Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children Kansas Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Kansas

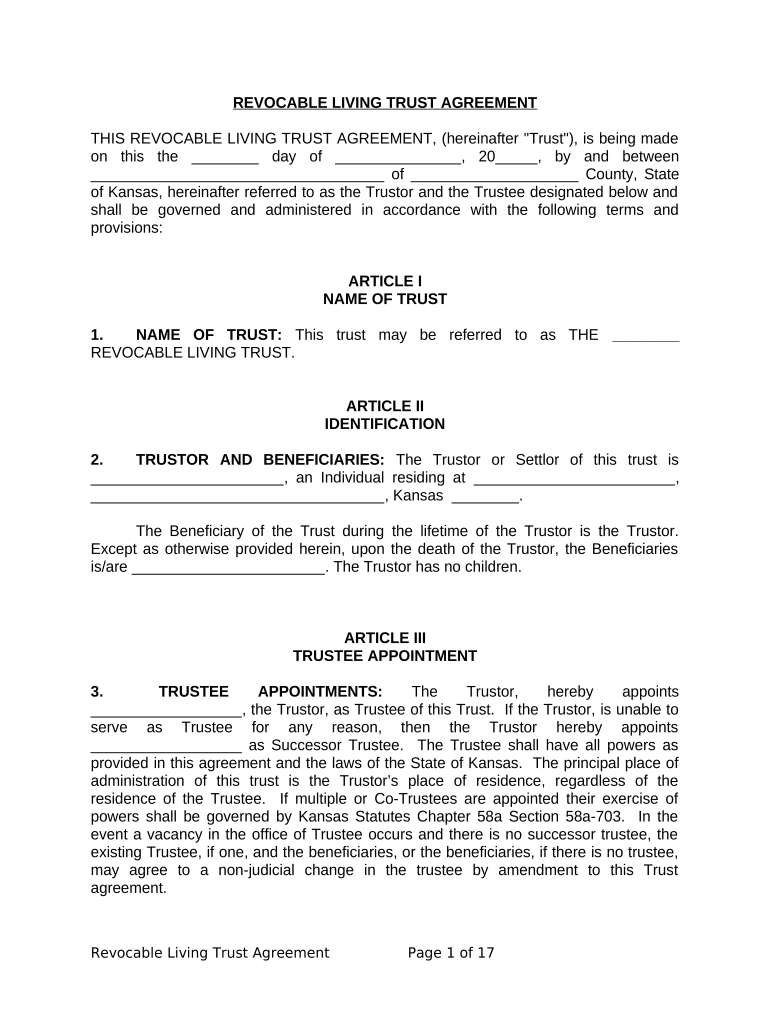

A living trust for individuals who are single, divorced, or widowed without children in Kansas is a legal document that allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust is particularly useful for individuals who want to avoid the probate process, which can be lengthy and costly. By establishing a living trust, the individual retains control over their assets while alive and can designate a trustee to manage the trust upon their passing.

How to Use the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Kansas

Using a living trust involves several steps. First, the individual must gather all relevant financial information, including bank accounts, real estate, investments, and personal property. Next, they will need to create the trust document, which outlines the terms of the trust, including the trustee's powers and the beneficiaries. Once the trust is established, the individual must transfer their assets into the trust. This process is known as funding the trust and is crucial for ensuring that the trust operates effectively.

Steps to Complete the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Kansas

Completing a living trust involves several key steps:

- Determine the assets to be included in the trust.

- Choose a reliable trustee, who can be a trusted friend, family member, or a professional.

- Draft the trust document, clearly outlining the terms and conditions.

- Sign the trust document in accordance with Kansas state laws, which may require witnesses or notarization.

- Transfer ownership of the selected assets into the trust.

Legal Use of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Kansas

The legal use of a living trust in Kansas is recognized under state law, allowing individuals to create a valid estate plan. This trust can help manage assets during the individual's lifetime and provide clear instructions for asset distribution upon death. It is essential to ensure that the trust document complies with Kansas laws to avoid any legal challenges in the future. Proper execution and funding of the trust are critical to its legal effectiveness.

State-Specific Rules for the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Kansas

Kansas has specific rules governing living trusts. For instance, the trust must be properly executed, which typically involves signing the document in front of a notary public. Additionally, Kansas law allows for the revocation of a living trust at any time, giving individuals the flexibility to change their estate plan as needed. It is important to stay informed about any changes in state laws that may affect living trusts.

Key Elements of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Kansas

Key elements of a living trust include:

- The name of the trust and the individual establishing it.

- A detailed list of assets included in the trust.

- The designation of a trustee responsible for managing the trust.

- Instructions for asset distribution upon the individual's death.

- Provisions for revocation or amendment of the trust.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with no children kansas

Effortlessly Create Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Kansas on Any Device

Digital document management has increasingly gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Manage Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Kansas on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Modify and Electronically Sign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Kansas with Ease

- Obtain Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Kansas and then click Get Form to begin.

- Make use of the available tools to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional handwritten signature.

- Review all the details and then click on the Done button to preserve your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Discard worries about lost or mislaid documents, tedious form searches, or errors necessitating new printed copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Kansas while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Kansas?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Kansas is a legal document that allows you to manage your assets while you’re alive and define how they should be distributed after your death. For individuals in these situations, a living trust can help avoid probate, ensuring a smoother transfer of assets without the complications of court involvement.

-

How does a Living Trust differ from a Will for single, divorced, or widowed individuals in Kansas?

While both a Living Trust and a Will are estate planning tools, a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Kansas avoids probate and provides more privacy. In contrast, a Will must go through probate court, which can be time-consuming and costly, making a trust a more efficient choice for many individuals.

-

What are the benefits of creating a Living Trust For Individuals Without Children in Kansas?

The primary benefits of creating a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Kansas include asset protection, avoiding probate, and the ability to manage assets efficiently. Additionally, it allows for greater control over asset distribution and can help reduce estate taxes, making it a smart choice for individuals without children.

-

How much does it cost to establish a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Kansas?

The cost to establish a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Kansas can vary based on complexity and the provider you choose. Generally, fees can range from a few hundred to several thousand dollars, but using streamlined services like airSlate SignNow can signNowly reduce costs while still ensuring a comprehensive estate plan.

-

Can I change or revoke my Living Trust at any time if I'm single or divorced in Kansas?

Yes, one of the signNow advantages of a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Kansas is the ability to change or revoke it at any time while you are alive. This flexibility allows you to adjust your estate plan as your circumstances change, ensuring it remains aligned with your wishes.

-

Is a Living Trust necessary if I already have a Will in Kansas?

While a Will is a vital component of an estate plan, having a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Kansas provides additional benefits. It helps avoid the probate process, offers privacy, and allows for easier management of your assets, making it a valuable addition to an existing Will.

-

How can airSlate SignNow help me create a Living Trust in Kansas?

airSlate SignNow offers an easy-to-use, cost-effective platform to create a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children in Kansas. Our solution simplifies the process by providing customizable templates and guidance, ensuring that your trust is established correctly and efficiently.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Kansas

- Short term disability benefits claim form city of edmonton edmonton

- Illinois affidavit form 100090416

- Unclaimed property letter template form

- Project narrative examples form

- Indiana state form 46800 413357447

- Childrenamp39s product certificate toys bluestem brands form

- India xxiii list form

- Online xxxi form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Kansas

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online