Kansas Lien Form

What is the Kansas Lien

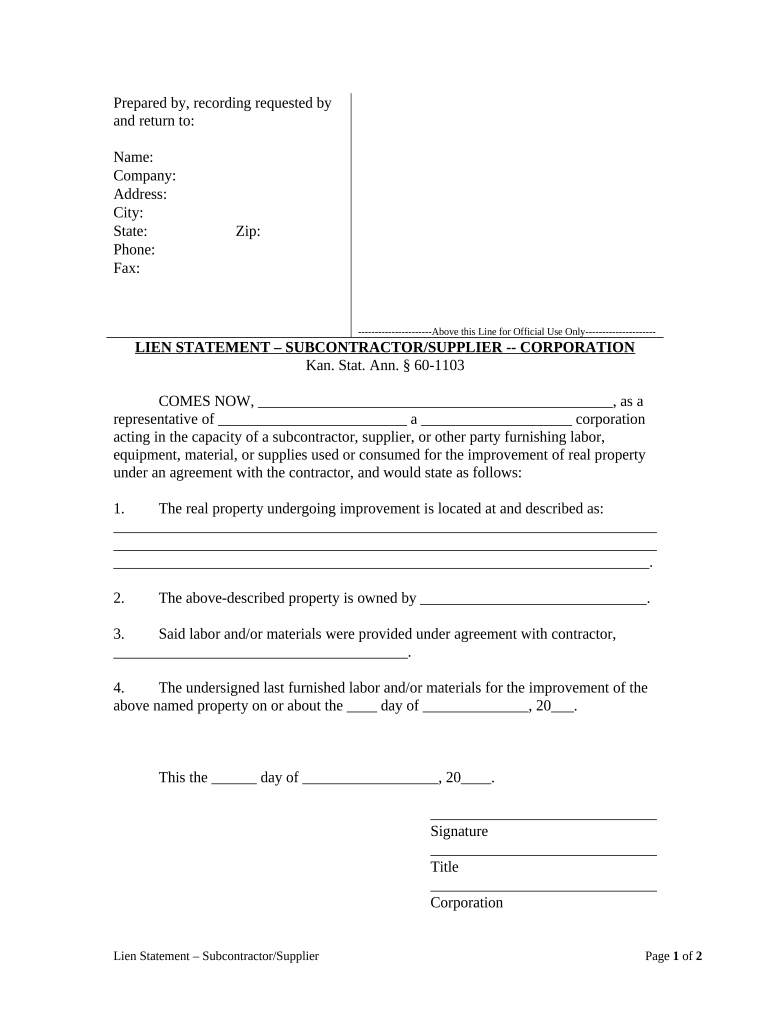

The Kansas lien is a legal claim against a property to secure payment for services rendered or materials supplied. This type of lien is particularly relevant for subcontractors and suppliers in the construction industry. When a contractor or subcontractor completes work on a property and is not paid, they may file a Kansas lien to ensure they receive compensation. The lien serves as a public notice of the debt and can affect the property owner's ability to sell or refinance the property until the lien is resolved.

Key elements of the Kansas Lien

Understanding the key elements of a Kansas lien is essential for anyone involved in construction or property management. The primary components include:

- Property Description: A clear description of the property where the lien is filed.

- Claim Amount: The total amount owed for services or materials provided.

- Claimant Information: The name and contact information of the subcontractor or supplier filing the lien.

- Owner Information: The name of the property owner against whom the lien is filed.

- Filing Date: The date the lien is officially recorded.

Steps to complete the Kansas Lien

Completing a Kansas lien involves several important steps to ensure its validity. Here are the main steps to follow:

- Gather necessary information about the property, including the owner's details and the amount owed.

- Draft the lien document, ensuring all required elements are included.

- File the lien with the appropriate county office where the property is located.

- Serve a copy of the lien to the property owner, notifying them of the claim.

Legal use of the Kansas Lien

The legal use of a Kansas lien is governed by state laws that outline the requirements for filing and enforcing the lien. It is crucial for subcontractors to follow these regulations to ensure their lien is enforceable. This includes adhering to timelines for filing and providing proper notice to property owners. Failure to comply with these legal requirements may result in the lien being invalidated, leaving the subcontractor without recourse for payment.

How to obtain the Kansas Lien

Obtaining a Kansas lien involves filing the lien document with the county clerk's office in the county where the property is located. The process typically includes:

- Completing the lien form with accurate information.

- Paying any required filing fees.

- Submitting the form in person or via mail, depending on the county's regulations.

Filing Deadlines / Important Dates

Timeliness is critical when filing a Kansas lien. Subcontractors must be aware of specific deadlines to ensure their claims are valid. Generally, a lien must be filed within six months of the last date services were provided or materials were supplied. Additionally, if the lien is not enforced through a lawsuit within one year of filing, it may become void. Keeping track of these important dates helps protect the rights of subcontractors and ensures they can pursue payment effectively.

Quick guide on how to complete kansas lien 497307390

Complete Kansas Lien effortlessly on any gadget

Web-based document handling has gained traction among businesses and individuals. It offers a flawless eco-friendly substitute to conventional printed and signed papers, as you can obtain the right format and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents promptly without hurdles. Manage Kansas Lien on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The optimal method to modify and eSign Kansas Lien effortlessly

- Locate Kansas Lien and then click Get Form to begin.

- Use the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere moments and holds the same legal significance as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Select how you want to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your requirements in document handling in a few clicks from a device of your selection. Alter and eSign Kansas Lien and ensure excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it benefit a Kansas subcontractor?

airSlate SignNow is a user-friendly platform that allows Kansas subcontractors to efficiently send and eSign documents. With features like document templates and automated workflows, it streamlines contract management, saving time and reducing errors for subcontractors.

-

How much does airSlate SignNow cost for Kansas subcontractors?

Pricing for airSlate SignNow is competitive and offers various plans to fit the needs of Kansas subcontractors. You can choose a monthly or annual subscription, depending on your project's scale, with costs often less than traditional faxing and mailing.

-

What features does airSlate SignNow include for Kansas subcontractors?

Key features of airSlate SignNow for Kansas subcontractors include eSignature capabilities, document management, and custom workflows. Additionally, it supports mobile signing, ensuring you can manage contracts on the go, which is crucial for construction businesses.

-

Is airSlate SignNow suitable for large subcontracting firms in Kansas?

Yes, airSlate SignNow is designed to accommodate all business sizes, including large subcontracting firms in Kansas. Its scalability allows teams to collaborate on documents efficiently and utilize advanced features such as audit trails and bulk send.

-

How can airSlate SignNow improve document workflow for Kansas subcontractors?

With airSlate SignNow, Kansas subcontractors can automate their document workflows, reducing manual tasks and improving efficiency. The platform allows easy tracking of document statuses, ensuring timely responses and approvals from all involved parties.

-

What integrations does airSlate SignNow offer for Kansas subcontractors?

AirSlate SignNow integrates seamlessly with various software commonly used by Kansas subcontractors, such as CRM systems, project management tools, and cloud storage services. This interoperability enhances productivity by allowing for smooth document management across platforms.

-

Can airSlate SignNow help Kansas subcontractors stay compliant with legal regulations?

Absolutely! airSlate SignNow is compliant with the ESIGN Act and UETA, ensuring that electronic signatures hold legal weight in Kansas. This means Kansas subcontractors can confidently manage contracts without the worry of regulatory issues.

Get more for Kansas Lien

Find out other Kansas Lien

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application