Quitclaim Deed from Corporation to Corporation Illinois Form

What is the Quitclaim Deed From Corporation To Corporation Illinois

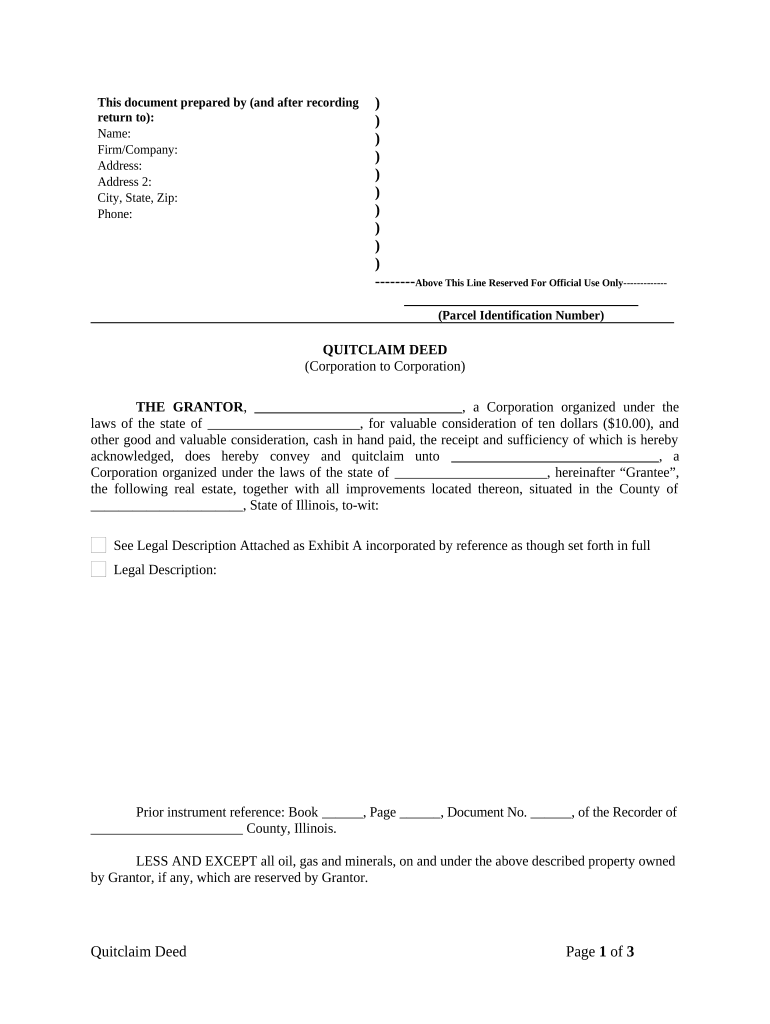

A quitclaim deed from corporation to corporation in Illinois is a legal document that transfers ownership interest in real property from one corporation to another without guaranteeing the title's validity. This type of deed is often used in business transactions, such as mergers or property transfers between corporate entities. Unlike warranty deeds, quitclaim deeds do not provide any warranties or guarantees regarding the title, making them a simpler option for transferring property rights.

Steps to Complete the Quitclaim Deed From Corporation To Corporation Illinois

Completing a quitclaim deed from corporation to corporation in Illinois involves several key steps:

- Gather necessary information: Collect details about both corporations, including their legal names, addresses, and the property description.

- Draft the deed: Create the quitclaim deed document, ensuring it includes all required information, such as the names of the grantor and grantee corporations, the property description, and the date of transfer.

- Obtain signatures: Ensure that authorized representatives of both corporations sign the deed. It may require notarization to be legally binding.

- File the deed: Submit the completed quitclaim deed to the appropriate county recorder's office in Illinois for official recording.

Key Elements of the Quitclaim Deed From Corporation To Corporation Illinois

Several essential elements must be included in a quitclaim deed from corporation to corporation in Illinois to ensure its validity:

- Grantor and Grantee Information: Clearly state the names and addresses of both the transferring and receiving corporations.

- Property Description: Provide a detailed description of the property being transferred, including any relevant legal descriptions or parcel numbers.

- Consideration: Indicate any payment or consideration exchanged for the property, even if it is nominal.

- Signatures: Include signatures from authorized representatives of both corporations, along with the date of signing.

- Notarization: Notarization may be required to validate the document, depending on local regulations.

Legal Use of the Quitclaim Deed From Corporation To Corporation Illinois

The quitclaim deed from corporation to corporation is legally recognized in Illinois for transferring property rights. It is commonly used in various scenarios, such as consolidating corporate assets, transferring property during corporate restructuring, or facilitating mergers and acquisitions. However, it is crucial for corporations to understand that this type of deed does not guarantee clear title, which can lead to potential disputes if any title issues arise after the transfer.

State-Specific Rules for the Quitclaim Deed From Corporation To Corporation Illinois

In Illinois, specific rules govern the execution and recording of quitclaim deeds. These include:

- Recording Requirements: The deed must be recorded with the county recorder’s office where the property is located to provide public notice of the transfer.

- Transfer Tax: Depending on the county, a transfer tax may apply, and the appropriate forms must be completed and submitted along with the deed.

- Notarization: While notarization is not always required, it is recommended to ensure the document's acceptance by the recorder's office.

How to Use the Quitclaim Deed From Corporation To Corporation Illinois

To effectively use a quitclaim deed from corporation to corporation in Illinois, follow these guidelines:

- Understand the Purpose: Recognize that this deed is used for transferring property without title guarantees, making it suitable for specific business transactions.

- Consult Legal Counsel: It is advisable to seek legal advice to ensure compliance with state laws and to address any potential title issues before proceeding with the transfer.

- Complete the Document Accurately: Ensure all required information is accurately filled out to avoid delays or complications during the recording process.

Quick guide on how to complete quitclaim deed from corporation to corporation illinois

Effortlessly Prepare Quitclaim Deed From Corporation To Corporation Illinois on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any holdups. Manage Quitclaim Deed From Corporation To Corporation Illinois on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The easiest way to modify and electronically sign Quitclaim Deed From Corporation To Corporation Illinois with ease

- Find Quitclaim Deed From Corporation To Corporation Illinois and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or mask sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature utilizing the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Quitclaim Deed From Corporation To Corporation Illinois and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To Corporation Illinois?

A Quitclaim Deed From Corporation To Corporation in Illinois is a legal document that transfers ownership of property from one corporation to another without guaranteeing that the title is clear. It is an essential tool for businesses looking to reallocate assets quickly. Understanding this process can help corporations manage their property rights effectively.

-

How do I create a Quitclaim Deed From Corporation To Corporation Illinois?

Creating a Quitclaim Deed From Corporation To Corporation in Illinois typically involves drafting the deed, ensuring it includes all necessary details such as the legal description of the property and the corporations' names. You can utilize airSlate SignNow to simplify this process by providing customizable templates and eSignature options for a seamless experience.

-

What are the benefits of using airSlate SignNow for Quitclaim Deeds?

Using airSlate SignNow to manage your Quitclaim Deed From Corporation To Corporation Illinois provides convenience and security. The platform allows for eSigning and the ability to securely store and share documents online, streamlining the transfer process. Additionally, it reduces the risk of document loss and enhances collaboration among corporate stakeholders.

-

Is there a cost associated with signing a Quitclaim Deed From Corporation To Corporation Illinois on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow to eSign a Quitclaim Deed From Corporation To Corporation Illinois, but it is designed to be cost-effective for businesses. Plans vary based on the features needed, and many users find that the time saved and efficiencies gained far outweigh these costs. It's best to review the pricing plans to find one that suits your corporate needs.

-

Are there specific fields required in a Quitclaim Deed From Corporation To Corporation Illinois?

Yes, a Quitclaim Deed From Corporation To Corporation in Illinois must include specific fields such as the names of the corporations involved, the legal description of the property, and the signatures of authorized representatives. Ensuring all these fields are correctly filled is crucial to the legal validity of the deed. AirSlate SignNow helps you make sure these details are not overlooked.

-

Can I integrate airSlate SignNow with other platforms for managing Quitclaim Deeds?

Absolutely! airSlate SignNow offers integrations with various platforms, enhancing how you manage your Quitclaim Deed From Corporation To Corporation Illinois. These integrations can help streamline your workflow by allowing you to connect your signing processes directly with your existing systems, such as CRM and document management solutions.

-

What is the process for submitting a Quitclaim Deed From Corporation To Corporation Illinois after signing?

Once you have completed and signed the Quitclaim Deed From Corporation To Corporation Illinois via airSlate SignNow, the next step is to have it signNowd, if required. After notarization, you must file the deed with the county recorder's office to formalize the transfer of property ownership. This seals the transaction and makes it part of the public record.

Get more for Quitclaim Deed From Corporation To Corporation Illinois

Find out other Quitclaim Deed From Corporation To Corporation Illinois

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy