Il Ucc1 Form

What is the Illinois UCC1?

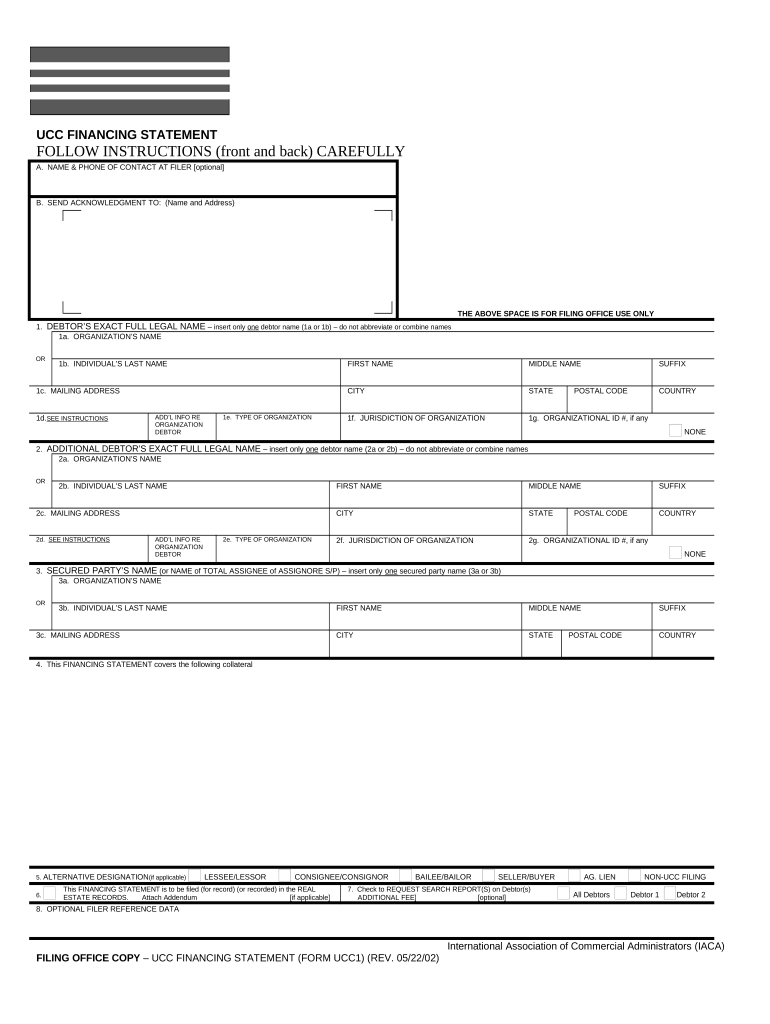

The Illinois UCC1 form, also known as the Illinois financing statement, is a legal document used to secure a creditor's interest in a debtor's personal property. This form is part of the Uniform Commercial Code (UCC), which standardizes commercial transactions across the United States. By filing the UCC1, creditors can establish their rights to collateral in the event of a default by the debtor. The document serves as public notice of the secured interest, which is essential for protecting the creditor's claim against other potential creditors.

Steps to Complete the Illinois UCC1

Completing the Illinois UCC1 form involves several key steps to ensure accuracy and compliance with state regulations. Here is a straightforward guide:

- Gather necessary information: Collect details about the debtor, including their legal name and address, as well as the secured party's information.

- Describe the collateral: Clearly outline the personal property that is being secured. This description should be specific enough to identify the collateral.

- Complete the form: Fill out the Illinois UCC1 form with the gathered information. Ensure that all fields are accurately filled to avoid delays in processing.

- Review for accuracy: Double-check all entries for correctness, as errors can lead to complications in enforcing the security interest.

- File the form: Submit the completed UCC1 form to the appropriate state office, either online or by mail, along with any required filing fees.

Legal Use of the Illinois UCC1

The Illinois UCC1 form must be used in accordance with state laws to ensure its legal validity. It is essential for creditors to understand that the filing of this form creates a public record of their security interest. This legal documentation is crucial for establishing priority over other creditors in case of bankruptcy or liquidation. Additionally, the UCC1 must be filed within a specific timeframe after a security agreement is executed to maintain enforceability.

Key Elements of the Illinois UCC1

When filling out the Illinois UCC1 form, certain key elements must be included to ensure its effectiveness:

- Debtor information: The full legal name and address of the debtor are required.

- Secured party information: The name and address of the creditor or secured party must be provided.

- Collateral description: A detailed description of the collateral being secured is necessary for clarity.

- Signature: The form must be signed by the secured party or their authorized representative to validate the filing.

Form Submission Methods

Submitting the Illinois UCC1 form can be done through various methods, providing flexibility for creditors. The options typically include:

- Online submission: Many creditors opt to file electronically through the state’s online portal, which is often faster and more efficient.

- Mail submission: The form can also be mailed to the designated state office along with the appropriate filing fee.

- In-person filing: Creditors may choose to deliver the form in person to ensure immediate processing and to address any questions directly.

Examples of Using the Illinois UCC1

The Illinois UCC1 form is commonly used in various scenarios, such as:

- Securing loans: A lender may file a UCC1 to secure interests in inventory or equipment financed through a loan.

- Leasing agreements: Lessors may use the UCC1 to protect their interests in leased equipment.

- Business transactions: Companies may file a UCC1 to secure their interests in accounts receivable or other assets during mergers or acquisitions.

Quick guide on how to complete il ucc1

Complete Il Ucc1 effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely manage it online. airSlate SignNow equips you with all the resources you require to create, amend, and eSign your documents swiftly without interruptions. Manage Il Ucc1 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to amend and eSign Il Ucc1 with ease

- Obtain Il Ucc1 and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your adjustments.

- Choose how you wish to distribute your form, via email, text message (SMS), or invite link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Il Ucc1 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois financing statement?

An Illinois financing statement is a legal document used to secure a lender’s interest in a debtor's collateral under the Uniform Commercial Code. By filing an Illinois financing statement, lenders can establish priority over other creditors. This document is crucial for protecting your financial interest when lending or borrowing.

-

How can airSlate SignNow help with Illinois financing statements?

airSlate SignNow simplifies the process of creating, signing, and filing Illinois financing statements. Our platform allows you to electronically sign documents, ensuring a fast and secure filing process. With easy access to templates, managing financing statements becomes more efficient.

-

Is there a fee for filing an Illinois financing statement?

Yes, there is a fee for filing an Illinois financing statement, but the cost varies based on the method of filing and the specific requirements of your filing. Using airSlate SignNow can help you avoid additional costs associated with delays or errors, delivering a cost-effective solution for your business needs.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers various features tailored for document management, including secure e-signatures, document templates, and automated workflows. These features streamline the creation and management of Illinois financing statements, ensuring that you can efficiently handle your filings from anywhere.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with popular platforms like Google Drive, Salesforce, and Dropbox, allowing you to seamlessly incorporate your Illinois financing statements into your existing workflows. Integration enhances productivity by centralizing document management.

-

How does electronic signing work for Illinois financing statements?

Electronic signing through airSlate SignNow is straightforward and legally binding. After creating your Illinois financing statement, you invite signers via email to review and approve the document electronically. This process reduces paperwork and accelerates transaction completion.

-

What benefits does airSlate SignNow provide for small businesses handling Illinois financing statements?

For small businesses, airSlate SignNow offers an affordable solution for managing Illinois financing statements effectively. The platform improves productivity by providing easy document access and quick sign-off processes, helping small businesses save time and money.

Get more for Il Ucc1

Find out other Il Ucc1

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online