Ky Answer Form

What is the Ky Answer Form

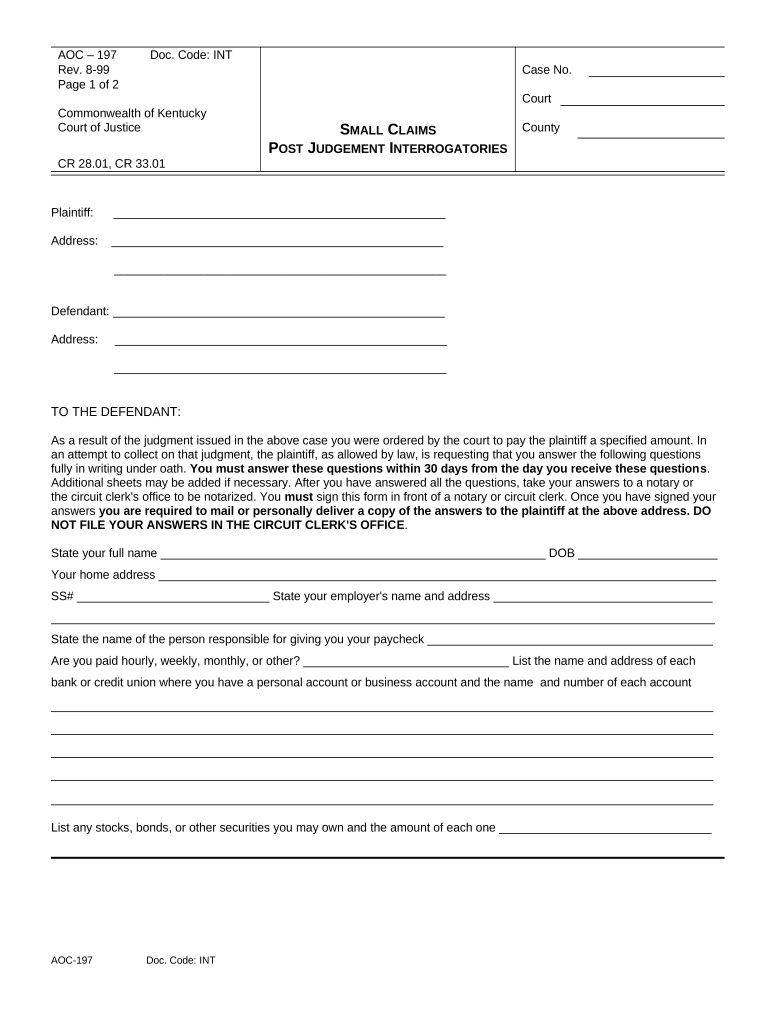

The Kentucky Answer Form, often referred to as the Kentucky interrogatories, is a legal document used in civil litigation. It serves as a formal response to interrogatories, which are written questions posed by one party to another during the discovery phase of a lawsuit. This form is essential for parties to provide their answers to the questions, ensuring that all relevant information is disclosed to facilitate the legal process. The form must be completed accurately and submitted within the specified time frame to avoid potential penalties or adverse judgments.

How to use the Ky Answer Form

Using the Kentucky Answer Form involves several steps to ensure compliance with legal requirements. First, the party receiving the interrogatories must carefully read each question. Next, they should formulate clear and concise responses, providing all necessary details. It is crucial to ensure that the answers are truthful and complete, as any misleading information can lead to legal repercussions. Once the form is filled out, it should be signed and dated before being submitted to the requesting party or the court, depending on the instructions provided.

Steps to complete the Ky Answer Form

Completing the Kentucky Answer Form requires attention to detail and adherence to specific guidelines. Follow these steps:

- Review the interrogatories thoroughly to understand what information is being requested.

- Draft responses for each question, ensuring clarity and accuracy.

- Include any necessary supporting documents that may be required to substantiate your answers.

- Sign and date the form, confirming the authenticity of your responses.

- Submit the completed form to the appropriate party or court as directed.

