the processing time.

Quick guide on how to complete idaho incorporation

Set Up Idaho Incorporation Effortlessly on Any Device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Idaho Incorporation on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Steps to Modify and Electronically Sign Idaho Incorporation with Ease

- Obtain Idaho Incorporation and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then press the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Idaho Incorporation to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Idaho incorporation?

Idaho incorporation is the process of legally forming a corporation in the state of Idaho. This involves filing the necessary paperwork with the Idaho Secretary of State and adhering to state regulations. It's an essential step for any business looking to establish a legal identity and limit personal liability.

-

How much does Idaho incorporation cost?

The cost of Idaho incorporation can vary depending on the specific services you choose. Basic filing fees with the Idaho Secretary of State typically start around $100. Additional services, such as legal assistance or registered agent services, might bring the total cost higher but can be worth the investment for a smooth incorporation process.

-

What are the benefits of Idaho incorporation?

Incorporating in Idaho offers several benefits, including limited liability protection for personal assets and enhanced credibility with customers and investors. Additionally, Idaho corporations can benefit from favorable tax rates and a business-friendly regulatory environment, making it an attractive option for entrepreneurs.

-

What documents are required for Idaho incorporation?

To complete Idaho incorporation, you will need to prepare and file articles of incorporation with the state. You may also need to draft bylaws, obtain an Employer Identification Number (EIN), and ensure compliance with any local business licenses and permits specific to your industry.

-

How long does the Idaho incorporation process take?

The Idaho incorporation process typically takes between 5 to 10 business days once all necessary documents are submitted. If you opt for expedited filings, you can receive faster processing times. Properly preparing your documents beforehand can help streamline the process.

-

Can I manage my Idaho incorporation online?

Yes, you can manage your Idaho incorporation online through the Idaho Secretary of State's website. There, you can file your articles of incorporation, check the status of your application, and pay the required fees electronically. Utilizing tools like airSlate SignNow can make the eSigning and document management process even easier.

-

Are there any ongoing requirements for Idaho corporations?

Yes, Idaho corporations must fulfill ongoing requirements, including filing an annual report and paying an annual fee. Maintaining accurate records, holding regular board meetings, and ensuring compliance with state regulations is crucial. Staying on top of these requirements helps avoid penalties and ensures your corporation stays in good standing.

Get more for Idaho Incorporation

- Benetech forms

- Therapist employment application form

- Pa american water backflow test form

- Everything disc manual pdf download form

- Estate 706 tax organizer form

- White cap credit application form

- Gsa 2957pd reimbursable work authorization real property utilization and disposal form

- Sales contract 788027344 form

Find out other Idaho Incorporation

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate