Living Trust for Individual, Who is Single, Divorced or Widow or Widower with Children Louisiana Form

What is the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Louisiana

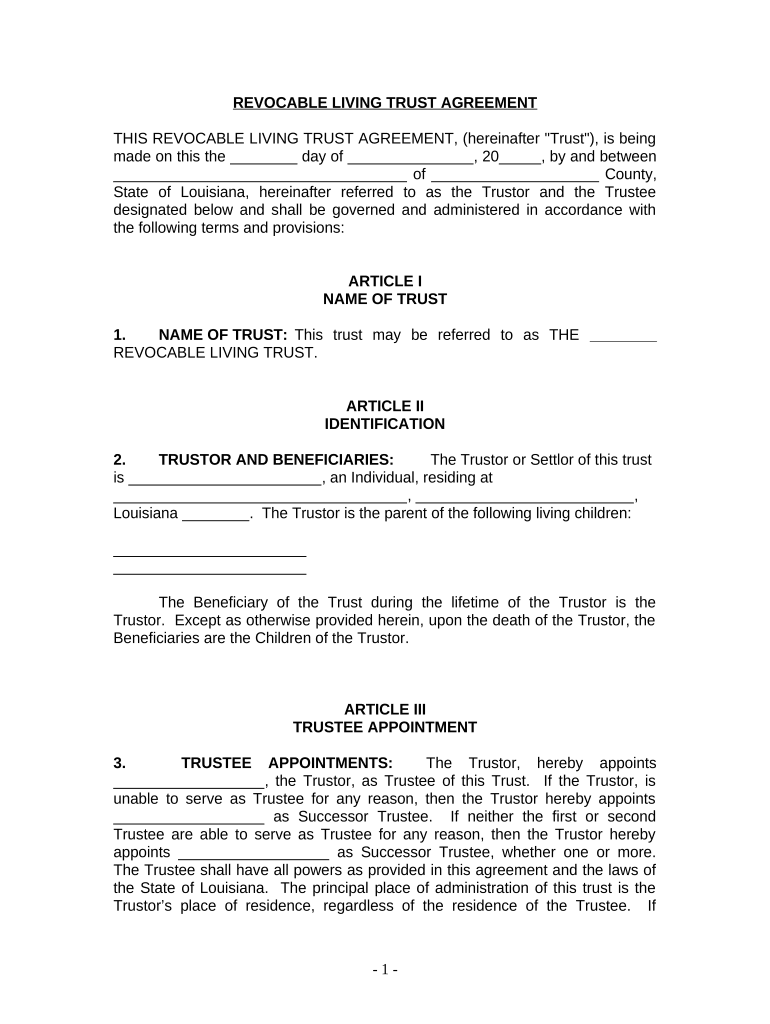

A living trust for individuals who are single, divorced, or widowed with children in Louisiana is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. This type of trust is particularly beneficial for those with children, as it can provide clear instructions for guardianship and asset management. It helps avoid probate, ensuring a smoother transition of your estate to your beneficiaries while maintaining privacy.

How to Use the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Louisiana

Using a living trust involves several steps. First, you need to create the trust document, which outlines the terms and conditions of the trust. You will then transfer your assets into the trust, which may include real estate, bank accounts, and personal property. It is essential to name a trustee, who will manage the trust according to your wishes. Additionally, you should regularly review and update the trust as your circumstances change, such as the birth of a child or changes in your financial situation.

Steps to Complete the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Louisiana

Completing a living trust involves a series of steps:

- Determine your assets and decide which ones to include in the trust.

- Draft the trust document, specifying the terms, beneficiaries, and trustee.

- Sign the document in accordance with Louisiana state laws, which may require notarization.

- Transfer ownership of your assets into the trust, ensuring proper documentation for each asset.

- Keep the trust document in a safe place and inform your trustee of its location.

Key Elements of the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Louisiana

Key elements of a living trust include the following:

- Trustee: The individual or institution responsible for managing the trust.

- Beneficiaries: Individuals or entities that will receive the trust assets upon your passing.

- Terms of the Trust: Specific instructions regarding how assets should be managed and distributed.

- Revocability: Most living trusts are revocable, allowing you to alter or dissolve the trust during your lifetime.

State-Specific Rules for the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Louisiana

In Louisiana, living trusts must adhere to specific state laws, including the need for proper execution and notarization. Additionally, Louisiana's unique legal framework may influence how property is classified and transferred into the trust. It is advisable to consult with a legal professional familiar with Louisiana estate planning to ensure compliance with all state regulations.

Legal Use of the Living Trust for Individual, Who Is Single, Divorced or Widow or Widower With Children in Louisiana

The legal use of a living trust in Louisiana allows individuals to manage their assets effectively while providing clear guidelines for distribution after death. It serves to protect the interests of minor children by outlining guardianship and asset management. Properly executed, a living trust can help avoid probate, reduce estate taxes, and maintain privacy regarding the distribution of assets.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children louisiana

Prepare Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It presents an excellent eco-conscious alternative to traditional printed and signed papers, allowing you to access the necessary format and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to alter and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana with ease

- Locate Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to missing or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana?

A Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana is a legal document that allows you to manage your assets during your lifetime and set forth how your assets will be distributed after your death. It ensures that your children are taken care of and helps avoid probate, simplifying the transfer of your property.

-

How can a Living Trust benefit me as a single parent in Louisiana?

Utilizing a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana provides peace of mind knowing that your children’s financial future is secured. It allows you to specify guardianship and allocate resources for their care, education, and maintenance without the lengthy probate process.

-

What are the costs associated with creating a Living Trust in Louisiana?

The costs of setting up a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana can vary based on the complexity of your estate. While DIY options can be inexpensive, seeking legal advice may incur higher fees, ensuring your trust meets all state requirements and effectively protects your assets.

-

Can I modify my Living Trust after it’s established?

Yes, a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana is revocable, meaning you can modify or revoke it as your circumstances change. This flexibility allows you to adapt to life changes such as remarriage or changes in your financial situation.

-

How does a Living Trust differ from a will in Louisiana?

A Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana avoids the probate process, whereas a will must go through probate court. This difference can save time and money, ensuring your assets are transferred to your children more quickly.

-

Is a Living Trust sufficient on its own, or should I still consider a will?

While a Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana is a powerful tool, it’s often advisable to have a will as well. A will can address any assets not included in the trust and can establish guardianship for minor children.

-

What happens to my Living Trust if I move out of Louisiana?

If you move out of Louisiana, your Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana remains valid, but it may be prudent to review and update it according to the laws of your new state. This ensures compliance and adequate protection of your assets in the new jurisdiction.

Get more for Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana

Find out other Living Trust For Individual, Who Is Single, Divorced Or Widow or Widower With Children Louisiana

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure