Indiana State Form 46800

What is the Indiana State Form 46800

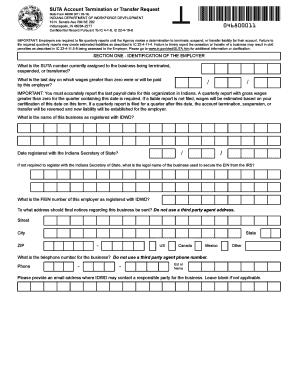

The Indiana State Form 46800 is a specific document used for reporting various tax-related information to the Indiana Department of Revenue. This form is primarily utilized by individuals and businesses to declare income, deductions, and credits applicable to their tax obligations within the state. Understanding the purpose of this form is essential for ensuring compliance with state tax regulations and for accurately reporting financial information.

How to use the Indiana State Form 46800

Using the Indiana State Form 46800 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and records of deductions. Next, fill out the form by entering your personal information, income details, and any applicable deductions or credits. It is crucial to double-check all entries for accuracy before submission. After completing the form, you can submit it electronically or by mail, depending on your preference and the specific requirements set by the Indiana Department of Revenue.

Steps to complete the Indiana State Form 46800

Completing the Indiana State Form 46800 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Begin filling out the form by entering your personal identification information, such as your name, address, and Social Security number.

- Report your total income from all sources, ensuring that you include all necessary documentation.

- List any deductions or credits you are eligible for, following the guidelines provided on the form.

- Review the completed form for accuracy and completeness.

- Submit the form electronically through an approved platform or mail it to the appropriate address.

Legal use of the Indiana State Form 46800

The Indiana State Form 46800 holds legal significance as it serves as an official document submitted to the state tax authority. To ensure its legal validity, it must be filled out completely and accurately. Failure to provide truthful information or to submit the form by the designated deadlines can result in penalties, including fines or additional tax liabilities. Therefore, it is essential to adhere to all legal requirements when using this form.

Key elements of the Indiana State Form 46800

The Indiana State Form 46800 includes several key elements that must be addressed for proper completion. These elements typically consist of:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Total income from various sources, including wages, self-employment income, and interest.

- Deductions: Any applicable deductions that reduce taxable income, such as business expenses or educational credits.

- Signature: A declaration that the information provided is accurate and complete, usually requiring a signature or electronic verification.

Form Submission Methods (Online / Mail / In-Person)

The Indiana State Form 46800 can be submitted through various methods to accommodate different preferences. Individuals may choose to submit the form online via the Indiana Department of Revenue's electronic filing system, which offers a streamlined process. Alternatively, the form can be mailed to the designated address provided by the state. In some cases, individuals may also have the option to submit the form in person at local tax offices. Each submission method has specific guidelines and deadlines that must be followed to ensure timely processing.

Quick guide on how to complete indiana state form 46800 413357447

Manage Indiana State Form 46800 effortlessly on any device

Online document organization has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly and without delays. Handle Indiana State Form 46800 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Indiana State Form 46800 with ease

- Find Indiana State Form 46800 and select Get Form to begin.

- Employ the tools we offer to fill out your document.

- Mark key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal standing as a traditional wet ink signature.

- Review all the details and click the Done button to save your updates.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Indiana State Form 46800 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana state form 46800 413357447

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana Form 46800 and why is it important?

The Indiana Form 46800 is used for tax purposes, specifically for reporting estimated tax payments. Understanding and correctly completing this form is crucial for businesses to ensure compliance with state tax regulations and avoid penalties.

-

How can airSlate SignNow help with the Indiana Form 46800?

airSlate SignNow allows you to easily send and eSign the Indiana Form 46800 digitally. This speeds up the process of submission and ensures that your form is filed securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Indiana Form 46800?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. You can choose a plan that suits your requirements for managing documents like the Indiana Form 46800.

-

What features does airSlate SignNow offer for form management?

airSlate SignNow includes features such as customizable templates, document tracking, and in-app collaboration. These features make managing the Indiana Form 46800 and other documents more seamless and effective.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow integrates with various applications, including Google Workspace and Microsoft Office, to enhance your document workflow. This makes it easy to work on documents like the Indiana Form 46800 across different platforms.

-

What are the benefits of eSigning the Indiana Form 46800?

eSigning the Indiana Form 46800 offers benefits like faster processing, reduced paperwork, and improved security. With airSlate SignNow, you can ensure that your digital signature meets legal requirements while streamlining the submission process.

-

Is airSlate SignNow user-friendly for first-time users?

Yes, airSlate SignNow is designed to be user-friendly, even for first-time users. The intuitive interface makes it easy to navigate and complete forms like the Indiana Form 46800 without needing extensive technical skills.

Get more for Indiana State Form 46800

Find out other Indiana State Form 46800

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation