Financial Account Transfer to Living Trust Indiana Form

What is the Financial Account Transfer To Living Trust Indiana

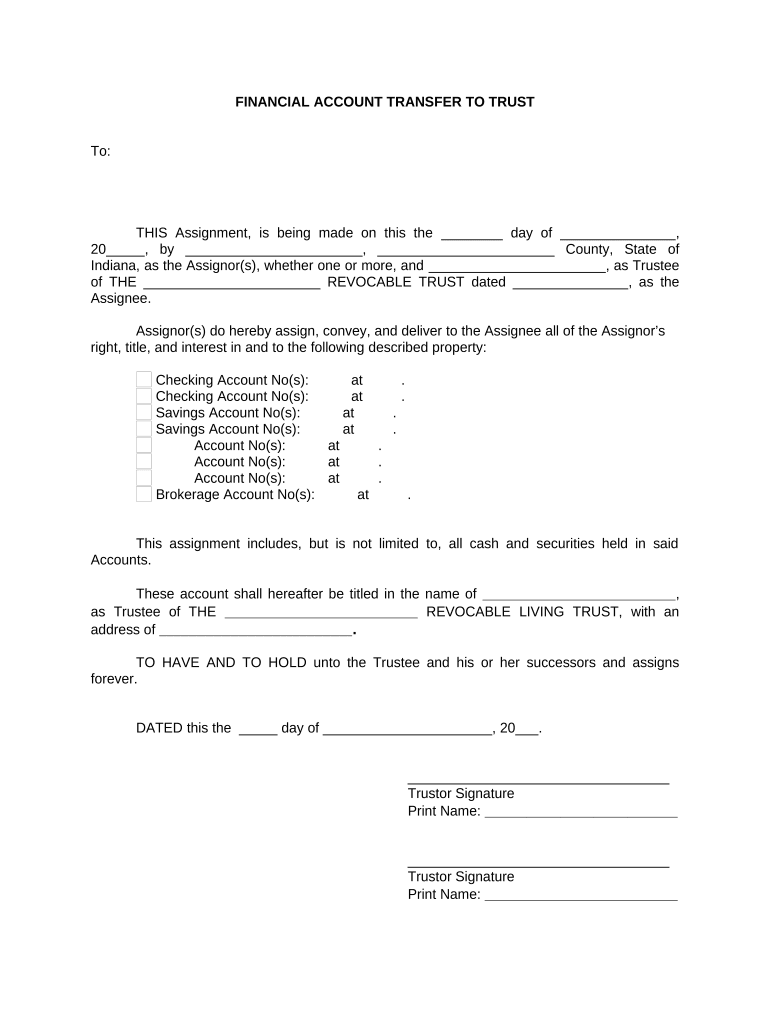

The Financial Account Transfer To Living Trust Indiana form is a legal document that facilitates the transfer of financial assets into a living trust. This process allows individuals to manage their assets during their lifetime and ensure a smooth transition of these assets to beneficiaries upon death. The form is essential for individuals in Indiana who wish to establish a living trust, as it provides the necessary legal framework for the transfer of bank accounts, investment accounts, and other financial holdings. By utilizing this form, individuals can maintain control over their assets while also simplifying the estate planning process.

Steps to Complete the Financial Account Transfer To Living Trust Indiana

Completing the Financial Account Transfer To Living Trust Indiana form involves several key steps to ensure that the transfer is executed correctly. First, gather all relevant financial documents, including account statements and trust documentation. Next, fill out the form with accurate information regarding the trust and the assets being transferred. It is important to include the name of the trust, the trustee's name, and the specific accounts being transferred. Once the form is completed, it should be signed by the trustee and, if required, notarized. Finally, submit the form to the financial institution holding the accounts to finalize the transfer.

Legal Use of the Financial Account Transfer To Living Trust Indiana

The legal use of the Financial Account Transfer To Living Trust Indiana form is governed by state laws regarding trusts and estate planning. In Indiana, this form must comply with the Indiana Trust Code, which outlines the requirements for establishing and managing a living trust. Proper execution of the form ensures that the transfer of assets is legally binding and recognized by financial institutions. Additionally, it is crucial to ensure that the trust is properly funded with the transferred assets to avoid complications during the probate process.

