Quitclaim Deed from Corporation to LLC Illinois Form

What is the Quitclaim Deed From Corporation To LLC Illinois

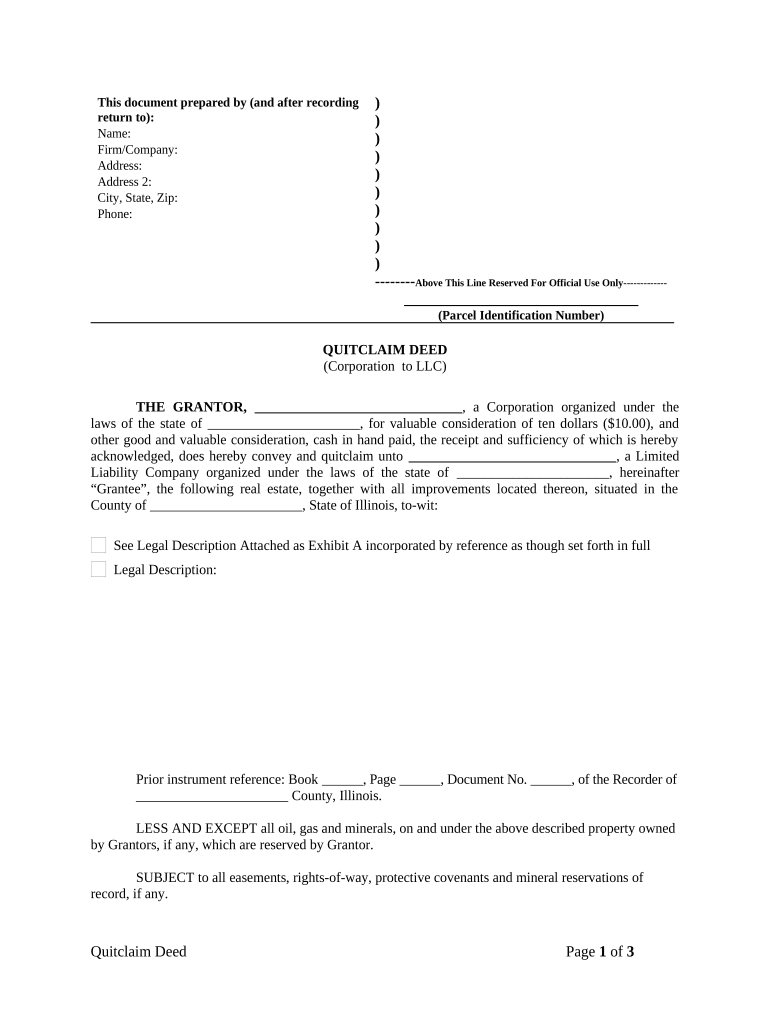

A quitclaim deed from a corporation to an LLC in Illinois is a legal document that facilitates the transfer of property ownership from a corporation to a limited liability company. This type of deed is often used when a corporation wishes to transfer its real estate assets to an LLC, which may provide liability protection and tax benefits. Unlike warranty deeds, quitclaim deeds do not guarantee that the title is free from defects; they simply transfer whatever interest the corporation has in the property. This makes it essential for the parties involved to conduct proper due diligence before proceeding with the transfer.

Steps to Complete the Quitclaim Deed From Corporation To LLC Illinois

Completing a quitclaim deed from a corporation to an LLC involves several key steps to ensure the transfer is legally valid. The process typically includes:

- Gather necessary information, including the legal description of the property, the names of the parties involved, and any relevant corporate resolutions.

- Draft the quitclaim deed, ensuring it includes all required elements, such as the grantor's and grantee's names, the property description, and the signature of an authorized corporate representative.

- Have the document notarized to verify the identities of the signers and to comply with state requirements.

- File the completed quitclaim deed with the appropriate county recorder's office to make the transfer official and public.

Legal Use of the Quitclaim Deed From Corporation To LLC Illinois

The quitclaim deed from a corporation to an LLC is legally recognized in Illinois, provided it meets state-specific requirements. It serves as a straightforward method for transferring property without the complexities associated with warranty deeds. However, it is crucial for both parties to understand the implications of this type of deed, particularly regarding liability and title issues. Legal counsel is often recommended to navigate any potential complications that may arise during the transfer process.

