Chapter 13 Plan Form

What is the Chapter 13 Plan

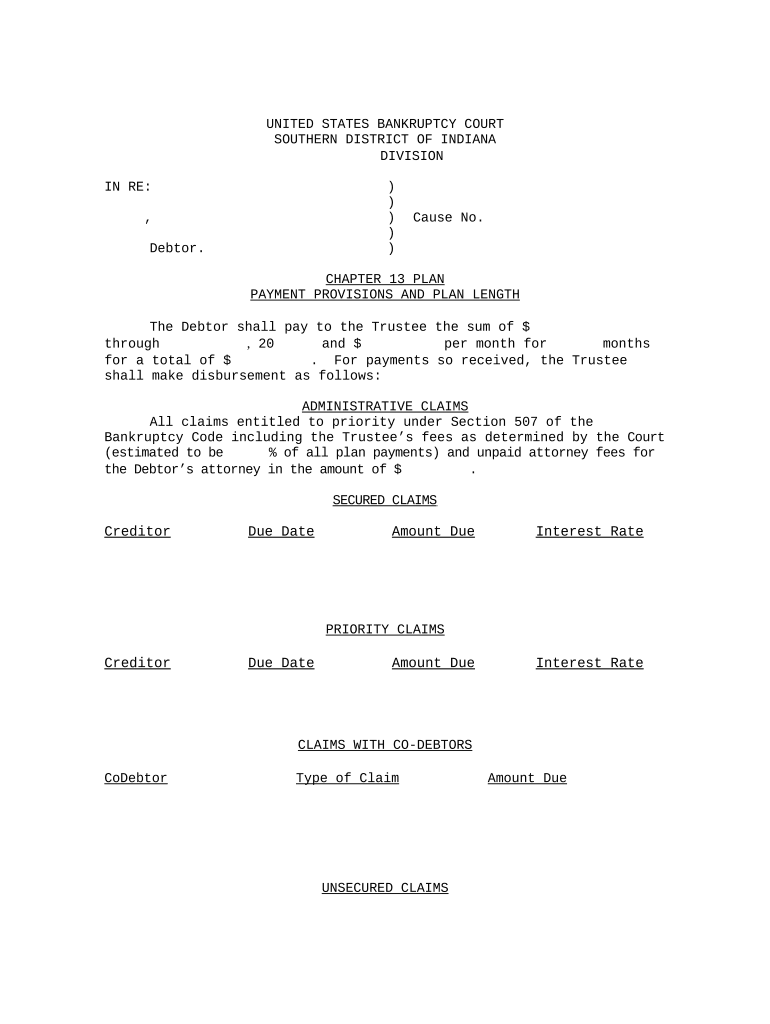

The Chapter 13 Plan is a legal framework designed for individuals in the United States who are facing financial difficulties but wish to retain their assets while repaying debts over a specified period. This plan allows debtors to propose a repayment schedule to their creditors, typically lasting three to five years. It is particularly beneficial for those who have a regular income and want to avoid foreclosure or repossession of property. The plan must be approved by the bankruptcy court, ensuring that it meets legal requirements and is feasible for the debtor.

How to use the Chapter 13 Plan

Using the Chapter 13 Plan involves several key steps. First, individuals must file a petition with the bankruptcy court, which includes detailed information about their income, expenses, and debts. Once the petition is filed, the debtor must propose a repayment plan that outlines how they intend to pay off their debts. This plan is then submitted to the court for approval. After approval, the debtor begins making payments according to the plan, which are distributed to creditors by a trustee. It is essential to adhere to the terms of the plan to avoid complications or dismissal of the case.

Steps to complete the Chapter 13 Plan

Completing the Chapter 13 Plan requires careful attention to detail. The following steps outline the process:

- Gather financial documents, including income statements, tax returns, and a list of debts.

- Consult with a bankruptcy attorney to ensure compliance with legal requirements.

- File the Chapter 13 petition with the bankruptcy court, including the proposed repayment plan.

- Attend the creditors' meeting, where creditors can ask questions about the plan.

- Make regular payments as outlined in the approved plan.

- Complete any required financial management courses.

- Obtain a discharge of remaining debts after successfully completing the plan.