State-Specific Rules for the Financial Account Transfer To Living Trust Indiana

Indiana has specific rules that govern the establishment and management of living trusts. These rules dictate how the Financial Account Transfer To Living Trust Indiana form should be completed and submitted. For instance, Indiana law requires that the trust document be properly executed and that the trustee has the authority to manage the assets being transferred. Furthermore, the form must include specific information about the trust and the assets to ensure compliance with state regulations. Understanding these state-specific rules is vital for individuals looking to effectively use this form in their estate planning.

Required Documents for the Financial Account Transfer To Living Trust Indiana

To successfully complete the Financial Account Transfer To Living Trust Indiana form, certain documents are required. These typically include the trust document, which outlines the terms and conditions of the living trust, and identification documents for the trustee. Additionally, financial institutions may request account statements or proof of ownership for the assets being transferred. Having these documents ready will facilitate a smoother transfer process and help avoid delays when submitting the form.

Examples of Using the Financial Account Transfer To Living Trust Indiana

There are various scenarios in which individuals may use the Financial Account Transfer To Living Trust Indiana form. For example, a married couple may transfer their joint bank account into their living trust to ensure that their assets are managed according to their wishes after one spouse passes away. Another example is an individual who has a brokerage account and wants to ensure that their investments are distributed according to their estate plan. These examples illustrate the practical applications of the form in different financial contexts.

Quick guide on how to complete financial account transfer to living trust indiana

Manage Financial Account Transfer To Living Trust Indiana seamlessly on any gadget

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can acquire the necessary form and securely retain it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your paperwork rapidly without delays. Handle Financial Account Transfer To Living Trust Indiana on any gadget using airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest method to modify and electronically sign Financial Account Transfer To Living Trust Indiana effortlessly

- Obtain Financial Account Transfer To Living Trust Indiana and click Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Verify all the details and click on the Finish button to preserve your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or an invite link, or download it to your computer.

Put an end to lost or misplaced documents, tiresome form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Financial Account Transfer To Living Trust Indiana and guarantee exceptional communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for Financial Account Transfer To Living Trust in Indiana?

The process for Financial Account Transfer To Living Trust in Indiana generally involves gathering necessary documents, such as the trust agreement, and then contacting your financial institution to initiate the transfer. Ensure that all signatures are completed to avoid delays. Once submitted, your bank or financial advisor will guide you through the steps to finalize the transfer.

-

What are the benefits of transferring financial accounts to a living trust in Indiana?

Transferring financial accounts to a living trust in Indiana can provide various benefits, including avoiding probate, protecting privacy, and ensuring a smooth transition of assets to beneficiaries. This transfer can also allow for more efficient management of your assets during life and after death. It simplifies the distribution process and may save on estate taxes.

-

Are there any fees associated with the Financial Account Transfer To Living Trust in Indiana?

Yes, there may be fees associated with the Financial Account Transfer To Living Trust in Indiana, which can vary by financial institution. Some institutions may charge processing fees for the transfer or require an initial setup fee for the trust. It’s best to check with your specific bank or credit union to understand all potential costs involved.

-

How does airSlate SignNow assist with Financial Account Transfer To Living Trust in Indiana?

airSlate SignNow offers an easy-to-use platform that streamlines the documentation process for Financial Account Transfer To Living Trust in Indiana. Users can eSign necessary documents quickly, ensuring a hassle-free experience. Our cost-effective solution saves time and reduces the stress associated with transferring financial accounts.

-

What documents are needed for Financial Account Transfer To Living Trust in Indiana?

The main documents needed for Financial Account Transfer To Living Trust in Indiana include the original trust document, identification, and transfer forms from your financial institution. Additional documents such as tax identification numbers and any prior account statements may also be required. Be sure to gather all relevant documentation to simplify the transfer process.

-

Can I use airSlate SignNow for multiple financial accounts when transferring to a living trust in Indiana?

Absolutely! airSlate SignNow supports the electronic signing and management of multiple financial accounts when transferring to a living trust in Indiana. You can handle various accounts seamlessly within our platform, ensuring all documentation is signed and submitted efficiently. This convenience helps you manage complex transfers with ease.

-

Is it necessary to hire an attorney for Financial Account Transfer To Living Trust in Indiana?

While it is not strictly necessary to hire an attorney for Financial Account Transfer To Living Trust in Indiana, consulting one can provide valuable guidance. An attorney can help ensure that your trust is properly established and that all legal requirements are met. This can prevent potential issues in the future and provide peace of mind regarding the legality of your transfer.

Get more for Financial Account Transfer To Living Trust Indiana

Find out other Financial Account Transfer To Living Trust Indiana

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA