City F Killeen Contractor Registration 2009

What is the City F Killeen Contractor Registration

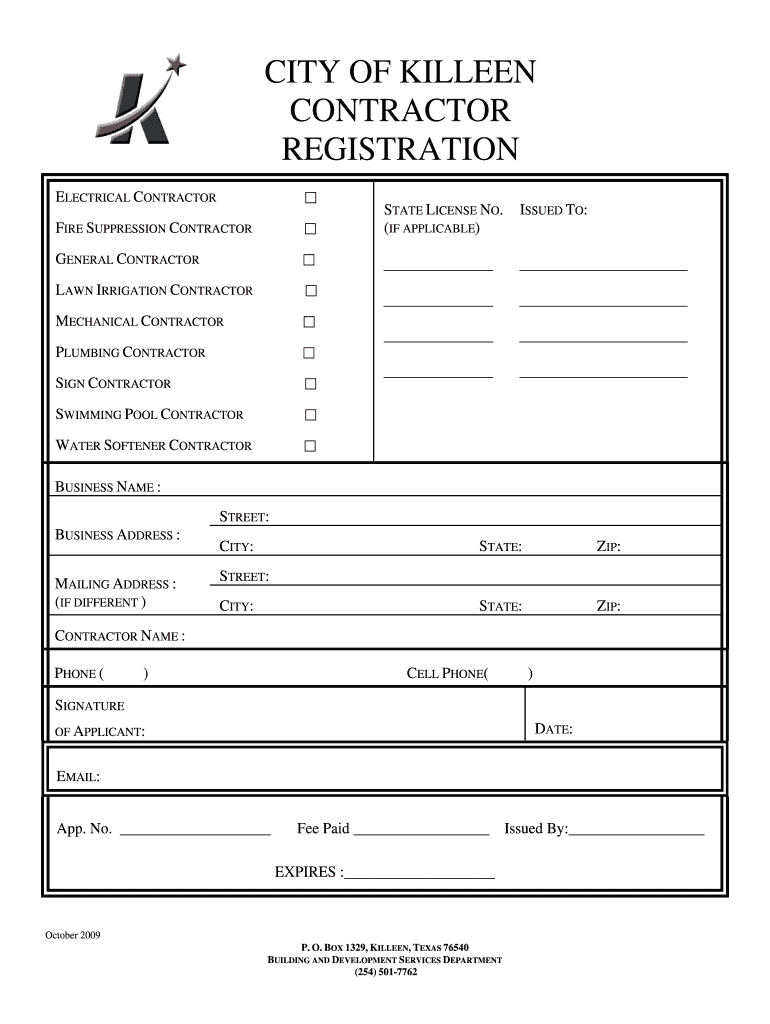

The City F Killeen Contractor Registration is a formal process required for contractors who wish to operate within the city limits of Killeen, Texas. This registration ensures that contractors meet local regulations and standards, promoting safety and quality in construction and related services. The registration is essential for various types of contractors, including those in the fire sprinkler industry, plumbing, electrical work, and general contracting. By obtaining this registration, contractors demonstrate their compliance with city ordinances and state laws, which helps maintain a high standard of workmanship in the community.

How to obtain the City F Killeen Contractor Registration

To obtain the City F Killeen Contractor Registration, contractors must follow a series of steps. First, they need to gather all necessary documentation, which may include proof of insurance, a valid business license, and any relevant certifications. Next, contractors should complete the registration application, which can typically be found on the city’s official website or at the city hall. After submitting the application along with the required documents and fees, contractors will receive confirmation of their registration status. It is advisable to check for any additional local requirements that may apply.

Steps to complete the City F Killeen Contractor Registration

Completing the City F Killeen Contractor Registration involves several key steps:

- Gather necessary documents, including proof of insurance and business licenses.

- Fill out the contractor registration application form accurately.

- Submit the application along with any required fees to the appropriate city department.

- Await confirmation from the city regarding the status of your registration.

Following these steps will help ensure a smooth registration process, allowing contractors to legally operate within Killeen.

Legal use of the City F Killeen Contractor Registration

The legal use of the City F Killeen Contractor Registration is crucial for compliance with local laws and regulations. Registered contractors are authorized to perform work in Killeen, ensuring that all projects adhere to safety standards and building codes. Failure to register can result in penalties, including fines and the inability to obtain necessary permits for construction work. Therefore, maintaining an active registration is essential for contractors looking to establish a legitimate business presence in the city.

Required Documents

When applying for the City F Killeen Contractor Registration, several documents are typically required. These may include:

- Proof of liability insurance.

- A valid business license.

- Trade-specific certifications, if applicable.

- Identification documents of the business owner or principal contractor.

Ensuring that all required documents are submitted can expedite the registration process and help avoid delays.

Penalties for Non-Compliance

Contractors who fail to comply with the City F Killeen Contractor Registration requirements may face several penalties. These can include monetary fines, suspension of business operations, and potential legal action. Additionally, non-compliance can hinder contractors from obtaining necessary permits for projects, leading to further complications in their business activities. It is essential for contractors to remain informed about their registration status and ensure all requirements are met to avoid these penalties.

Quick guide on how to complete city of killeen contractor registration killeentexas

Handle City F Killeen Contractor Registration anytime, anywhere

Your daily business operations may need extra focus when handling state-specific forms. Regain your working hours and cut down on the paper costs linked to document-heavy workflows with airSlate SignNow. airSlate SignNow offers you an array of pre-made business forms, including City F Killeen Contractor Registration, which you can utilize and distribute to your business associates. Oversee your City F Killeen Contractor Registration seamlessly with powerful editing and eSignature features and send it straight to your recipients.

How to obtain City F Killeen Contractor Registration in just a few clicks:

- Select a form pertinent to your state.

- Click Learn More to view the document and confirm it is suitable.

- Choose Get Form to begin working on it.

- City F Killeen Contractor Registration will open directly in the editor. No further actions are necessary.

- Utilize airSlate SignNow’s sophisticated editing tools to complete or alter the form.

- Click on the Sign tool to generate your unique signature and eSign your document.

- Once ready, click Done, save your changes, and access your document.

- Share the form via email or text message, or use a link-to-fill option with your partners or have them download the file.

airSlate SignNow greatly conserves your time managing City F Killeen Contractor Registration and enables you to find crucial documents in one location. A broad collection of forms is organized and designed to address key business processes vital for your company. The advanced editor reduces the chance of errors, as you can swiftly amend mistakes and review your documents on any device before sending them out. Start your free trial today to explore all the advantages of airSlate SignNow for your everyday business operations.

Create this form in 5 minutes or less

Find and fill out the correct city of killeen contractor registration killeentexas

FAQs

-

Can I fill out the CPT form and the registration in ICAI before the examination of 12th class? How?

First of all I would like to say that CPT is now converted into CA Foundation. I have qualified CPT exam in 2012 and many things have changed now. So, despite giving my openion and suggestion, I am sharing here the link of ICAI for your all queries related to CA course The Institute of Chartered Accountants of IndiaI am also attaching relevant pdf uploaded on ICAI for your convenience.https://resource.cdn.icai.org/45...https://resource.cdn.icai.org/45...Hope! it’ll help you :)

-

I have created a registration form in HTML. When someone fills it out, how do I get the filled out form sent to my email?

Are you assuming that the browser will send the email? That is not the way it is typically done. You include in your registration form a and use PHP or whatever on the server to send the email. In PHP it is PHP: mail - Manual But if you are already on the server it seems illogical to send an email. Just register the user immediately.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the city of killeen contractor registration killeentexas

How to generate an electronic signature for your City Of Killeen Contractor Registration Killeentexas online

How to make an eSignature for your City Of Killeen Contractor Registration Killeentexas in Chrome

How to generate an eSignature for signing the City Of Killeen Contractor Registration Killeentexas in Gmail

How to create an eSignature for the City Of Killeen Contractor Registration Killeentexas from your smartphone

How to make an electronic signature for the City Of Killeen Contractor Registration Killeentexas on iOS

How to make an electronic signature for the City Of Killeen Contractor Registration Killeentexas on Android OS

People also ask

-

What is click2gov killeen and how does it relate to airSlate SignNow?

Click2gov killeen is an online portal that allows residents to access municipal services conveniently. With airSlate SignNow, users can streamline the document signing process related to their click2gov killeen transactions, ensuring a faster and more efficient experience.

-

What features does airSlate SignNow offer for click2gov killeen users?

AirSlate SignNow provides various features such as e-signatures, document templates, and automated workflows that support click2gov killeen users. These features simplify the process of submitting forms and documents necessary for city services, enhancing overall efficiency.

-

How is pricing structured for airSlate SignNow users accessing click2gov killeen?

AirSlate SignNow offers flexible pricing plans that cater to different needs, making it cost-effective for click2gov killeen users. Each plan includes essential features, ensuring that users can select an option that best fits their budget and document signing requirements.

-

What are the benefits of using airSlate SignNow for click2gov killeen transactions?

Using airSlate SignNow for click2gov killeen transactions means quicker processing times and reduced paper waste. Its intuitive interface and robust features enable users to complete their municipal transactions effortlessly, resulting in a more satisfactory experience.

-

Can airSlate SignNow integrate with other platforms used in click2gov killeen?

Yes, airSlate SignNow can integrate with various platforms that may be used alongside click2gov killeen. This integration capability enhances functionality and allows users to sync their data seamlessly, improving the overall user experience.

-

What types of documents can be signed using airSlate SignNow for click2gov killeen?

AirSlate SignNow allows you to sign a variety of documents relevant to click2gov killeen, including permits, applications, and contracts. This versatility ensures that users can handle all necessary paperwork efficiently without the hassle of printing and mailing.

-

Is airSlate SignNow compliant with legal e-signature standards for click2gov killeen?

Absolutely! AirSlate SignNow complies with key legal e-signature standards, ensuring that all documents related to click2gov killeen are legally binding. This compliance gives users peace of mind when utilizing digital signatures for municipal services.

Get more for City F Killeen Contractor Registration

Find out other City F Killeen Contractor Registration

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document