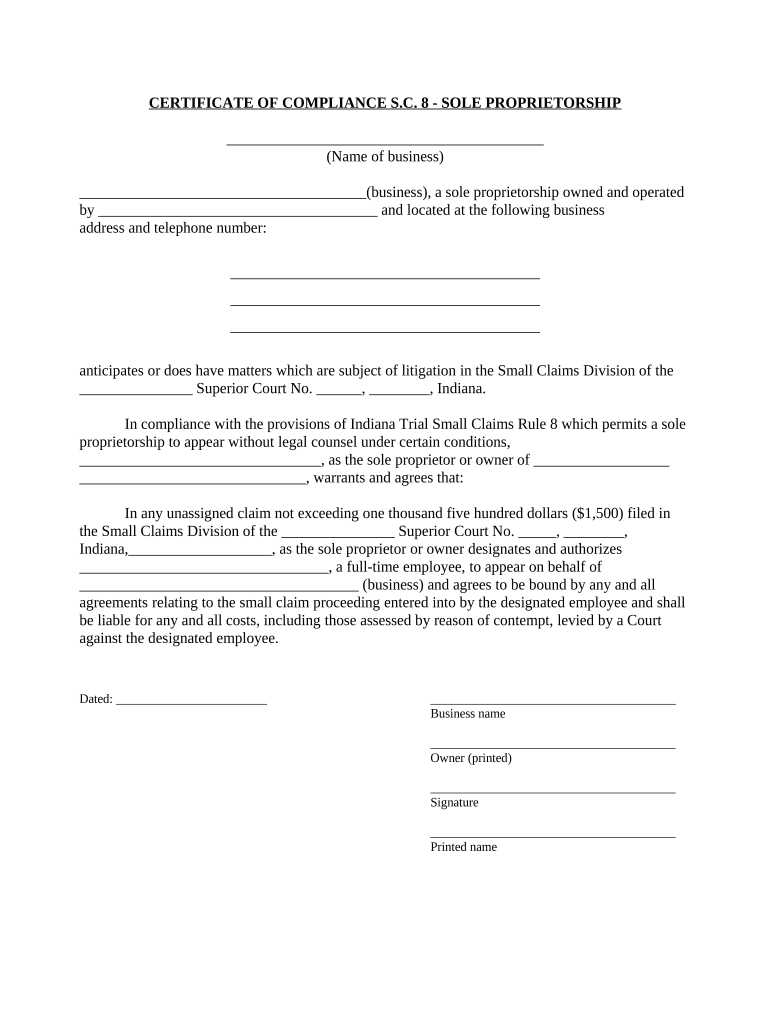

Indiana Sole Proprietorship Form

What is the Indiana Sole Proprietorship

A sole proprietorship in Indiana is a business structure owned and operated by a single individual. This type of business is the simplest form of ownership, allowing the owner to have complete control over all aspects of the business. Unlike corporations or limited liability companies (LLCs), a sole proprietorship does not require formal registration with the state, although obtaining necessary licenses and permits is essential. The owner is personally liable for all business debts and obligations, meaning personal assets are at risk if the business incurs debt or is sued.

How to use the Indiana Sole Proprietorship

Using an Indiana sole proprietorship involves several straightforward steps. First, the owner should choose a business name that reflects their services or products. If the name differs from the owner's legal name, they must file a "Doing Business As" (DBA) registration with the county clerk's office. Next, the owner should obtain any required licenses or permits specific to their industry. Finally, maintaining accurate records of income and expenses is crucial for tax purposes, as profits are reported on the owner's personal tax return.

Steps to complete the Indiana Sole Proprietorship

Completing the setup of an Indiana sole proprietorship involves a series of steps:

- Select a business name and check for availability.

- Register the DBA with the local county clerk if necessary.

- Obtain required business licenses and permits.

- Set up a separate business bank account to manage finances.

- Keep detailed records of all business transactions.