Key elements of the Chapter 13 Plan

The Chapter 13 Plan consists of several key elements that must be addressed to ensure its effectiveness:

- Payment Amount: The plan must specify how much the debtor will pay each month.

- Duration: The repayment period typically lasts three to five years.

- Debt Classification: Debts must be categorized as secured, unsecured, or priority, affecting how they are treated in the plan.

- Feasibility: The plan must demonstrate that the debtor can afford the proposed payments based on their income.

- Creditors' Rights: The plan must respect the rights of creditors while providing a fair repayment structure.

Legal use of the Chapter 13 Plan

The legal use of the Chapter 13 Plan is governed by federal bankruptcy laws. It allows individuals to reorganize their debts while maintaining their property. The plan must comply with the Bankruptcy Code and be approved by the bankruptcy court. Legal representation is often recommended to navigate the complexities of the process and ensure that all legal requirements are met. Failure to adhere to legal standards can result in the dismissal of the case or denial of the plan.

Eligibility Criteria

To qualify for a Chapter 13 Plan, individuals must meet specific eligibility criteria. These include:

- The debtor must have a regular income, which can include wages, self-employment income, or other reliable sources.

- Unsecured debts must be below a certain limit, which is adjusted periodically.

- Secured debts must also fall within specified limits.

- The debtor must not have had a Chapter 13 case dismissed within the previous 180 days for failure to comply with court orders.

Quick guide on how to complete chapter 13 plan 497307016

Easily Prepare Chapter 13 Plan on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Handle Chapter 13 Plan on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process now.

Effortlessly Edit and Electronically Sign Chapter 13 Plan

- Obtain Chapter 13 Plan and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced paperwork, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Chapter 13 Plan and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Chapter 13 plan?

A Chapter 13 plan is a repayment plan under bankruptcy law that allows individuals to reorganize their debts and pay them off over a specified period, typically three to five years. This plan helps debtors keep their assets while making manageable payments. It's an effective solution for those seeking financial relief.

-

How does airSlate SignNow support the Chapter 13 plan process?

airSlate SignNow streamlines the Chapter 13 plan process by allowing users to create, send, and eSign essential documents quickly and securely. With its user-friendly interface, you can manage all your bankruptcy paperwork digitally, ensuring that your Chapter 13 plan is organized and compliant. Our software simplifies collaboration with attorneys and financial advisors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those managing a Chapter 13 plan. You can choose from monthly or annual subscription models, ensuring you only pay for what you need. All plans come with a free trial, so you can explore our features risk-free.

-

Can I integrate airSlate SignNow with other tools for my Chapter 13 plan?

Yes, airSlate SignNow can be easily integrated with a variety of application tools, which can be beneficial for managing your Chapter 13 plan. Common integrations include CRM systems, file storage services, and accounting software. This connectivity enhances your workflow and ensures that all tasks related to your Chapter 13 plan are seamlessly coordinated.

-

What benefits does eSigning provide for a Chapter 13 plan?

eSigning with airSlate SignNow offers convenience and speed when managing a Chapter 13 plan. It allows you to obtain signatures from multiple parties quickly, eliminating the need for in-person meetings or physical paperwork. This not only saves time but also provides a secure way to finalize agreements related to your repayment plan.

-

Is airSlate SignNow secure for managing sensitive Chapter 13 plan documents?

Absolutely, airSlate SignNow prioritizes security, especially for sensitive Chapter 13 plan documents. Our platform employs advanced encryption and secure data storage, ensuring that your information remains protected. You can have peace of mind knowing that your financial data is handled with the utmost care.

-

What support options are available for users managing their Chapter 13 plan?

Users of airSlate SignNow can access a range of support options while managing their Chapter 13 plan. Our customer service team is available via chat, phone, and email to address any questions or issues you may encounter. Additionally, we provide comprehensive resources, including tutorials and FAQs, to assist you in using our platform effectively.

Get more for Chapter 13 Plan

- Worksheet graphing quadratic functions cloudfront net form

- Micrecycle form

- Interior savings direct deposit form

- Calpers physical requirements of position form

- Unlawful activity addendum the california apartment association form

- Nwmls form 35r pdf

- Mieterselbstauskunft form

- Iowa dot medical report form

Find out other Chapter 13 Plan

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple