Living Trust for Individual as Single, Divorced or Widow or Widower with No Children Louisiana Form

What is the Living Trust for Individual as Single, Divorced or Widow or Widower With No Children Louisiana

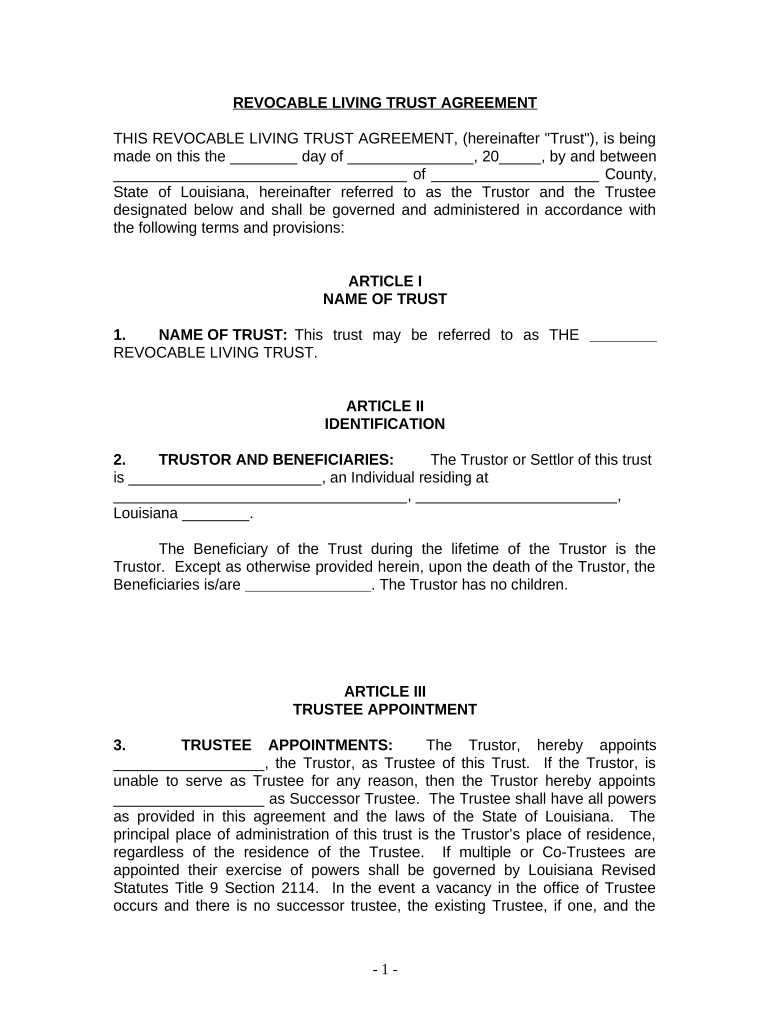

A living trust for individuals who are single, divorced, or widowed without children in Louisiana is a legal document that allows a person to manage their assets during their lifetime and dictate how those assets will be distributed upon their death. This type of trust can help avoid probate, ensuring a smoother transfer of assets. It provides flexibility and control over one's estate, allowing the trustor to make changes as needed. The trust can include various assets, such as real estate, bank accounts, and investments, tailored to the individual’s specific circumstances.

How to Use the Living Trust for Individual as Single, Divorced or Widow or Widower With No Children Louisiana

Using a living trust involves several steps. First, the individual must decide which assets to place into the trust. Next, they will need to draft the trust document, which outlines the terms, beneficiaries, and management of the assets. It is advisable to work with a legal professional to ensure compliance with Louisiana laws. Once the trust is established, the individual should transfer ownership of the chosen assets to the trust. This process typically involves changing titles or designating the trust as the beneficiary on accounts.

Steps to Complete the Living Trust for Individual as Single, Divorced or Widow or Widower With No Children Louisiana

Completing a living trust involves a series of steps:

- Identify assets to include in the trust.

- Choose a trustee, who will manage the trust.

- Draft the trust document, ensuring it meets Louisiana legal requirements.

- Transfer ownership of assets to the trust.

- Review and update the trust as necessary to reflect changes in circumstances.

Legal Use of the Living Trust for Individual as Single, Divorced or Widow or Widower With No Children Louisiana

The legal use of a living trust in Louisiana is governed by state laws. The trust must be properly executed, which typically involves signing the document in front of a notary public. The trustor retains control over the assets during their lifetime and can modify the trust as needed. Upon the trustor's death, the assets are distributed according to the terms laid out in the trust document, bypassing the probate process, which can be lengthy and costly.

State-Specific Rules for the Living Trust for Individual as Single, Divorced or Widow or Widower With No Children Louisiana

In Louisiana, specific rules apply to living trusts. The state recognizes both revocable and irrevocable trusts, but revocable trusts are more common for individuals looking to maintain control over their assets. It is important to ensure that the trust document complies with Louisiana’s laws regarding property and estate planning. Additionally, certain assets may require specific language or procedures to be effectively transferred into the trust.

Required Documents for the Living Trust for Individual as Single, Divorced or Widow or Widower With No Children Louisiana

To establish a living trust, the following documents are typically required:

- Identification documents, such as a driver’s license or passport.

- Property deeds for real estate included in the trust.

- Account statements for bank and investment accounts.

- Any existing wills or estate planning documents.

- Trustee information, including their consent to serve in this role.

Quick guide on how to complete living trust for individual as single divorced or widow or widower with no children louisiana

Manage Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Louisiana seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without any delays. Handle Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Louisiana on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Louisiana effortlessly

- Obtain Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Louisiana and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Louisiana while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana?

A Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. This arrangement can help avoid probate, making the process smoother for your beneficiaries. By establishing this trust, you can ensure your wishes are honored, even without direct heirs.

-

How much does it cost to create a Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana?

The cost to create a Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana can vary based on the complexity of your circumstances and the provider you choose. Generally, prices can range from a few hundred to over a thousand dollars. It's recommended to compare different service providers and seek consultations to find the best option for your needs.

-

What are the benefits of establishing a Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana?

Establishing a Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana offers several benefits, including avoiding probate, maintaining privacy, and simplifying estate management. Additionally, it allows you to specify detailed instructions for your assets, which can reduce conflicts among potential heirs. This trust can also provide peace of mind knowing your affairs are handled according to your wishes.

-

How does airSlate SignNow facilitate the creation of a Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana?

airSlate SignNow offers an easy-to-use platform that allows you to create and manage documents for a Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana efficiently. The platform provides templates, guidance, and eSignature capabilities that streamline the process. With airSlate SignNow, you can ensure that your documents are legally compliant while saving time and effort.

-

Can I update my Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana?

Yes, you can update your Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana whenever necessary, making it a flexible estate planning tool. Changes in your circumstances, such as marriage or acquiring new assets, may warrant an update to your trust. It's advisable to review your trust periodically to reflect any life changes or modifications in your wishes.

-

What happens to my Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana after I pass away?

After you pass away, the Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana becomes irrevocable, and the assets within it are distributed according to your specified instructions. This process typically takes place without court involvement, allowing for quicker distribution to beneficiaries. Your appointed successor trustee will manage this process, ensuring your estate is handled in accordance with your wishes.

-

Are there any tax implications associated with a Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana?

Generally, a Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children in Louisiana does not provide tax benefits during your lifetime, as the assets are still considered part of your estate. However, it can have implications regarding estate taxes and help in planning for tax efficiencies after death. Consulting with a tax professional is recommended to fully understand the specific tax implications related to your situation.

Get more for Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Louisiana

Find out other Living Trust For Individual As Single, Divorced Or Widow or Widower With No Children Louisiana

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile