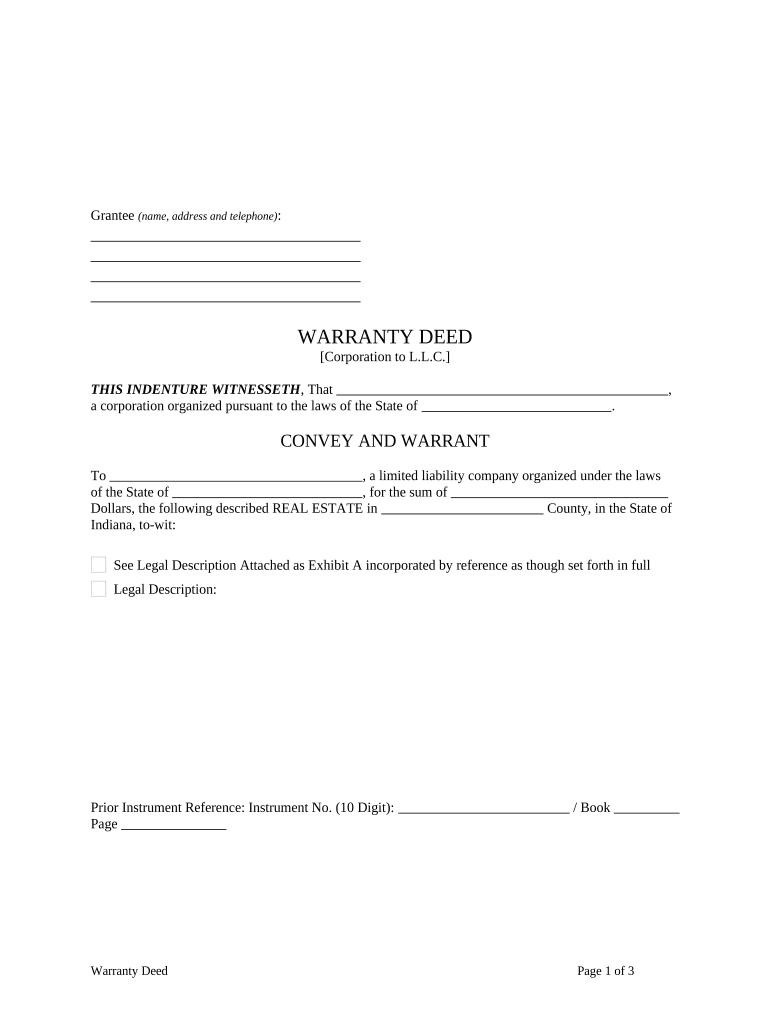

Indiana Corporation Company Form

What is the Indiana Corporation Company

The Indiana Corporation Company refers to a legal entity formed under Indiana state law for conducting business. This type of corporation is recognized as a separate legal entity from its owners, providing limited liability protection to its shareholders. This means that the personal assets of the shareholders are generally protected from the debts and liabilities of the corporation. Establishing a corporation in Indiana involves adhering to specific state regulations and requirements, which can vary based on the type of business and its operational needs.

Steps to complete the Indiana Corporation Company

Completing the Indiana Corporation Company form involves several important steps. First, you need to choose a unique name for your corporation that complies with Indiana naming regulations. Next, you will need to prepare and file the Articles of Incorporation with the Indiana Secretary of State. This document typically includes essential information such as the corporation's name, purpose, registered agent, and the number of shares authorized. After filing, you should obtain an Employer Identification Number (EIN) from the IRS, which is necessary for tax purposes. Lastly, it is important to create corporate bylaws and hold an organizational meeting to establish the corporation's operational framework.

Legal use of the Indiana Corporation Company

The Indiana Corporation Company must be used in compliance with state and federal laws. This includes adhering to corporate governance standards, maintaining proper records, and filing necessary reports with the state. Corporations are required to hold annual meetings and keep minutes of these meetings to ensure transparency and accountability. Additionally, corporations must comply with tax obligations and other regulatory requirements to maintain their good standing. Failure to comply with these legal obligations can result in penalties or the dissolution of the corporation.

Key elements of the Indiana Corporation Company

Several key elements define the Indiana Corporation Company. These include the Articles of Incorporation, which outline the corporation's structure, purpose, and operational guidelines. Another critical element is the registered agent, who is responsible for receiving legal documents on behalf of the corporation. The corporation must also establish a board of directors to oversee its operations and make strategic decisions. Additionally, maintaining accurate financial records and adhering to tax regulations is essential for the corporation's ongoing compliance and success.

State-specific rules for the Indiana Corporation Company

Indiana has specific rules governing the formation and operation of corporations. These include requirements for the minimum number of directors, which is typically one, and stipulations regarding the corporation's name, which must include a designation such as "Corporation," "Incorporated," or an abbreviation thereof. Indiana also mandates that corporations file biennial reports to maintain their active status. Understanding these state-specific rules is crucial for ensuring compliance and avoiding potential legal issues.

Required Documents

To establish an Indiana Corporation Company, several documents are required. The primary document is the Articles of Incorporation, which must be filed with the Indiana Secretary of State. Additionally, you will need to prepare corporate bylaws, which outline the internal governance of the corporation. An Employer Identification Number (EIN) application is also necessary for tax purposes. Depending on the nature of the business, additional permits or licenses may be required to operate legally within Indiana.

Form Submission Methods (Online / Mail / In-Person)

The Indiana Corporation Company form can be submitted through various methods. The most efficient way is to file the Articles of Incorporation online via the Indiana Secretary of State's website. This method allows for quicker processing times. Alternatively, you can submit the form by mail, ensuring you include the appropriate filing fee. In-person submissions are also accepted at the Secretary of State's office, providing another option for those who prefer direct interaction. Each submission method has its own processing times and requirements, so it is beneficial to choose the one that best suits your needs.

Quick guide on how to complete indiana corporation company

Effortlessly Prepare Indiana Corporation Company on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and store it securely in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Indiana Corporation Company on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

Edit and eSign Indiana Corporation Company with Ease

- Locate Indiana Corporation Company and select Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with the specialized tools provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which is quick and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to secure your modifications.

- Select your preferred method to submit your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns over lost or mishandled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and eSign Indiana Corporation Company to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Indiana corporation company?

An Indiana corporation company is a business entity formed under Indiana state law, allowing for limited liability protection for its owners. This structure is ideal for businesses looking to establish credibility and raise capital while limiting personal risk. Understanding the requirements to form an Indiana corporation company is essential for any entrepreneur.

-

How can airSlate SignNow benefit an Indiana corporation company?

airSlate SignNow provides an easy-to-use platform that enables Indiana corporation companies to streamline their document workflows. With features such as eSignature and document management, businesses can save time and reduce administrative burdens. This efficient solution helps Indiana corporation companies maintain professionalism and improve client interactions.

-

What pricing plans does airSlate SignNow offer for Indiana corporation companies?

airSlate SignNow offers various pricing plans tailored for Indiana corporation companies to accommodate different business sizes and needs. From basic to advanced features, the plans are designed to be cost-effective while ensuring robust functionality. This flexibility allows Indiana corporation companies to choose a plan that aligns with their budget and requirements.

-

Which features are essential for an Indiana corporation company using airSlate SignNow?

Essential features for an Indiana corporation company using airSlate SignNow include eSigning, document templates, and audit trails. These functionalities ensure that contracts and agreements are signed securely and efficiently. Additionally, they help Indiana corporation companies maintain compliance and transparency in their operations.

-

Can airSlate SignNow integrate with other tools used by Indiana corporation companies?

Yes, airSlate SignNow seamlessly integrates with a variety of tools commonly used by Indiana corporation companies, such as CRM systems and cloud storage services. This capability enhances overall productivity by allowing businesses to manage their documents within their existing workflows. Effective integrations ensure that Indiana corporation companies can streamline their operations better.

-

How does airSlate SignNow ensure the security of documents for Indiana corporation companies?

airSlate SignNow employs advanced security measures, such as encryption and secure access controls, to safeguard documents for Indiana corporation companies. This ensures that sensitive information remains confidential and protected from unauthorized access. By prioritizing security, airSlate SignNow helps Indiana corporation companies maintain trust with their clients.

-

What support options are available for Indiana corporation companies using airSlate SignNow?

Indiana corporation companies using airSlate SignNow have access to comprehensive support options, including live chat, email support, and extensive documentation. This ensures that businesses can quickly get assistance or find solutions to any issues they encounter. Reliable support helps Indiana corporation companies feel confident in their decision to use airSlate SignNow.

Get more for Indiana Corporation Company

- Knock knock about prediction sample form

- Add math form 5 chapter 8

- Sonora quest lab requisition form pdf

- E commerce in ghana form

- Kpmg application form

- Pennsylvania state police right to know law request form

- Danny williamson former recorder shelia moss police chief ron suttles fire chief don stallions

- Annual lifeline recertification form

Find out other Indiana Corporation Company

- Sign Word for Procurement Secure

- Sign Word for Procurement Fast

- Can I Sign Word for Procurement

- Sign Document for Procurement Online

- Sign Document for Procurement Computer

- Sign Document for Procurement Mobile

- Sign Document for Procurement Later

- Sign Document for Procurement Myself

- Sign Document for Procurement Free

- Sign Document for Procurement Simple

- Sign Document for Procurement Fast

- Sign Document for Procurement Safe

- How Can I Sign Document for Procurement

- Can I Sign Document for Procurement

- Sign Form for Procurement Online

- Sign Form for Procurement Mobile

- Sign Form for Procurement Now

- Sign Form for Procurement Free

- Sign Form for Procurement Easy

- Sign Form for Procurement Safe