Ir742 2015

What is the ir742?

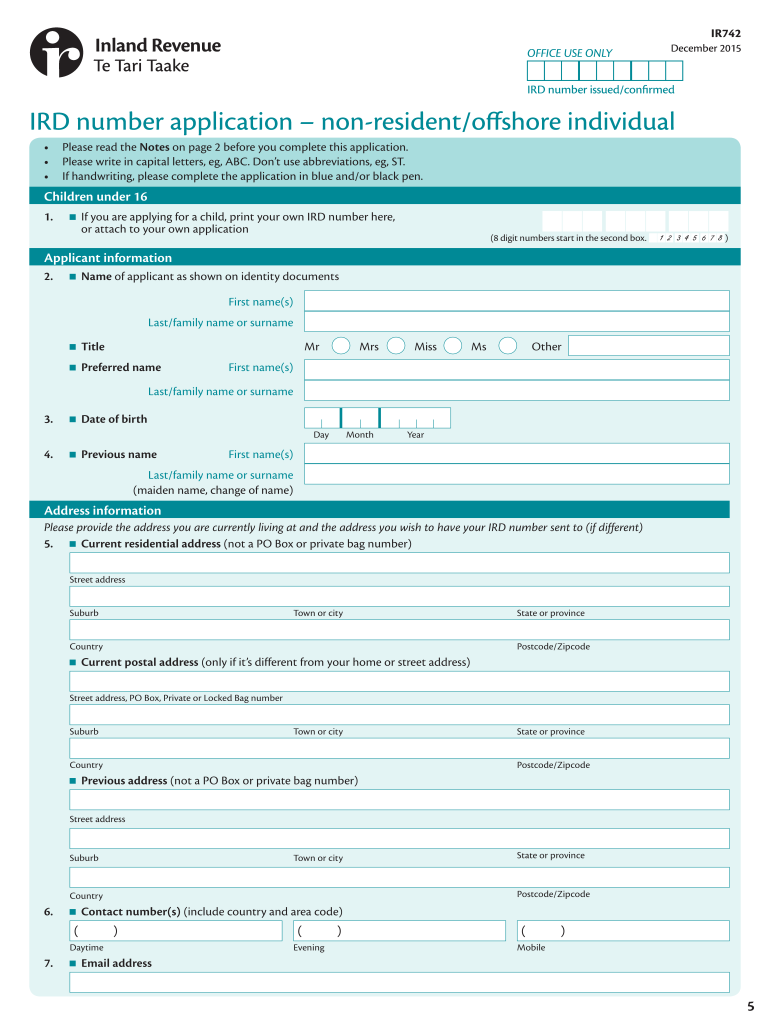

The ir742 form is a specific document utilized in various administrative and legal contexts. It serves as an essential tool for individuals and businesses to provide necessary information to government entities. The form is designed to streamline processes, ensuring that all required data is collected efficiently. Understanding the purpose and requirements of the ir742 is crucial for compliance and effective communication with authorities.

How to use the ir742

Using the ir742 form involves several straightforward steps to ensure accurate completion. First, gather all necessary information that pertains to the form's requirements. This may include personal identification details, financial information, or other relevant documentation. Next, fill out the form clearly and accurately, ensuring that all sections are completed as required. After completing the form, review it for any errors or omissions before submission.

Steps to complete the ir742

Completing the ir742 form effectively requires a systematic approach. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Collect all necessary documents and information needed to fill out the form.

- Fill out the form, ensuring accuracy in all entries.

- Double-check the completed form for any mistakes or missing information.

- Submit the form according to the specified methods, whether online or via mail.

Legal use of the ir742

The legal use of the ir742 form is governed by specific regulations that ensure its validity. To be considered legally binding, the form must be filled out completely and accurately. It is essential to adhere to any state-specific rules that may apply. Additionally, using a reliable platform for electronic submission can enhance the form's legal standing, as it may provide necessary security features and compliance with relevant laws.

Filing Deadlines / Important Dates

Filing deadlines for the ir742 form can vary based on specific circumstances and requirements. It is important to stay informed about any important dates associated with the form to avoid penalties. Generally, deadlines may be set by governmental agencies or specific legal guidelines. Keeping a calendar of these dates can help ensure timely submission and compliance.

IRS Guidelines

The ir742 form is subject to guidelines established by the IRS, which outline the proper procedures for completion and submission. These guidelines provide essential information on eligibility, required documentation, and any updates to the form. Familiarizing oneself with these guidelines is crucial for ensuring compliance and understanding the implications of the information provided on the form.

Quick guide on how to complete ir742 237220090

Complete Ir742 effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to produce, modify, and electronically sign your documents promptly without any hold-ups. Manage Ir742 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The easiest method to adjust and eSign Ir742 without hassle

- Locate Ir742 and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize critical sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to finalize your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, an invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Ir742 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ir742 237220090

Create this form in 5 minutes!

How to create an eSignature for the ir742 237220090

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is ir742 and how does it work with airSlate SignNow?

ir742 is a powerful identifier that helps streamline the eSigning process within airSlate SignNow. It allows users to quickly reference specific documents for signing, enhancing organization and efficiency. By integrating ir742 into your workflow, you can boost productivity and ensure smooth document handling.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to fit a variety of business needs. Each plan provides access to essential features, including those that utilize ir742 for document management. Visit our pricing page to find the best fit for your organization's requirements.

-

What features does airSlate SignNow provide for managing ir742 documents?

With airSlate SignNow, you can easily create, send, and eSign documents that utilize ir742 for effective tracking. The platform includes features like customizable templates, statuses, and reminder settings, ensuring a seamless signing experience. These tools help enhance collaboration and organization when dealing with multiple ir742 documents.

-

How does airSlate SignNow benefit businesses looking to use ir742?

Businesses can signNowly benefit from using airSlate SignNow with ir742 by improving efficiency in document processing. The platform enables quick access and management of documents, reducing time spent on administrative tasks. This leads to faster decision-making and overall productivity gains.

-

Can airSlate SignNow integrate with other applications to manage ir742 documents?

Yes, airSlate SignNow offers powerful integrations with many popular applications, allowing users to manage ir742 documents seamlessly. Whether you use CRM systems, payment processors, or other productivity tools, integration helps streamline workflows. This connectivity enhances your ability to handle documents efficiently.

-

Is it easy to get started with airSlate SignNow for ir742 eSigning?

Absolutely! Getting started with airSlate SignNow for ir742 eSigning is intuitive and user-friendly. Simply sign up for an account, explore the features, and learn how to utilize ir742 to enhance your document workflow. Our comprehensive guides and support resources can assist you in no time.

-

What security measures does airSlate SignNow provide for ir742 documents?

airSlate SignNow prioritizes the security of your ir742 documents with robust encryption protocols and compliance with industry standards. We ensure that your documents are protected during transmission and storage, providing peace of mind. Additionally, you can set user permissions and access controls for added security.

Get more for Ir742

- Order for genetic marker test 5 6pdf fpdf doc docx form

- Form 5 6a

- Paternity formsnycourtsgov unified court system

- Form 5 7a

- In the matter of commissioner of social services form

- The following instructions assume that you have successfully form

- Date of death to persons designated form

- Ny 599ppdf form

Find out other Ir742

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online