Complex Will with Credit Shelter Marital Trust for Large Estates Indiana Form

What is the Complex Will With Credit Shelter Marital Trust For Large Estates Indiana

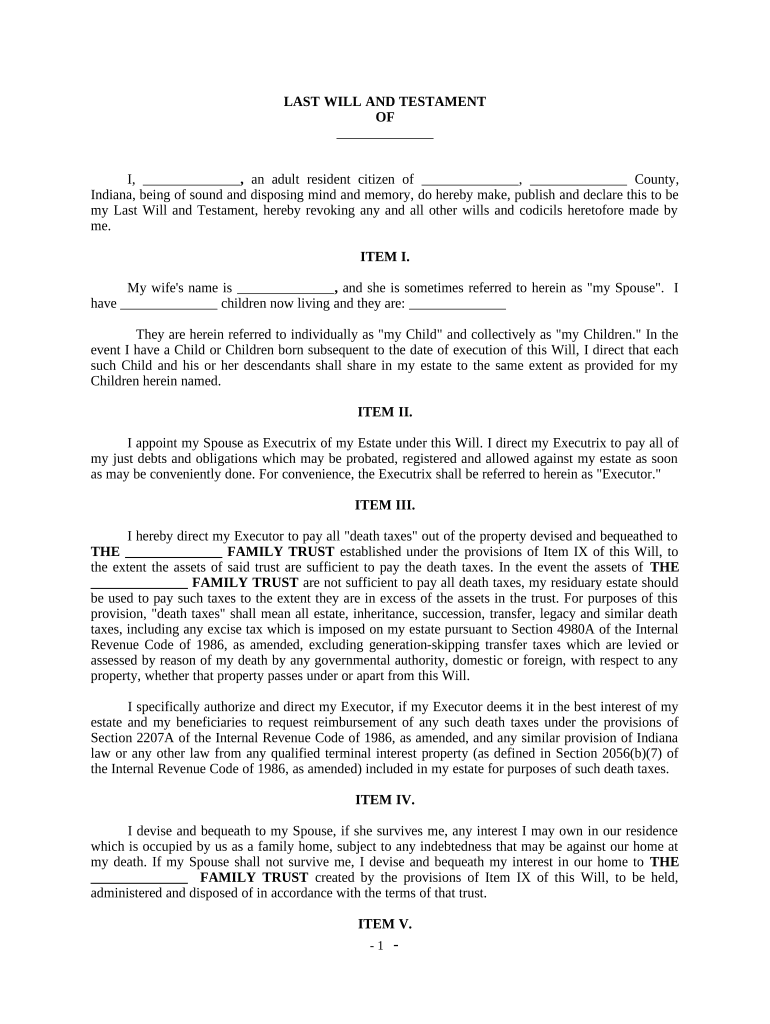

The Complex Will With Credit Shelter Marital Trust for Large Estates in Indiana is a legal document designed to manage the distribution of a deceased person's estate while minimizing estate taxes. This type of will incorporates a credit shelter trust, which allows a portion of the estate to be set aside for the surviving spouse, ensuring that it does not exceed the federal estate tax exemption limit. By doing so, this trust helps preserve wealth for heirs while providing financial security for the surviving spouse.

How to Use the Complex Will With Credit Shelter Marital Trust For Large Estates Indiana

To effectively use the Complex Will With Credit Shelter Marital Trust for Large Estates in Indiana, individuals should first consult with an estate planning attorney. This professional can help tailor the will to specific needs, ensuring compliance with state laws. Once the will is drafted, it should be signed in the presence of witnesses, as required by Indiana law. After execution, the will must be stored securely, and copies should be shared with relevant family members or advisors to ensure clarity regarding the estate plan.

Steps to Complete the Complex Will With Credit Shelter Marital Trust For Large Estates Indiana

Completing the Complex Will With Credit Shelter Marital Trust for Large Estates in Indiana involves several essential steps:

- Gather necessary information about assets, liabilities, and beneficiaries.

- Consult with an estate planning attorney to draft the will and trust provisions.

- Review the document for accuracy and clarity.

- Sign the will in front of at least two witnesses, as required by Indiana law.

- Store the signed document in a secure location, such as a safe or with an attorney.

- Inform your executor and beneficiaries about the location of the will.

Legal Use of the Complex Will With Credit Shelter Marital Trust For Large Estates Indiana

The legal use of the Complex Will With Credit Shelter Marital Trust in Indiana is governed by state laws regarding wills and trusts. This document must comply with Indiana's statutory requirements, including proper execution and witnessing. Additionally, the trust must be properly funded to ensure that the intended assets are transferred into the trust upon the death of the grantor. Failure to adhere to these legal standards may result in challenges to the will or trust, potentially complicating the estate settlement process.

