Non Foreign Affidavit under IRC 1445 Illinois Form

What is the Non Foreign Affidavit Under IRC 1445 Illinois

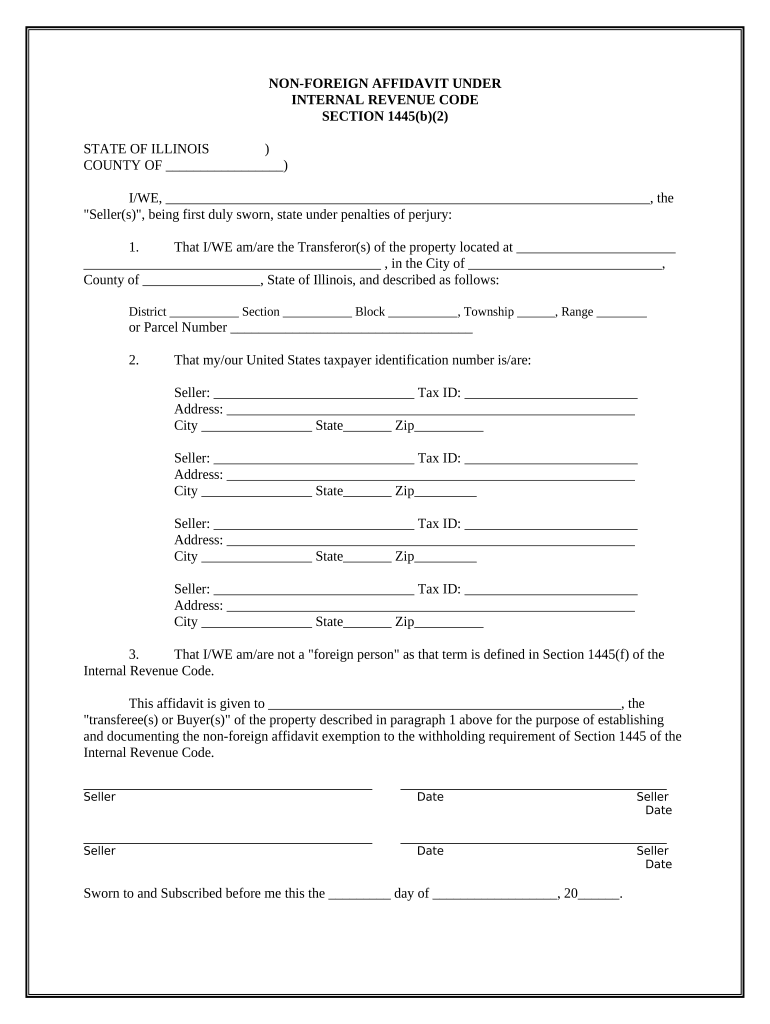

The Non Foreign Affidavit Under IRC 1445 is a legal document used in Illinois to certify that a seller of real estate is not a foreign person, as defined by the Internal Revenue Code. This affidavit is crucial for buyers and sellers to ensure compliance with tax regulations, specifically to avoid withholding requirements imposed on foreign sellers. By completing this affidavit, the seller affirms their status, which directly impacts the withholding tax obligations during the sale of property.

How to use the Non Foreign Affidavit Under IRC 1445 Illinois

To utilize the Non Foreign Affidavit Under IRC 1445, the seller must complete the form accurately and provide all required information. This includes personal details such as name, address, and taxpayer identification number. Once completed, the affidavit should be submitted to the buyer or their representative, who will retain it for their records. This document is typically presented during the closing process of a real estate transaction to confirm the seller's non-foreign status.

Steps to complete the Non Foreign Affidavit Under IRC 1445 Illinois

Completing the Non Foreign Affidavit Under IRC 1445 involves several key steps:

- Gather necessary information, including your full name, address, and taxpayer identification number.

- Obtain the official form, which can be accessed through legal or tax resources.

- Fill out the form, ensuring all sections are completed accurately.

- Sign and date the affidavit in the presence of a notary public, if required.

- Provide the completed affidavit to the buyer or their agent during the transaction.

Key elements of the Non Foreign Affidavit Under IRC 1445 Illinois

Several key elements are essential to the Non Foreign Affidavit Under IRC 1445. These include:

- Seller's Information: Full name, address, and taxpayer identification number must be clearly stated.

- Certification Statement: The seller must affirm that they are not a foreign person as defined by the Internal Revenue Code.

- Signature: The seller's signature is required to validate the affidavit.

- Date: The date of signing is crucial for record-keeping purposes.

Legal use of the Non Foreign Affidavit Under IRC 1445 Illinois

The legal use of the Non Foreign Affidavit Under IRC 1445 is primarily to ensure compliance with federal tax laws. By providing this affidavit, sellers help buyers avoid unnecessary withholding taxes that apply to foreign sellers. It serves as a protective measure for both parties in a real estate transaction, ensuring that all tax obligations are met and reducing the risk of penalties or disputes related to tax withholding.

Filing Deadlines / Important Dates

While the Non Foreign Affidavit Under IRC 1445 does not have a specific filing deadline, it should be completed and submitted during the closing process of a real estate transaction. It is advisable to prepare the affidavit well in advance to ensure that all parties have adequate time to review and process the document before the closing date. Timely submission helps prevent delays in the transaction and ensures compliance with tax regulations.

Quick guide on how to complete non foreign affidavit under irc 1445 illinois

Effortlessly prepare Non Foreign Affidavit Under IRC 1445 Illinois on any device

Online document management has gained traction among companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Non Foreign Affidavit Under IRC 1445 Illinois on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to edit and eSign Non Foreign Affidavit Under IRC 1445 Illinois with ease

- Obtain Non Foreign Affidavit Under IRC 1445 Illinois and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Non Foreign Affidavit Under IRC 1445 Illinois and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Illinois?

A Non Foreign Affidavit Under IRC 1445 Illinois is a legal document that certifies the status of a foreign investor in a property transaction. This affidavit is required to ensure that the buyer does not withhold taxes when purchasing U.S. real estate from a foreign seller. It helps streamline the process for both parties, providing clarity and compliance with federal regulations.

-

Why do I need a Non Foreign Affidavit Under IRC 1445 Illinois?

You need a Non Foreign Affidavit Under IRC 1445 Illinois to confirm that the selling party is not a foreign person, thereby avoiding withholding taxes during real estate transactions. Not providing this affidavit can lead to complications and potential tax liabilities for buyers. It’s a crucial document that helps ensure compliance with U.S. tax laws.

-

How does airSlate SignNow facilitate the Non Foreign Affidavit Under IRC 1445 Illinois process?

airSlate SignNow empowers businesses to easily create, send, and sign the Non Foreign Affidavit Under IRC 1445 Illinois online. With intuitive templates and secure eSigning features, the platform simplifies the document workflow, saving time and reducing the risk of errors. This efficient process allows you to focus on closing deals, not on paperwork.

-

What are the pricing options for using airSlate SignNow for the Non Foreign Affidavit Under IRC 1445 Illinois?

airSlate SignNow offers several pricing tiers to accommodate different business needs, including a free trial for new users. Once the trial ends, flexible plans allow you to choose based on the number of users and features required. This makes it a cost-effective solution for managing the Non Foreign Affidavit Under IRC 1445 Illinois documentation.

-

Can I integrate airSlate SignNow with other applications for my Non Foreign Affidavit Under IRC 1445 Illinois needs?

Yes, airSlate SignNow provides robust integrations with various applications like Google Drive, Salesforce, and more. This allows you to seamlessly incorporate the Non Foreign Affidavit Under IRC 1445 Illinois into your existing business workflows. Streamlined integrations help maintain productivity while managing your documents.

-

What benefits does eSigning the Non Foreign Affidavit Under IRC 1445 Illinois offer?

eSigning the Non Foreign Affidavit Under IRC 1445 Illinois offers quick turnaround times, enhanced security, and improved accessibility. You can sign documents from anywhere, making it convenient for all parties involved. Additionally, electronic signatures are legally binding, satisfying regulatory requirements and expediting your transactions.

-

Is airSlate SignNow compliant with legal standards for the Non Foreign Affidavit Under IRC 1445 Illinois?

Absolutely! airSlate SignNow adheres to the legal requirements for electronic signatures, ensuring that the Non Foreign Affidavit Under IRC 1445 Illinois is compliant with state and federal regulations. The platform employs advanced security measures to protect documents and user information, offering peace of mind while managing legal paperwork.

Get more for Non Foreign Affidavit Under IRC 1445 Illinois

Find out other Non Foreign Affidavit Under IRC 1445 Illinois

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online