Legal use of the Ky Answer Form

The Kentucky Answer Form is legally binding once completed and submitted correctly. It is crucial that the form adheres to the rules of civil procedure in Kentucky. This means that all responses must be made under oath, typically requiring a signature affirming the truthfulness of the answers. Failure to comply with these legal standards can result in sanctions, including the possibility of being held in contempt of court. Thus, understanding the legal implications of this form is essential for any party involved in litigation.

Key elements of the Ky Answer Form

Several key elements must be included in the Kentucky Answer Form to ensure its validity:

- Case Information: Include the case number, court name, and parties involved.

- Interrogatory Questions: Clearly list each question as it appears in the request.

- Your Answers: Provide a detailed response to each question, ensuring accuracy.

- Signature: The form must be signed by the responding party or their legal representative.

- Date: Include the date of completion to establish a timeline for the response.

State-specific rules for the Ky Answer Form

Each state has specific rules governing the use of interrogatories and the corresponding answer forms. In Kentucky, the rules of civil procedure outline the requirements for submitting interrogatories, including deadlines for responses and formatting guidelines. It is essential to be aware of these state-specific regulations to ensure compliance and avoid potential legal issues. Familiarizing oneself with Kentucky's rules can help streamline the process and enhance the effectiveness of the responses provided.

Quick guide on how to complete ky answer form

Complete Ky Answer Form easily on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Ky Answer Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Ky Answer Form effortlessly

- Obtain Ky Answer Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Ky Answer Form to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an interrogatories form order?

An interrogatories form order is a legal document used in the discovery phase of litigation that allows one party to request written answers to specific questions from another party. This process helps gather relevant information before a trial begins. airSlate SignNow streamlines the creation and management of these forms, making it easy to obtain necessary responses efficiently.

-

How does airSlate SignNow assist with interrogatories form order?

airSlate SignNow simplifies the process of creating and sending interrogatories form orders. With our intuitive platform, you can easily draft, customize, and eSign these documents, ensuring they meet legal standards. This efficiency saves time and reduces the potential for errors in your legal procedures.

-

What are the pricing plans for using airSlate SignNow for interrogatories form order?

airSlate SignNow offers flexible pricing plans tailored to fit the needs of both individuals and businesses. Our plans provide access to essential features for managing interrogatories form orders at competitive rates. For a detailed breakdown of pricing options, visit our pricing page to find the plan that best suits your requirements.

-

Can I integrate airSlate SignNow with other software for managing interrogatories form orders?

Yes, airSlate SignNow integrates seamlessly with numerous applications and software platforms. This allows you to streamline your workflow when managing interrogatories form orders. Whether you're using CRM systems, cloud storage, or project management tools, our integrations enhance your overall productivity.

-

What benefits does airSlate SignNow offer for managing interrogatories form order?

Using airSlate SignNow to manage your interrogatories form order offers several advantages. The platform provides an easy-to-use interface that increases efficiency, minimizes paper usage, and boosts collaboration among legal teams. Moreover, its secure eSigning feature ensures that your documents are legally binding and protected.

-

Is there a mobile application for managing interrogatories form orders with airSlate SignNow?

Yes, airSlate SignNow has a mobile application that allows you to manage interrogatories form orders on-the-go. This flexibility means you can create, send, and eSign documents from anywhere, ensuring that you can keep your legal processes moving forward, even when you’re not at your desk.

-

How can I ensure compliance while using airSlate SignNow for interrogatories form orders?

airSlate SignNow is designed with compliance in mind, ensuring that your interrogatories form orders meet all legal requirements. We provide templates that adhere to standard regulations and you can customize them as needed. Additionally, our secure eSigning feature guarantees the authenticity and integrity of your documents.

Get more for Ky Answer Form

- Note taking worksheet forces form

- State of georgia department of revenue pv corp worksheet form

- How a bill becomes a law worksheet pdf answer key form

- Ventura county comprehensive alternate language proficiency survey form

- Affidavit of exemption for workers compensation insurance 11107985 form

- Xxxx xxxxxx xxx xxxxxx xxxxxx xxx xxxx xxxxxx xxxxxxxxxx form

- Lpc ssupervision log applications and forms

- Hotel room rental agreement template form

Find out other Ky Answer Form

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document