Form 8621 Example

What is the Form 8621 Example

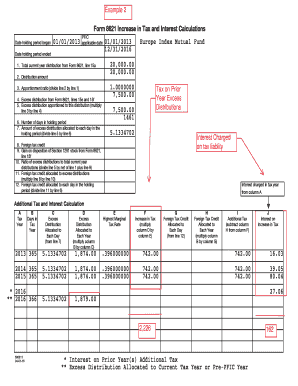

The Form 8621 is a tax form used by U.S. taxpayers to report information regarding certain foreign corporations in which they own shares. This form is particularly relevant for individuals who are shareholders in Passive Foreign Investment Companies (PFICs). The Form 8621 example illustrates how to disclose income, gains, and distributions from these foreign entities, ensuring compliance with U.S. tax laws. Understanding the form is crucial for accurately reporting foreign investments and avoiding potential penalties.

How to Use the Form 8621 Example

Using the Form 8621 example involves several steps to ensure proper completion and submission. Taxpayers must first gather relevant information about the foreign corporation, including its name, address, and tax identification number. Next, the taxpayer should accurately report their share of income, gains, and distributions from the corporation. It is important to follow the instructions provided with the form carefully, as errors can lead to delays or penalties. The form can be submitted electronically or via mail, depending on the taxpayer's preference.

Steps to Complete the Form 8621 Example

Completing the Form 8621 example requires a systematic approach:

- Gather necessary documentation related to the foreign corporation.

- Fill in personal information, including name and taxpayer identification number.

- Report the type of income received from the foreign corporation.

- Calculate any gains or distributions and provide the corresponding amounts.

- Review the completed form for accuracy before submission.

Following these steps will help ensure that the form is filled out correctly and submitted on time.

Legal Use of the Form 8621 Example

The legal use of the Form 8621 example is essential for compliance with U.S. tax regulations regarding foreign investments. Filing this form accurately helps taxpayers avoid penalties associated with underreporting income from foreign corporations. The form must be submitted in accordance with IRS guidelines to ensure that all reported information is valid and legally binding. It is advisable to consult with a tax professional if there are uncertainties regarding the completion or submission of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8621 example are crucial for compliance. Generally, the form must be submitted by the due date of the taxpayer's income tax return, including extensions. It is important to stay informed about any changes to deadlines, as they can vary based on individual circumstances or IRS updates. Missing a deadline can result in penalties, so taxpayers should mark their calendars and plan accordingly.

Required Documents

To complete the Form 8621 example accurately, several documents may be required:

- Taxpayer identification number.

- Documentation of shares owned in the foreign corporation.

- Records of income, gains, and distributions received from the corporation.

- Any previous correspondence with the IRS regarding foreign investments.

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is accurately reported.

Quick guide on how to complete form 8621 example

Accomplish Form 8621 Example seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to generate, amend, and eSign your documents rapidly without interruptions. Manage Form 8621 Example on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Form 8621 Example effortlessly

- Find Form 8621 Example and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks, accessible from any device you prefer. Edit and eSign Form 8621 Example to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8621 example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'form 8621 example' and why is it important?

The 'form 8621 example' is a crucial document for U.S. taxpayers who have investments in foreign corporations. It ensures compliance with IRS requirements and helps in reporting passive foreign investment company (PFIC) income. Understanding this form can prevent costly penalties and errors in your tax filings.

-

How can airSlate SignNow assist with managing 'form 8621 example'?

airSlate SignNow simplifies the process of working with the 'form 8621 example' by providing an intuitive platform for creating, signing, and sending documents. Its user-friendly interface allows users to easily fill out and eSign forms, ensuring that all information is correctly captured and submitted on time.

-

What features does airSlate SignNow offer for handling 'form 8621 example'?

airSlate SignNow offers a range of features tailored for managing documents like the 'form 8621 example,' including templates, automated workflows, and secure storage. These features streamline the document management process, making it efficient for users who need to focus on compliance and accuracy.

-

Is there a cost associated with using airSlate SignNow for 'form 8621 example'?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including options for individuals handling documents like the 'form 8621 example.' The platform is known for its cost-effective solutions, delivering signNow value through its comprehensive features.

-

Can I integrate airSlate SignNow with other applications for 'form 8621 example'?

Absolutely! airSlate SignNow supports integration with numerous applications, which can enhance your workflow while dealing with 'form 8621 example.' By connecting with tools like CRM and accounting software, businesses can automate processes and improve document tracking.

-

What are the benefits of using airSlate SignNow for business documents like the 'form 8621 example'?

Using airSlate SignNow for your business documents, such as the 'form 8621 example,' provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. The platform ensures that your documents are signed and stored securely, making compliance hassle-free.

-

How does airSlate SignNow ensure the security of 'form 8621 example'?

airSlate SignNow employs robust security measures to protect documents like the 'form 8621 example,' including encryption and secure storage solutions. This ensures that sensitive information remains confidential and secure throughout the signing and storage process.

Get more for Form 8621 Example

Find out other Form 8621 Example

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document