Living Trust Property Record Indiana Form

What is the Living Trust Property Record Indiana

The Living Trust Property Record Indiana is a legal document that outlines the assets held in a living trust within the state of Indiana. This record serves to clarify the ownership and management of property during the grantor’s lifetime and after their passing. It is essential for ensuring that the assets are distributed according to the grantor's wishes, avoiding probate, and providing clear instructions for the trustee. This document is particularly important for individuals looking to manage their estate efficiently and protect their assets from potential legal disputes.

How to Obtain the Living Trust Property Record Indiana

Obtaining the Living Trust Property Record Indiana involves several steps. First, individuals should consult with a legal professional who specializes in estate planning to ensure that the trust is set up correctly. Once the trust is established, the grantor or trustee can request the record through the appropriate county office or online resources provided by the state. It is important to gather all necessary documentation, including identification and proof of trust establishment, to facilitate the process. Additionally, some counties may offer online portals for easier access to these records.

Steps to Complete the Living Trust Property Record Indiana

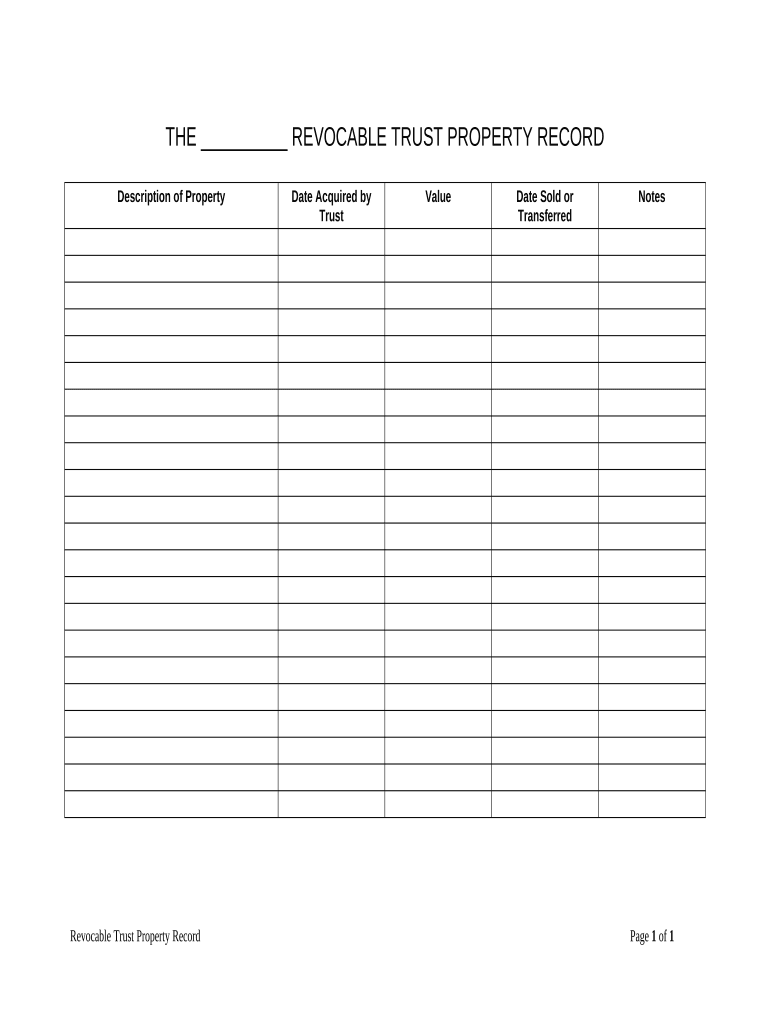

Completing the Living Trust Property Record Indiana requires careful attention to detail. Begin by collecting all relevant information about the trust, including the names of the grantor, trustee, and beneficiaries. Next, list all assets included in the trust, such as real estate, bank accounts, and personal property. Ensure that each asset is accurately described and valued. After compiling this information, fill out the official form provided by the state or county office, ensuring that all sections are completed accurately. Finally, review the document for any errors before submitting it to the appropriate office for filing.