Legal use of the Indiana Sole Proprietorship

Legally operating as a sole proprietorship in Indiana requires compliance with local, state, and federal regulations. The owner must ensure they have the appropriate licenses for their business type and comply with zoning laws. Additionally, it is important to understand tax obligations, as all business income is reported on the owner's personal tax return. This structure does not provide liability protection, so personal assets can be at risk if the business faces legal issues.

Required Documents

To establish and operate a sole proprietorship in Indiana, several documents may be necessary:

- Business name registration (DBA) if applicable.

- Licenses and permits specific to the business type.

- Tax identification number (EIN) if hiring employees.

- Bank account documentation for business transactions.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines for sole proprietorships, primarily focusing on tax reporting. Income from the business is reported on Schedule C of the owner's Form 1040 during tax season. It is essential for sole proprietors to keep meticulous records of all income and expenses to accurately report profits and claim eligible deductions. Understanding these guidelines helps ensure compliance and can minimize tax liabilities.

Quick guide on how to complete indiana sole proprietorship

Complete Indiana Sole Proprietorship effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed papers, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the features required to generate, modify, and eSign your documents promptly without holdups. Manage Indiana Sole Proprietorship on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Indiana Sole Proprietorship seamlessly

- Find Indiana Sole Proprietorship and select Get Form to commence.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require you to print new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Indiana Sole Proprietorship to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the largest sole proprietorships in the world?

The largest sole proprietorships in the world are typically characterized by their individual ownership and the personal management style of their founders. These businesses can range from local enterprises to internationally recognized brands. Understanding the largest sole proprietorships can provide insights into successful business practices and innovative strategies that can be applied to diverse industries.

-

How does airSlate SignNow cater to sole proprietorships?

airSlate SignNow offers an easy-to-use platform that is particularly beneficial for sole proprietorships looking to streamline their document signing and management processes. With features that enable quick eSigning, document templates, and secure cloud storage, airSlate SignNow helps sole proprietors enhance efficiency. This makes it an ideal solution for the largest sole proprietorships in the world as they seek to optimize their operations.

-

What pricing plans does airSlate SignNow offer for sole proprietorships?

airSlate SignNow provides flexible pricing plans designed to suit the needs of sole proprietorships of various sizes. Customers can choose from basic to advanced plans, depending on their document management requirements. The cost-effectiveness of airSlate SignNow makes it accessible for even the largest sole proprietorships in the world, while still offering robust features.

-

What features are essential for the largest sole proprietorships in the world when using SignNow?

The largest sole proprietorships in the world benefit from features such as customizable document templates, real-time tracking of document status, and secure cloud storage. Additionally, the ability to automate workflows and integrate with other applications makes airSlate SignNow particularly valuable. These features help sole proprietorships maintain control and efficiency in their document management processes.

-

How can airSlate SignNow improve workflow for sole proprietorships?

airSlate SignNow signNowly improves workflows for sole proprietorships by simplifying the eSigning process and reducing the time spent on paperwork. By facilitating seamless collaboration on documents, it allows business owners to focus on their core activities rather than administrative tasks. As a result, any sole proprietorship, including the largest sole proprietorships in the world, can optimize their productivity.

-

Is airSlate SignNow compatible with other software commonly used by sole proprietorships?

Yes, airSlate SignNow is designed to integrate seamlessly with a variety of popular software solutions, enhancing the operational capabilities of sole proprietorships. This includes integration with CRM systems, accounting software, and productivity tools. Such compatibility is essential for the largest sole proprietorships in the world, who often rely on interconnected systems to manage their businesses effectively.

-

What benefits can my sole proprietorship gain from using airSlate SignNow?

By using airSlate SignNow, your sole proprietorship can gain numerous benefits, including faster document turnaround times and improved customer satisfaction. It also enhances security and compliance by providing a legally binding eSignature solution. Such advantages support the growth and scalability of even the largest sole proprietorships in the world.

Get more for Indiana Sole Proprietorship

Find out other Indiana Sole Proprietorship

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online