State-Specific Rules for the Quitclaim Deed From Corporation To LLC Illinois

In Illinois, specific rules govern the use of quitclaim deeds. These include:

- The deed must be in writing and signed by the grantor.

- It should contain a legal description of the property being transferred.

- Notarization is required to validate the signatures.

- Filing the deed with the county recorder's office is necessary for the transfer to be effective against third parties.

Failure to adhere to these rules may result in the deed being deemed ineffective, which can complicate ownership claims in the future.

Required Documents for the Quitclaim Deed From Corporation To LLC Illinois

To complete a quitclaim deed from a corporation to an LLC in Illinois, several documents are required. These typically include:

- The quitclaim deed itself, properly drafted and signed.

- A corporate resolution authorizing the transfer of property.

- Proof of identity for the signers, such as a driver's license or state ID.

- The legal description of the property being transferred.

Having all necessary documents prepared can streamline the process and help avoid delays during the transfer.

Who Issues the Quitclaim Deed From Corporation To LLC Illinois

The quitclaim deed itself is not issued by a specific authority; rather, it is created by the parties involved in the property transfer. Typically, the corporation's legal representative or an attorney drafts the deed. Once completed, the deed must be signed, notarized, and then filed with the appropriate county recorder's office in Illinois. This filing is what officially records the transfer of ownership and makes it public record.

Quick guide on how to complete quitclaim deed from corporation to llc illinois

Prepare Quitclaim Deed From Corporation To LLC Illinois seamlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can find the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Quitclaim Deed From Corporation To LLC Illinois on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to alter and eSign Quitclaim Deed From Corporation To LLC Illinois with ease

- Find Quitclaim Deed From Corporation To LLC Illinois and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Quitclaim Deed From Corporation To LLC Illinois and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To LLC in Illinois?

A Quitclaim Deed From Corporation To LLC in Illinois is a legal document that allows a corporation to transfer its property interest to a limited liability company (LLC). This deed serves to convey any interest the corporation has in the property without any guarantees, making it a simple and efficient option for transferring ownership.

-

How do I create a Quitclaim Deed From Corporation To LLC in Illinois?

To create a Quitclaim Deed From Corporation To LLC in Illinois, you can use an online document service like airSlate SignNow. Our platform provides easy templates that guide you through the process of drafting this important document, ensuring all necessary information is included for proper legal compliance.

-

What are the costs associated with a Quitclaim Deed From Corporation To LLC in Illinois?

The costs for a Quitclaim Deed From Corporation To LLC in Illinois can vary, including potential filing fees and service charges. Using airSlate SignNow, you can access affordable pricing options for document preparation and eSigning, making it a cost-effective solution for businesses.

-

What are the benefits of using a Quitclaim Deed From Corporation To LLC?

Using a Quitclaim Deed From Corporation To LLC allows for a straightforward transfer of property without the complexities often associated with traditional deeds. It is particularly beneficial for LLCs looking to streamline their property acquisitions while maintaining flexibility in ownership structures.

-

Is a Quitclaim Deed From Corporation To LLC in Illinois legally binding?

Yes, a Quitclaim Deed From Corporation To LLC in Illinois is legally binding once properly executed and filed with the appropriate state office. Ensuring that all parties sign the document and that it is recorded correctly adds to its enforceability.

-

Can airSlate SignNow help with eSigning a Quitclaim Deed From Corporation To LLC?

Absolutely! airSlate SignNow allows you to easily eSign a Quitclaim Deed From Corporation To LLC in Illinois. Our platform simplifies the signing process with secure, remote options to ensure all parties can quickly complete the transaction.

-

How can I ensure my Quitclaim Deed From Corporation To LLC complies with Illinois laws?

To ensure compliance when drafting a Quitclaim Deed From Corporation To LLC in Illinois, use reliable templates from airSlate SignNow that are designed to meet state requirements. Additionally, consulting with a legal professional can provide added assurance that all legalities are addressed.

Get more for Quitclaim Deed From Corporation To LLC Illinois

Find out other Quitclaim Deed From Corporation To LLC Illinois

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now