Cbt 150 Form

What is the CBT 150?

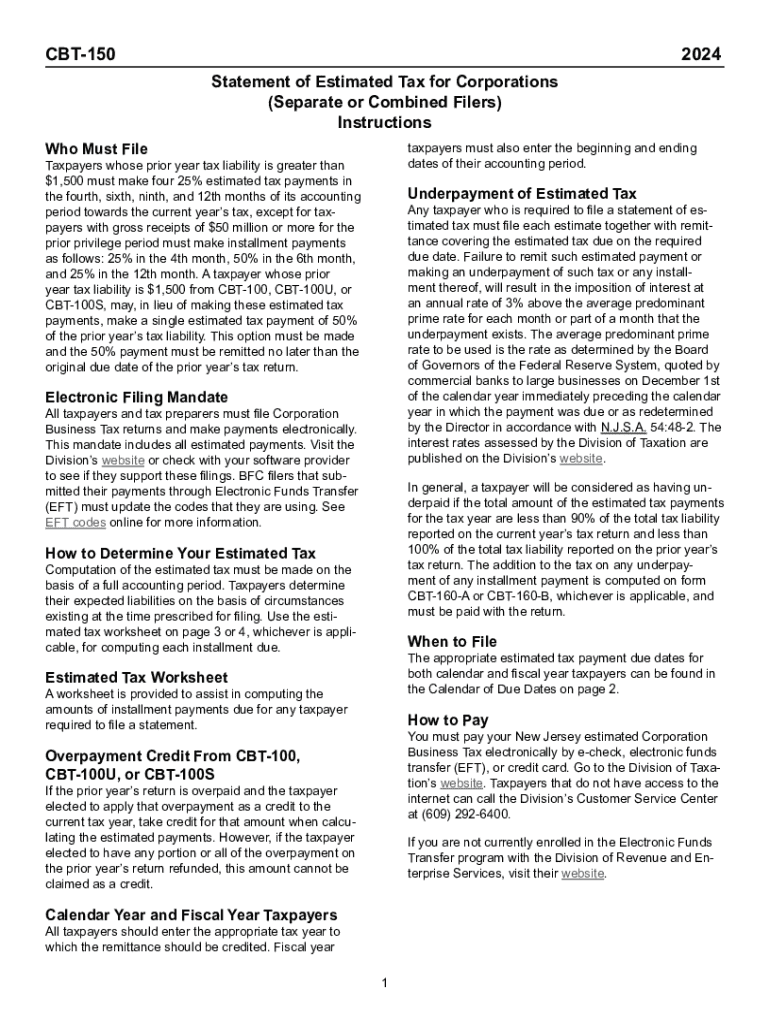

The CBT 150, or Corporate Business Tax Form 150, is a tax document used by businesses operating in New Jersey. This form is essential for corporations to report their income and calculate their tax liability to the state. It provides the New Jersey Division of Taxation with necessary financial details, ensuring compliance with state tax laws. Understanding the CBT 150 is crucial for businesses to maintain good standing and avoid penalties.

How to Obtain the CBT 150

To obtain the CBT 150, businesses can visit the New Jersey Division of Taxation's official website, where the form is available for download. Additionally, businesses may request a physical copy through mail or by contacting the Division directly. It is important to ensure that the most current version of the form is used, as outdated forms may lead to compliance issues.

Steps to Complete the CBT 150

Completing the CBT 150 involves several key steps:

- Gather Financial Information: Collect all necessary financial documents, including income statements and balance sheets.

- Fill Out the Form: Input the required information accurately, ensuring all figures are correct.

- Review for Accuracy: Double-check all entries to avoid mistakes that could lead to penalties.

- Submit the Form: Choose a submission method—online, by mail, or in person—and send the completed form to the appropriate tax authority.

Legal Use of the CBT 150

The CBT 150 is legally required for corporations operating in New Jersey. Filing this form accurately and on time is essential to comply with state tax regulations. Failure to file can result in penalties, interest on unpaid taxes, and potential legal consequences. It is advisable for businesses to consult with tax professionals to ensure compliance and avoid any legal issues.

Key Elements of the CBT 150

Key elements of the CBT 150 include:

- Business Identification: Name, address, and identification number of the corporation.

- Income Reporting: Total income earned during the tax year.

- Deductions: Allowable deductions that can reduce taxable income.

- Tax Calculation: The method used to calculate the tax owed based on reported income.

Form Submission Methods

Businesses can submit the CBT 150 through various methods:

- Online: Many businesses prefer to file electronically through the New Jersey Division of Taxation's online portal.

- By Mail: Completed forms can be printed and mailed to the appropriate tax office.

- In Person: Businesses can also submit the form directly at designated tax offices.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cbt 150

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cbt 150 nj and how does it work?

The cbt 150 nj is a powerful tool designed to streamline document signing and management. It allows users to send, sign, and store documents electronically, making the process faster and more efficient. With airSlate SignNow, you can easily integrate the cbt 150 nj into your existing workflows.

-

What are the pricing options for cbt 150 nj?

airSlate SignNow offers flexible pricing plans for the cbt 150 nj, catering to businesses of all sizes. You can choose from monthly or annual subscriptions, with options that provide various features to suit your needs. Visit our pricing page for detailed information on each plan.

-

What features does the cbt 150 nj offer?

The cbt 150 nj includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the document signing experience, ensuring that you can manage your documents efficiently. Additionally, the cbt 150 nj supports multiple file formats for added convenience.

-

How can the cbt 150 nj benefit my business?

Implementing the cbt 150 nj can signNowly reduce the time spent on document management and signing processes. This efficiency leads to faster turnaround times and improved productivity. Moreover, the cbt 150 nj enhances security and compliance, protecting your sensitive information.

-

Is the cbt 150 nj easy to integrate with other tools?

Yes, the cbt 150 nj is designed for seamless integration with various business applications. Whether you use CRM systems, project management tools, or other software, airSlate SignNow can connect with them effortlessly. This integration helps streamline your workflows and enhances overall efficiency.

-

Can I try the cbt 150 nj before committing?

Absolutely! airSlate SignNow offers a free trial for the cbt 150 nj, allowing you to explore its features and benefits without any commitment. This trial period gives you the opportunity to see how the cbt 150 nj can transform your document management processes.

-

What security measures are in place for the cbt 150 nj?

The cbt 150 nj prioritizes security with advanced encryption and compliance with industry standards. Your documents are protected during transmission and storage, ensuring that sensitive information remains confidential. Trust airSlate SignNow to keep your data safe while using the cbt 150 nj.

Get more for Cbt 150

Find out other Cbt 150

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online