Indiana Unsecured Installment Payment Promissory Note for Fixed Rate Indiana Form

What is the Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana

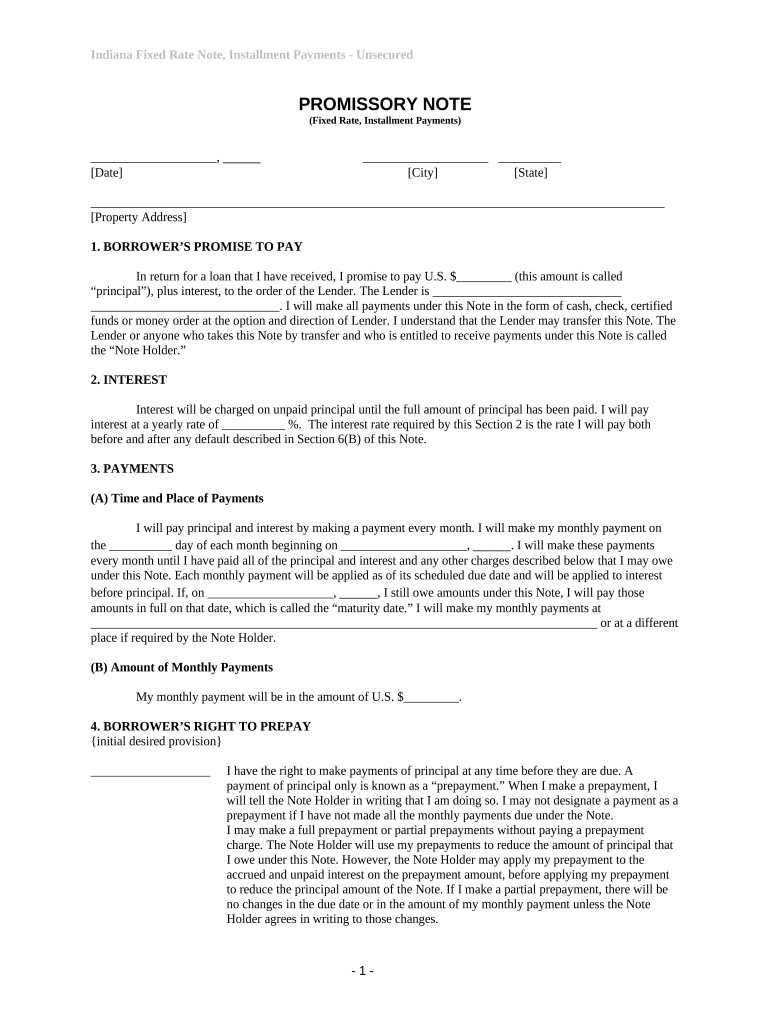

The Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana is a legal document that outlines a borrower's promise to repay a loan in fixed installments over a specified period. This type of note is typically used in situations where no collateral is required, making it an unsecured form of borrowing. It includes essential details such as the loan amount, interest rate, payment schedule, and the consequences of default. Understanding this document is crucial for both lenders and borrowers to ensure clarity and enforceability in the lending agreement.

Key elements of the Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana

Several key elements must be included in the Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana to ensure its validity. These elements typically include:

- Borrower and Lender Information: Names and addresses of both parties.

- Loan Amount: The total sum being borrowed.

- Interest Rate: The fixed rate applied to the loan.

- Payment Schedule: Details on how and when payments will be made.

- Default Terms: Conditions that define what constitutes a default and the consequences thereof.

- Governing Law: Specification that Indiana law governs the agreement.

How to use the Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana

Using the Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana involves several straightforward steps. First, both parties should review the terms of the note to ensure mutual understanding. Next, the borrower fills in the required information, including personal details and loan specifics. After completing the form, both parties should sign the document, ideally in the presence of a witness or notary to enhance its legal standing. Finally, each party should retain a copy of the signed note for their records.

Steps to complete the Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana

Completing the Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana involves the following steps:

- Gather necessary information, including personal details and loan specifics.

- Fill out the document accurately, ensuring all required fields are completed.

- Review the terms with the lender to confirm agreement on all points.

- Sign the document, preferably in front of a witness or notary.

- Distribute copies to all parties involved for their records.

Legal use of the Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana

The Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana is legally binding when executed properly. For it to hold up in court, it must meet specific legal requirements, such as clear identification of the parties, a definite loan amount, and a defined repayment schedule. Additionally, compliance with state laws regarding unsecured loans is essential. Proper execution, including signatures and, if applicable, notarization, ensures that the document can be enforced in case of a dispute.

State-specific rules for the Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana

Indiana has specific rules governing unsecured loans and promissory notes that must be adhered to when using the Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana. These rules include compliance with state lending laws, interest rate limits, and the requirement for clear terms regarding repayment and default. It is advisable for both lenders and borrowers to familiarize themselves with these regulations to avoid potential legal issues and ensure the enforceability of the note.

Quick guide on how to complete indiana unsecured installment payment promissory note for fixed rate indiana

Effortlessly Prepare Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without any delays. Manage Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-based operation today.

The Easiest Way to Edit and eSign Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana Seamlessly

- Find Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or redact sensitive information with tools designed specifically for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana?

An Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana is a legal document that outlines the terms of repayment for a loan that does not require any collateral. This document specifies the fixed interest rate, repayment schedule, and other essential terms. It is designed to protect both the lender and borrower in Indiana.

-

How can I create an Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana?

To create an Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana, you can utilize airSlate SignNow's easy-to-use document creation tools. Simply select the template, fill in the necessary details like loan amount, interest rates, and payment terms, and your document will be ready for eSigning. This process is quick and efficient, ensuring your note is legally compliant.

-

What are the benefits of using an Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana?

Using an Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana provides several benefits, including clarity on repayment obligations and legally binding terms. It helps both parties understand their rights and responsibilities, reduces the risk of conflicts, and promotes trust in financial transactions. Additionally, it can provide legal recourse in case of default.

-

Is there a cost associated with obtaining an Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana?

The cost of obtaining an Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana varies depending on whether you use online services like airSlate SignNow or consult with legal professionals. airSlate SignNow offers affordable pricing plans, making it accessible for businesses and individuals. This ensures that you can create your document without breaking the bank.

-

Can I customize my Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana?

Yes, airSlate SignNow allows you to customize your Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana according to your specific needs. You can modify terms, payment amounts, and interest rates easily. Customization ensures that the note fits the transaction perfectly and serves its intended purpose.

-

What integrations does airSlate SignNow offer for the Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana?

airSlate SignNow integrates with various applications, enhancing your experience when creating an Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana. These integrations include popular platforms like Google Drive, Dropbox, and CRM systems, allowing for seamless document management and eSigning. This connectivity increases your workflow efficiency.

-

How does eSigning work for the Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana?

eSigning an Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana with airSlate SignNow is straightforward. Once your document is prepared, you can send it to all parties for their electronic signatures. The platform ensures that signatures are legally recognized, and you receive a final copy once all parties have signed, streamlining the process signNowly.

Get more for Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana

Find out other Indiana Unsecured Installment Payment Promissory Note For Fixed Rate Indiana

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word