Warranty Deed from Husband and Wife to LLC Illinois Form

What is the Warranty Deed From Husband And Wife To LLC Illinois

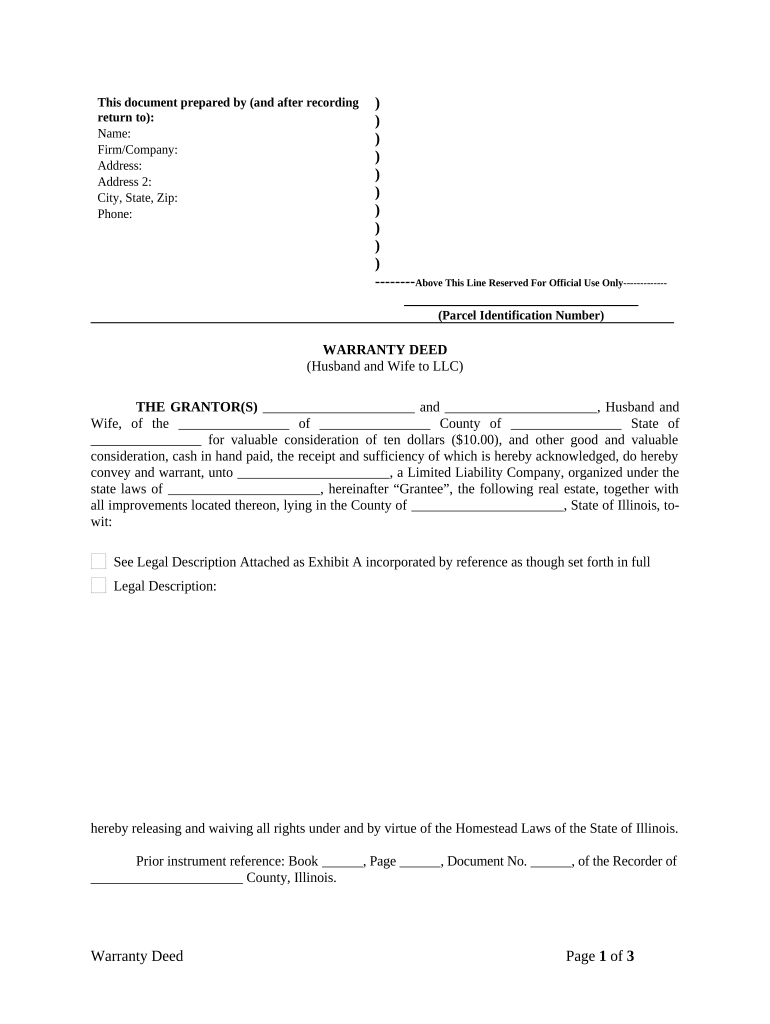

A warranty deed from husband and wife to LLC in Illinois is a legal document used to transfer property ownership from a married couple to a limited liability company (LLC). This type of deed guarantees that the property is free from any liens or encumbrances, ensuring that the LLC receives clear title. The warranty deed serves as a formal record of the transaction, providing protection to the LLC against any future claims on the property. It is essential for both parties to understand the implications of this transfer, as it can affect personal liability and tax obligations.

Key elements of the Warranty Deed From Husband And Wife To LLC Illinois

Several key elements are crucial for the warranty deed from husband and wife to LLC in Illinois. These include:

- Grantors: The names of the husband and wife transferring the property.

- Grantee: The name of the LLC receiving the property.

- Legal Description: A detailed description of the property being transferred, including boundaries and any relevant identifiers.

- Consideration: The value exchanged for the property, which may be monetary or non-monetary.

- Signatures: The signatures of both spouses, which must be notarized to validate the document.

Steps to complete the Warranty Deed From Husband And Wife To LLC Illinois

Completing a warranty deed from husband and wife to LLC in Illinois involves several steps:

- Gather necessary information, including the legal description of the property and the names of the parties involved.

- Draft the warranty deed, ensuring all key elements are included.

- Both spouses must sign the document in the presence of a notary public.

- File the completed warranty deed with the appropriate county recorder's office to make the transfer official.

- Obtain a copy of the recorded deed for your records.