Key Elements of the Complex Will With Credit Shelter Marital Trust For Large Estates Indiana

Key elements of the Complex Will With Credit Shelter Marital Trust for Large Estates in Indiana include:

- Credit Shelter Trust: A trust that holds assets for the surviving spouse without counting towards their estate for tax purposes.

- Marital Trust: A trust that benefits the surviving spouse, allowing them to access income and principal during their lifetime.

- Executor Designation: The appointment of an executor responsible for managing the estate and ensuring the will's provisions are carried out.

- Beneficiary Designation: Clear identification of beneficiaries who will receive assets upon the grantor's death.

State-Specific Rules for the Complex Will With Credit Shelter Marital Trust For Large Estates Indiana

Indiana has specific rules governing the execution and validity of wills and trusts. For the Complex Will With Credit Shelter Marital Trust, it is essential to adhere to the following state-specific rules:

- Wills must be signed by the testator and witnessed by at least two individuals.

- Trust provisions must comply with Indiana's trust laws, including proper funding and management.

- Any amendments or revocations of the will must also follow the same execution requirements.

Quick guide on how to complete complex will with credit shelter marital trust for large estates indiana

Effortlessly Prepare Complex Will With Credit Shelter Marital Trust For Large Estates Indiana on Any Device

Digital document management has increasingly become favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without any delays. Manage Complex Will With Credit Shelter Marital Trust For Large Estates Indiana on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The easiest method to edit and eSign Complex Will With Credit Shelter Marital Trust For Large Estates Indiana without hassle

- Obtain Complex Will With Credit Shelter Marital Trust For Large Estates Indiana and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize key parts of the documents or redact sensitive information using the tools that airSlate SignNow specifically supplies for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, lengthy form searches, or errors necessitating the printing of new document copies. airSlate SignNow fulfills all your document management requirements within a few clicks from your preferred device. Modify and eSign Complex Will With Credit Shelter Marital Trust For Large Estates Indiana and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Complex Will With Credit Shelter Marital Trust For Large Estates in Indiana?

A Complex Will With Credit Shelter Marital Trust For Large Estates in Indiana is a legal document that helps manage and protect wealth for married couples, ensuring that assets are distributed according to their wishes. This type of will includes provisions for a credit shelter trust, which can minimize estate taxes and provide financial security for surviving spouses.

-

How does a Complex Will With Credit Shelter Marital Trust For Large Estates in Indiana benefit my family?

By utilizing a Complex Will With Credit Shelter Marital Trust For Large Estates in Indiana, you can safeguard your family's financial future. This will helps avoid probate, minimizes estate taxes, and allows for the seamless transfer of assets, ensuring your loved ones are taken care of.

-

What are the costs associated with creating a Complex Will With Credit Shelter Marital Trust For Large Estates in Indiana?

The costs for creating a Complex Will With Credit Shelter Marital Trust For Large Estates in Indiana can vary widely based on the complexity of your estate and the attorney's fees. It's essential to compare prices and consider the long-term savings from tax benefits when choosing a legal service.

-

Does airSlate SignNow support the creation of a Complex Will With Credit Shelter Marital Trust For Large Estates in Indiana?

Yes, airSlate SignNow provides an easy-to-use platform that enables you to create, modify, and sign a Complex Will With Credit Shelter Marital Trust For Large Estates in Indiana digitally. Our solution ensures that the process is efficient and compliant with legal standards.

-

What features does airSlate SignNow offer for handling Complex Wills and Trusts?

airSlate SignNow offers a range of features to facilitate the handling of Complex Wills and Trusts, including customizable document templates, secure electronic signatures, and real-time collaboration. These features can help streamline the process of creating a Complex Will With Credit Shelter Marital Trust For Large Estates in Indiana.

-

How can I ensure my Complex Will With Credit Shelter Marital Trust For Large Estates in Indiana is legally binding?

To ensure that your Complex Will With Credit Shelter Marital Trust For Large Estates in Indiana is legally binding, it’s crucial to follow Indiana’s specific legal requirements, such as proper execution and witnessing of the document. Using airSlate SignNow helps meet these requirements efficiently.

-

Can my Complex Will With Credit Shelter Marital Trust For Large Estates in Indiana be updated or revoked?

Yes, you can update or revoke your Complex Will With Credit Shelter Marital Trust For Large Estates in Indiana as your circumstances change, such as marriage, divorce, or signNow life events. airSlate SignNow allows you to easily make revisions to your documents while maintaining compliance.

Get more for Complex Will With Credit Shelter Marital Trust For Large Estates Indiana

Find out other Complex Will With Credit Shelter Marital Trust For Large Estates Indiana

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself