Quitclaim Deed from Husband and Wife to an Individual Illinois Form

What is the Quitclaim Deed From Husband And Wife To An Individual Illinois

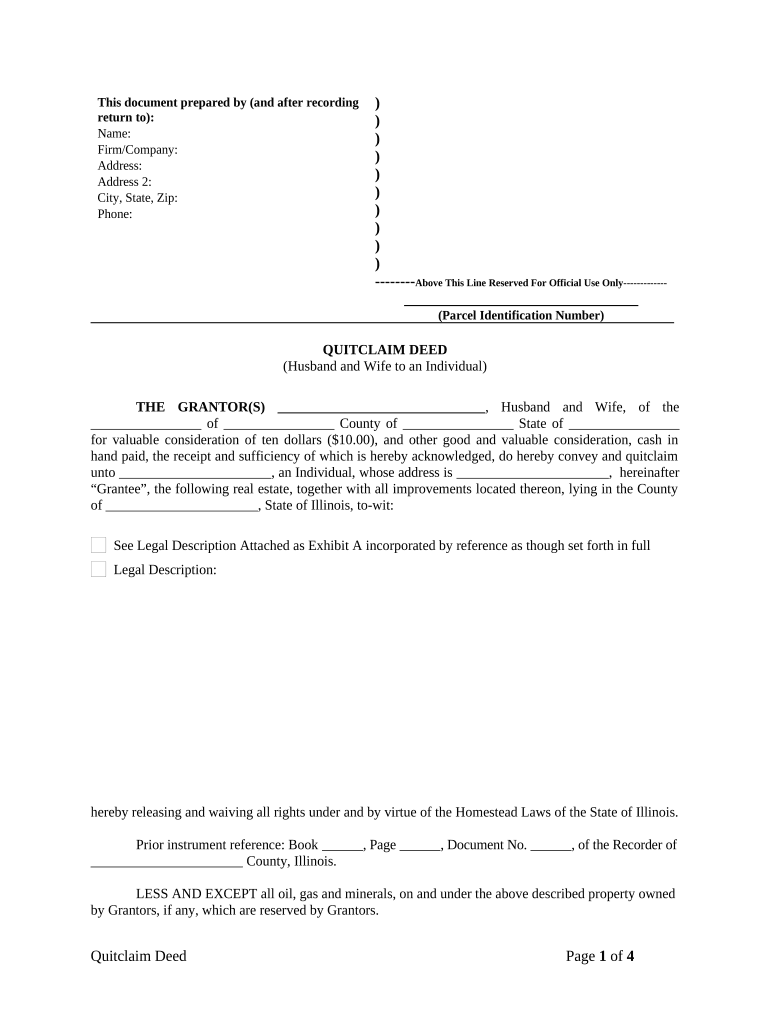

A quitclaim deed from husband and wife to an individual in Illinois is a legal document that allows a married couple to transfer their ownership interest in a property to another individual. This type of deed does not guarantee that the property is free of liens or claims; it simply conveys whatever interest the couple has in the property at the time of transfer. It is often used in situations such as divorce settlements, gifting property, or transferring property to a family member.

Key Elements of the Quitclaim Deed From Husband And Wife To An Individual Illinois

Several key elements must be included in a quitclaim deed for it to be valid in Illinois:

- Grantors: The names of the husband and wife transferring the property.

- Grantee: The name of the individual receiving the property.

- Property Description: A legal description of the property being transferred, including the address and parcel number.

- Consideration: The amount paid for the property, if applicable, or a statement indicating that the transfer is a gift.

- Signatures: The signatures of both grantors, along with the date of signing.

- Notarization: The document must be notarized to be legally binding.

Steps to Complete the Quitclaim Deed From Husband And Wife To An Individual Illinois

Completing a quitclaim deed involves several important steps:

- Gather necessary information about the property, including its legal description and current ownership details.

- Obtain a quitclaim deed form, which can be found online or at legal stationery stores.

- Fill out the form with accurate information regarding the grantors, grantee, and property description.

- Both husband and wife should sign the form in the presence of a notary public.

- File the completed deed with the appropriate county recorder's office to ensure public record.

Legal Use of the Quitclaim Deed From Husband And Wife To An Individual Illinois

The quitclaim deed is legally recognized in Illinois and can be used for various purposes, including:

- Transferring property ownership between family members.

- Completing a divorce settlement where one spouse transfers their interest to the other.

- Gifting property without a monetary exchange.

- Clearing up title issues by transferring ownership to a new individual.

State-Specific Rules for the Quitclaim Deed From Husband And Wife To An Individual Illinois

Illinois has specific regulations that govern the use of quitclaim deeds:

- The deed must be signed by both spouses if the property is jointly owned.

- Notarization is required for the deed to be valid.

- It must be recorded with the county recorder's office where the property is located.

- Any transfer of property may be subject to transfer taxes, depending on local regulations.

How to Obtain the Quitclaim Deed From Husband And Wife To An Individual Illinois

Obtaining a quitclaim deed form in Illinois can be done through several methods:

- Download a template from reputable legal websites.

- Visit local legal stationery stores for printed forms.

- Consult with a real estate attorney for customized assistance.

Quick guide on how to complete quitclaim deed from husband and wife to an individual illinois

Effortlessly Prepare Quitclaim Deed From Husband And Wife To An Individual Illinois on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without any delays. Manage Quitclaim Deed From Husband And Wife To An Individual Illinois on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Quitclaim Deed From Husband And Wife To An Individual Illinois seamlessly

- Find Quitclaim Deed From Husband And Wife To An Individual Illinois and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Quitclaim Deed From Husband And Wife To An Individual Illinois and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Husband And Wife To An Individual in Illinois?

A Quitclaim Deed From Husband And Wife To An Individual in Illinois is a legal document used to transfer ownership of property. This type of deed conveys whatever interest the husband and wife may have in the property to another individual without any guarantees or warranties. It is commonly used in divorce settlements or to simplify property transfers.

-

How much does it cost to create a Quitclaim Deed From Husband And Wife To An Individual in Illinois?

The cost of creating a Quitclaim Deed From Husband And Wife To An Individual in Illinois can vary based on services used and complexity. Generally, using an online service like airSlate SignNow can be more cost-effective than hiring an attorney. Additionally, you may need to consider recording fees charged by the county.

-

What are the benefits of using airSlate SignNow for a Quitclaim Deed From Husband And Wife To An Individual in Illinois?

Using airSlate SignNow for a Quitclaim Deed From Husband And Wife To An Individual in Illinois offers a convenient and user-friendly platform to create and sign documents electronically. You can easily customize the deed, track its status, and ensure secure storage of your documents. This streamlines the process, making it quick and efficient.

-

Can the Quitclaim Deed From Husband And Wife To An Individual in Illinois be signed electronically?

Yes, the Quitclaim Deed From Husband And Wife To An Individual in Illinois can be signed electronically using airSlate SignNow. Electronic signatures are legally recognized in Illinois, and our platform provides a secure method to ensure the authenticity of the signatures. This makes it easier for all parties involved to complete the deed remotely.

-

Are there templates available for a Quitclaim Deed From Husband And Wife To An Individual in Illinois?

airSlate SignNow offers templates for a Quitclaim Deed From Husband And Wife To An Individual in Illinois, making it easy to get started. These templates are designed to meet legal requirements and can be customized to suit your needs. This saves time and ensures that all necessary information is included.

-

What information is required to complete a Quitclaim Deed From Husband And Wife To An Individual in Illinois?

To complete a Quitclaim Deed From Husband And Wife To An Individual in Illinois, you will need to provide the names of the husband and wife, the individual receiving the property, a legal description of the property, and any relevant details regarding the terms of the transfer. Ensuring all this information is accurate is crucial for the deed's validity.

-

Is it necessary to signNow a Quitclaim Deed From Husband And Wife To An Individual in Illinois?

Yes, it is necessary to have a Quitclaim Deed From Husband And Wife To An Individual in Illinois signNowd for it to be legally valid. Notarization serves to verify the identities of the signers and ensures that the document is executed voluntarily. After notarization, the deed must be recorded with the county to be effective.

Get more for Quitclaim Deed From Husband And Wife To An Individual Illinois

- Void cheque rbc form

- Final decree of divorce form

- Statement of services rendered form

- Form rc325

- Declaration of intent to evict for landlord occupancy form

- Chl 6 form

- Hipaa authorization form georgia

- Form it 2658 nys attachment to form it 2658 report of estimated personal income tax for nonresident individuals year

Find out other Quitclaim Deed From Husband And Wife To An Individual Illinois

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document