Legal Use of the Living Trust Property Record Indiana

The Living Trust Property Record Indiana is legally binding and plays a crucial role in estate planning. It allows the trustee to manage the assets according to the grantor’s wishes without going through probate. This document can be presented in court if disputes arise regarding the trust or its assets. It is essential for the record to be accurate and up-to-date to ensure that it reflects the current status of the trust and its assets. Proper legal use of this record can help prevent misunderstandings and disputes among beneficiaries.

State-Specific Rules for the Living Trust Property Record Indiana

Indiana has specific rules governing the creation and management of living trusts. These include requirements for the trust document to be in writing, signed by the grantor, and witnessed. Additionally, the state allows for the transfer of property into the trust without the need for probate, provided that the trust is properly funded. It is important for individuals to familiarize themselves with Indiana’s laws regarding trusts to ensure compliance and to maximize the benefits of their living trust property record.

Key Elements of the Living Trust Property Record Indiana

Key elements of the Living Trust Property Record Indiana include the names of the grantor, trustee, and beneficiaries, as well as a detailed inventory of the trust assets. The document should also specify the terms of the trust, including how assets are to be managed and distributed. Additionally, it is important to include any specific instructions or conditions related to the trust. These elements are crucial for ensuring that the trust operates smoothly and according to the grantor's intentions.

Quick guide on how to complete living trust property record indiana

Effortlessly Prepare Living Trust Property Record Indiana on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any hold-ups. Manage Living Trust Property Record Indiana on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The Most Efficient Way to Alter and eSign Living Trust Property Record Indiana with Ease

- Locate Living Trust Property Record Indiana and select Get Form to begin.

- Make use of the available tools to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your preference. Modify and eSign Living Trust Property Record Indiana to ensure effective communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust Property Record in Indiana?

A Living Trust Property Record in Indiana is a legal document that outlines how your assets will be managed and distributed during your lifetime and after your death. This record helps avoid probate and ensures a smooth transition of property ownership to your beneficiaries. Utilizing airSlate SignNow can help you create and manage these documents efficiently.

-

How can I create a Living Trust Property Record in Indiana using airSlate SignNow?

Creating a Living Trust Property Record in Indiana with airSlate SignNow is simple. Start by selecting our customizable templates that comply with Indiana laws, complete the necessary details, and eSign the document digitally. Our platform ensures a secure and legally binding process to streamline your estate planning.

-

What are the benefits of having a Living Trust Property Record in Indiana?

Having a Living Trust Property Record in Indiana offers numerous benefits, including the avoidance of probate, privacy concerning your assets, and more control over asset distribution. It also allows for seamless management of your affairs if you become incapacitated. This essential document ensures your wishes are honored according to your specific instructions.

-

Are there any costs associated with creating a Living Trust Property Record in Indiana?

Yes, creating a Living Trust Property Record in Indiana may involve various costs such as registration fees and potential attorney fees if you seek legal advice. However, airSlate SignNow provides a cost-effective solution, allowing you to create and eSign documents online at a fraction of traditional costs, helping you save money while ensuring legal compliance.

-

Can I edit my Living Trust Property Record in Indiana after it is created?

Yes, you can edit your Living Trust Property Record in Indiana as needed. Life changes such as marriage, divorce, or the birth of a child may require updates to your trust document. With airSlate SignNow's user-friendly platform, updating and eSigning your documents is quick and easy.

-

Is my Living Trust Property Record in Indiana secure with airSlate SignNow?

Absolutely! Your Living Trust Property Record in Indiana is secure with airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive information, ensuring that your estate planning documents are safe from unauthorized access.

-

Can I integrate airSlate SignNow with other tools for managing my Living Trust Property Record in Indiana?

Yes, airSlate SignNow offers various integrations with popular business tools and applications. This ability allows you to seamlessly manage your Living Trust Property Record in Indiana alongside other important documents and workflows, enhancing your overall productivity and organization.

Get more for Living Trust Property Record Indiana

- Personal estimated tax form

- Yes bank personal loan agreement pdf 267333 form

- Printable insurance verification form 15064261

- Body check form 56712962

- Da form 7631

- Psb lpn judgement and comprehension form

- Stop 6525 sp cis form

- Instructions for form 1120 f instructions for form 1120 f u s income tax return of a foreign corporation 732269227

Find out other Living Trust Property Record Indiana

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe