Schedule of Loss Intact Insurance Form

What is the Schedule Of Loss Intact Insurance

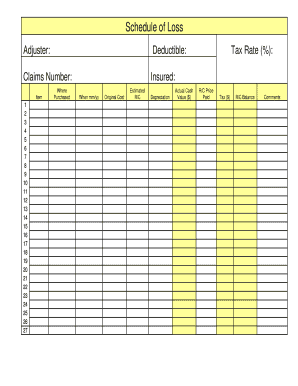

The Schedule Of Loss Intact Insurance is a detailed document that outlines the financial losses incurred by an insured party due to an event covered by their insurance policy. This form is essential for accurately assessing and claiming compensation for losses, including property damage, business interruption, and other related expenses. It serves as a formal record that helps both the insured and the insurer understand the extent of the losses and facilitates the claims process.

How to Use the Schedule Of Loss Intact Insurance

Using the Schedule Of Loss Intact Insurance involves several steps to ensure that all relevant information is captured accurately. Start by gathering all necessary documentation related to the losses, such as receipts, invoices, and photographs of the damage. Next, fill out the form by detailing each loss, including descriptions, dates, and amounts. It is crucial to provide clear and concise information to avoid delays in the claims process. Once completed, submit the form to your insurance provider according to their specified submission guidelines.

Steps to Complete the Schedule Of Loss Intact Insurance

Completing the Schedule Of Loss Intact Insurance requires careful attention to detail. Follow these steps:

- Collect all documentation related to your losses.

- Identify and categorize each loss, such as property damage or lost income.

- Provide accurate descriptions and dates for each item listed.

- Calculate the total amount for each loss and ensure all figures are correct.

- Review the completed form for accuracy and completeness.

- Submit the form to your insurance provider, following their instructions for submission.

Key Elements of the Schedule Of Loss Intact Insurance

The Schedule Of Loss Intact Insurance includes several key elements that are vital for processing a claim. These elements typically consist of:

- A detailed description of each loss incurred.

- The date when the loss occurred.

- The estimated monetary value of each loss.

- Supporting documentation that validates the claims, such as receipts and photographs.

- Contact information for the insured party and the insurance provider.

Legal Use of the Schedule Of Loss Intact Insurance

The Schedule Of Loss Intact Insurance is legally recognized as a formal document in the claims process. It is important to ensure that all information provided is truthful and accurate, as submitting false information can lead to penalties or denial of the claim. This document serves as evidence in case of disputes and helps to establish the legitimacy of the losses claimed.

Examples of Using the Schedule Of Loss Intact Insurance

Examples of using the Schedule Of Loss Intact Insurance can vary widely based on the nature of the loss. For instance:

- A business may use the form to claim lost revenue due to a fire that damaged their property.

- A homeowner might document losses from a severe storm, including roof damage and destroyed personal belongings.

- A renter could list losses from theft, providing details on stolen items and their values.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule of loss intact insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule Of Loss Intact Insurance?

The Schedule Of Loss Intact Insurance is a detailed document that outlines the financial losses incurred due to an insured event. It serves as a crucial component in the claims process, helping policyholders receive fair compensation. Understanding this schedule is essential for maximizing your insurance benefits.

-

How can airSlate SignNow help with the Schedule Of Loss Intact Insurance?

airSlate SignNow streamlines the process of preparing and signing the Schedule Of Loss Intact Insurance. Our platform allows you to easily create, edit, and send documents for eSignature, ensuring that your claims are processed quickly and efficiently. This saves you time and reduces the hassle of paperwork.

-

What features does airSlate SignNow offer for managing the Schedule Of Loss Intact Insurance?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for the Schedule Of Loss Intact Insurance. These tools enhance your workflow, making it easier to manage your insurance documents. Additionally, our platform ensures compliance and security throughout the process.

-

Is airSlate SignNow cost-effective for handling the Schedule Of Loss Intact Insurance?

Yes, airSlate SignNow provides a cost-effective solution for managing the Schedule Of Loss Intact Insurance. Our pricing plans are designed to fit various business needs, allowing you to save on administrative costs while ensuring efficient document management. This makes it an ideal choice for businesses of all sizes.

-

Can I integrate airSlate SignNow with other tools for the Schedule Of Loss Intact Insurance?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms that can assist in managing the Schedule Of Loss Intact Insurance. This includes CRM systems, cloud storage services, and more, allowing you to create a cohesive workflow that enhances productivity.

-

What are the benefits of using airSlate SignNow for the Schedule Of Loss Intact Insurance?

Using airSlate SignNow for the Schedule Of Loss Intact Insurance provides numerous benefits, including faster processing times, improved accuracy, and enhanced security. Our platform simplifies the eSigning process, ensuring that your documents are signed and returned promptly. This ultimately leads to a smoother claims experience.

-

How secure is airSlate SignNow when handling the Schedule Of Loss Intact Insurance?

Security is a top priority at airSlate SignNow. When managing the Schedule Of Loss Intact Insurance, your documents are protected with advanced encryption and secure storage. We comply with industry standards to ensure that your sensitive information remains confidential and safe from unauthorized access.

Get more for Schedule Of Loss Intact Insurance

Find out other Schedule Of Loss Intact Insurance

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed