Ky Chapter 13 Form

What is the Ky Chapter 13

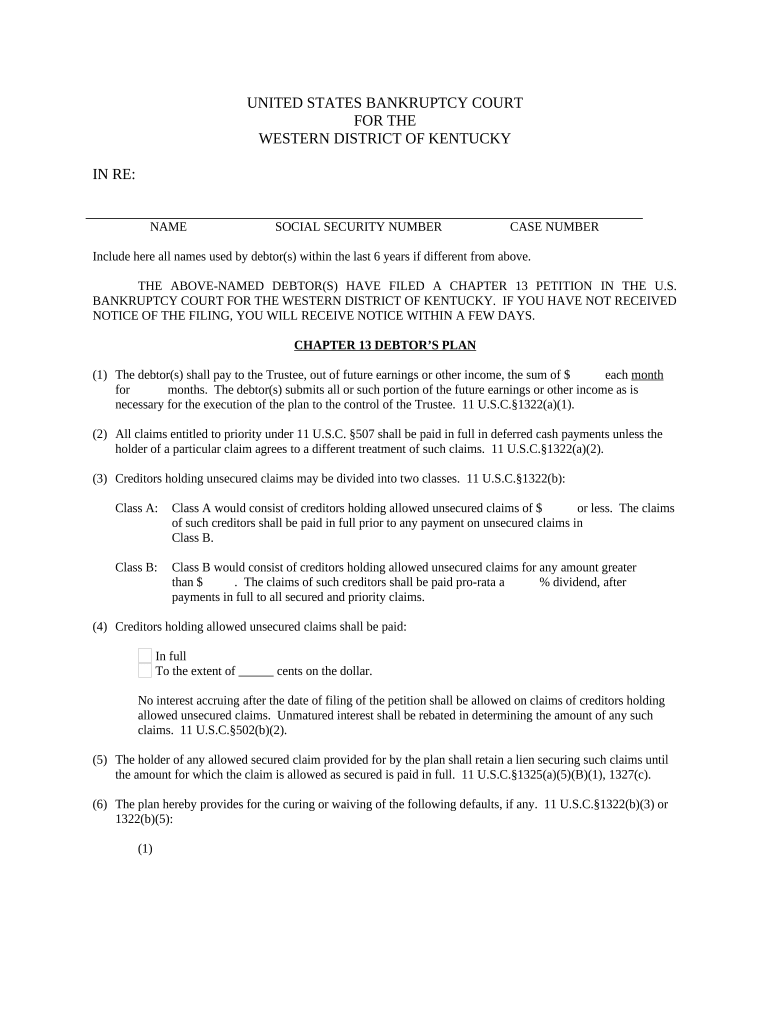

The Kentucky Chapter 13 form is a legal document used in bankruptcy proceedings, specifically for individuals seeking to reorganize their debts. This form allows debtors to propose a repayment plan to make installments to creditors over a period of three to five years. It is designed for individuals with a regular income who wish to keep their property while repaying debts in a manageable way. The plan must be approved by the court, ensuring that it meets the necessary legal requirements.

Steps to complete the Ky Chapter 13

Completing the Kentucky Chapter 13 form involves several steps to ensure accuracy and compliance with legal standards. Here’s a structured approach:

- Gather necessary financial documents, including income statements, tax returns, and a list of debts.

- Fill out the form with accurate personal information, including your name, address, and social security number.

- Detail your income and expenses to demonstrate your ability to adhere to the proposed repayment plan.

- Outline the debts you wish to include in the plan, ensuring to categorize them correctly.

- Review the completed form for accuracy before submission.

- File the form with the appropriate bankruptcy court, either online or by mail.

Legal use of the Ky Chapter 13

The legal use of the Kentucky Chapter 13 form is crucial for ensuring that the bankruptcy process is recognized by the court. To be legally binding, the form must be filled out completely and accurately, adhering to the guidelines set forth by the U.S. Bankruptcy Code. This includes providing truthful information about your financial situation and adhering to the repayment plan approved by the court. Failure to comply with these legal requirements can result in dismissal of the case or denial of the repayment plan.

Eligibility Criteria

To qualify for filing a Kentucky Chapter 13 form, certain eligibility criteria must be met. These include:

- Having a regular income, which can be from employment, self-employment, or other sources.

- Unsecured debts must not exceed a specified limit, which is updated periodically.

- Secured debts must also fall within certain thresholds.

- Completion of credit counseling from an approved agency within six months before filing.

Required Documents

When preparing to file the Kentucky Chapter 13 form, several documents are required to support your application. These documents typically include:

- Proof of income, such as pay stubs or tax returns.

- A list of all debts, including credit cards, loans, and mortgages.

- A detailed list of monthly expenses to demonstrate financial capability.

- Documentation of any assets, such as property or vehicles.

Form Submission Methods

The Kentucky Chapter 13 form can be submitted through various methods, ensuring flexibility for filers. Options include:

- Online submission through the court's electronic filing system, which provides a convenient and fast option.

- Mailing the completed form directly to the bankruptcy court, ensuring it is sent via a trackable method.

- In-person submission at the court clerk's office, allowing for immediate confirmation of receipt.

Key elements of the Ky Chapter 13

Understanding the key elements of the Kentucky Chapter 13 form is essential for successful completion. These elements include:

- The repayment plan, which outlines how debts will be paid over the specified period.

- Disclosure of all income sources and expenses to provide a clear financial picture.

- Identification of all creditors and the amounts owed to each.

- Confirmation of the debtor's eligibility and compliance with bankruptcy laws.

Quick guide on how to complete ky chapter 13

Complete Ky Chapter 13 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Ky Chapter 13 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related processes today.

How to modify and eSign Ky Chapter 13 with ease

- Obtain Ky Chapter 13 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Ky Chapter 13 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is KY Chapter 13 and how does it work?

KY Chapter 13 is a bankruptcy option that allows individuals to create a repayment plan for their debts. Under this plan, you can restructure your debts over three to five years, helping you keep your assets while making manageable payments. With airSlate SignNow, you can electronically sign your Chapter 13 plan documents easily and securely.

-

How can airSlate SignNow help with KY Chapter 13 paperwork?

AirSlate SignNow streamlines the process of handling KY Chapter 13 paperwork by allowing you to send and eSign all necessary documents online. This eliminates the need for printed forms and speeds up the filing process. The platform’s user-friendly interface ensures that you can complete your Chapter 13 documents quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for KY Chapter 13 documents?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, making it a cost-effective solution for handling KY Chapter 13 documents. The fees are competitive and typically much lower than traditional legal services, providing signNow savings while allowing users to manage their bankruptcy paperwork.

-

What features does airSlate SignNow provide for KY Chapter 13 users?

AirSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time collaboration to assist users with their KY Chapter 13 documents. Its electronic signing capability ensures that you can complete your filings quickly, without the hassles of in-person meetings or physical paperwork.

-

Can airSlate SignNow integrate with other tools I use for KY Chapter 13?

Absolutely! airSlate SignNow offers integrations with various applications and services that you may already be using for managing your KY Chapter 13 process. This allows for seamless data transfer, enhancing your overall efficiency and ensuring all your financial documents are in sync.

-

What are the benefits of using airSlate SignNow for KY Chapter 13 filings?

Using airSlate SignNow for KY Chapter 13 filings provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Users appreciate the ease of electronic signatures, which speed up the filing process, and the ability to track document statuses in real time.

-

Is airSlate SignNow suitable for individuals filing KY Chapter 13 on their own?

Yes, airSlate SignNow is designed to be user-friendly, making it an excellent choice for individuals filing KY Chapter 13 on their own. With clear instructions and supportive resources, it empowers you to manage your bankruptcy paperwork confidently and correctly.

Get more for Ky Chapter 13

- Cash in form phoenix life limited

- Blank usps form 2568a

- Certificate of satisfaction template 78386114 form

- 815 page 2 of 3 wla 53 washington landlord association form

- Chem skills worksheet 10 dimensional analysis form

- I pass application illinois tollway form

- Satisfaction of mortgage form

- Citizenship and immigration canada citoyennet et immigration canada immigration canada table of contents appendix a document form

Find out other Ky Chapter 13

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later