Legal use of the Warranty Deed From Husband And Wife To LLC Illinois

The warranty deed from husband and wife to LLC in Illinois is legally binding when executed correctly. It must comply with state laws regarding property transfers, including proper notarization and recording. This deed provides a legal assurance that the property is free from claims and encumbrances, protecting the LLC from potential disputes. It is advisable for both parties to consult with a legal professional to ensure compliance with all legal requirements and to understand the implications of the transfer.

State-specific rules for the Warranty Deed From Husband And Wife To LLC Illinois

In Illinois, specific rules govern the execution and recording of warranty deeds. The deed must be signed by both spouses and notarized. Additionally, it must be recorded in the county where the property is located. Illinois law requires that the legal description of the property be accurate and complete. Failure to adhere to these rules may result in the deed being deemed invalid or unenforceable. It is important to check for any local regulations that may apply to property transfers in specific counties.

How to use the Warranty Deed From Husband And Wife To LLC Illinois

Using a warranty deed from husband and wife to LLC in Illinois involves several practical considerations. First, ensure that the deed is properly drafted with all required information. Once the deed is signed and notarized, it should be filed with the county recorder's office. This step is crucial for establishing public notice of the property transfer. After filing, keep a copy of the recorded deed for your records, as it serves as proof of ownership for the LLC. Understanding the implications of this transfer on personal liability and taxes is also essential.

Quick guide on how to complete warranty deed from husband and wife to llc illinois

Complete Warranty Deed From Husband And Wife To LLC Illinois effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal sustainable alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow offers all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Warranty Deed From Husband And Wife To LLC Illinois on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Warranty Deed From Husband And Wife To LLC Illinois with ease

- Obtain Warranty Deed From Husband And Wife To LLC Illinois and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Warranty Deed From Husband And Wife To LLC Illinois and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Warranty Deed From Husband And Wife To LLC in Illinois?

A Warranty Deed From Husband And Wife To LLC in Illinois is a legal document used to transfer real property ownership from a married couple to a limited liability company (LLC). This type of deed guarantees that the property title is clear and free from any liens or encumbrances, providing peace of mind to the LLC as the new owner.

-

How do I prepare a Warranty Deed From Husband And Wife To LLC in Illinois?

To prepare a Warranty Deed From Husband And Wife To LLC in Illinois, you need to include specific information such as the grantors' names, the LLC's name, a legal description of the property, and a statement of consideration. Additionally, it's advisable to have this document signNowd to ensure its legal validity.

-

What are the costs associated with creating a Warranty Deed From Husband And Wife To LLC in Illinois?

The costs for creating a Warranty Deed From Husband And Wife To LLC in Illinois can vary depending on whether you choose to use legal services or online platforms like airSlate SignNow. Typically, using an online service may be more cost-effective, with fees ranging from $50 to $200 for document preparation and e-signing.

-

What are the benefits of using airSlate SignNow for my Warranty Deed From Husband And Wife To LLC in Illinois?

Using airSlate SignNow for your Warranty Deed From Husband And Wife To LLC in Illinois offers several benefits, including a user-friendly interface, ease of e-signing, and secure document storage. It allows you to complete the process quickly and efficiently, streamlining the transfer of property ownership.

-

Is it necessary to have a lawyer when filing a Warranty Deed From Husband And Wife To LLC in Illinois?

While it's not strictly necessary to have a lawyer to file a Warranty Deed From Husband And Wife To LLC in Illinois, consulting with a legal professional is recommended to ensure compliance with state regulations and to address any unique circumstances regarding your property.

-

Can I eSign my Warranty Deed From Husband And Wife To LLC in Illinois?

Yes, you can eSign your Warranty Deed From Husband And Wife To LLC in Illinois using airSlate SignNow. Our platform complies with electronic signature laws, making it legally binding and ensuring that your document is executed efficiently without the need for physical signatures.

-

What happens after I file a Warranty Deed From Husband And Wife To LLC in Illinois?

After you file a Warranty Deed From Husband And Wife To LLC in Illinois with the county clerk or recorder, the deed becomes a matter of public record. This officially documents the transfer of property ownership and provides legal recognition to the LLC as the new owner.

Get more for Warranty Deed From Husband And Wife To LLC Illinois

Find out other Warranty Deed From Husband And Wife To LLC Illinois

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application