Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate Louisiana Form

What is the Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana

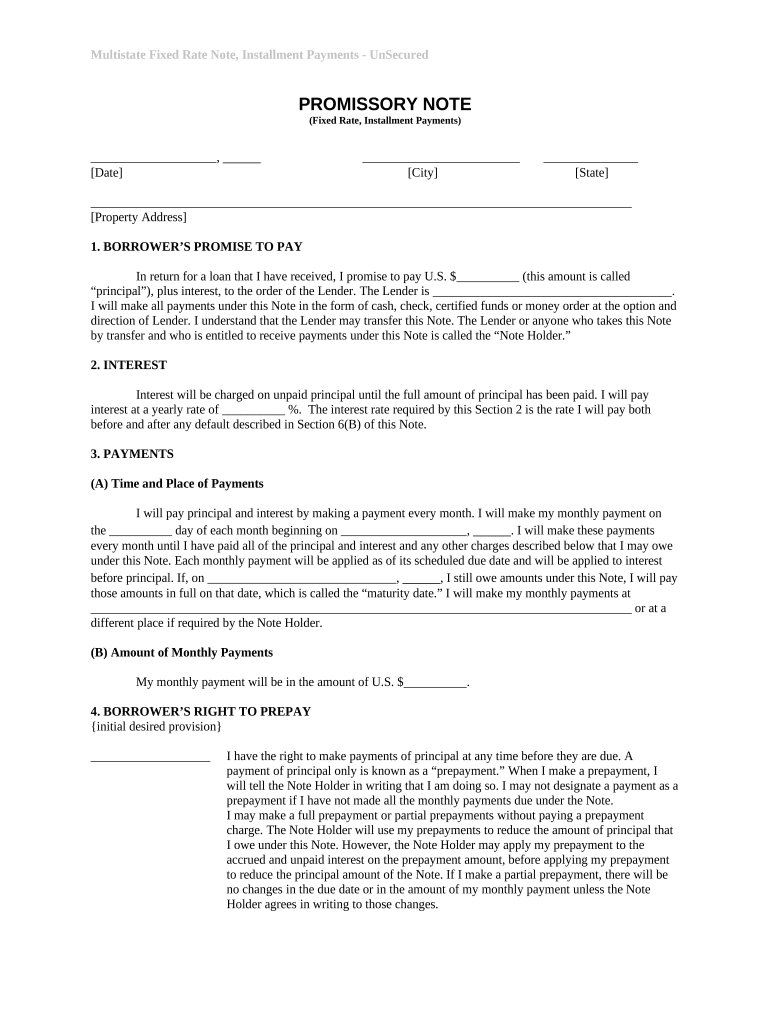

The Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate Louisiana is a legal document that outlines the terms of a loan agreement between a borrower and a lender. This form is specifically designed for unsecured loans, meaning that no collateral is required to secure the loan. The document details the fixed interest rate, repayment schedule, and other essential terms of the loan, ensuring both parties understand their rights and obligations. This type of promissory note is commonly used in personal loans, business financing, and other financial transactions where the lender seeks a formal agreement for repayment.

Key elements of the Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana

Several key elements must be included in the Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate Louisiana to ensure its effectiveness and legal standing. These elements include:

- Borrower and Lender Information: Full names and contact details of both parties involved.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate of interest applicable to the loan.

- Repayment Schedule: Details on how and when payments will be made, including the frequency and due dates.

- Late Fees: Information on any penalties for late payments.

- Governing Law: A statement indicating that the agreement is governed by Louisiana state law.

Steps to complete the Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana

Completing the Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate Louisiana involves several straightforward steps:

- Gather Information: Collect all necessary details, including borrower and lender information, loan amount, and terms.

- Fill Out the Form: Accurately enter the gathered information into the promissory note template.

- Review Terms: Both parties should review the terms to ensure mutual understanding and agreement.

- Sign the Document: Both the borrower and lender must sign the document, which can be done electronically for convenience.

- Distribute Copies: Provide copies of the signed document to both parties for their records.

Legal use of the Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana

The Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate Louisiana serves as a legally binding agreement when properly executed. For the note to be enforceable, it must meet specific legal requirements, including clear terms, mutual consent, and the signatures of both parties. In the event of a dispute, this document can be presented in court as evidence of the agreed-upon terms, making it crucial for both borrowers and lenders to maintain accurate records and adhere to the stipulations outlined in the note.

How to use the Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana

Using the Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate Louisiana involves several practical applications. This document can be utilized in various scenarios, such as:

- Personal loans between friends or family members.

- Business loans for startup capital or operational expenses.

- Financing for purchasing goods or services where payment is made over time.

By clearly outlining the terms of the loan, this promissory note helps prevent misunderstandings and provides a framework for repayment, ensuring both parties are protected throughout the loan period.

State-specific rules for the Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana

When using the Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate Louisiana, it is essential to be aware of state-specific rules that may apply. Louisiana law requires that all promissory notes adhere to specific formatting and content requirements to be considered valid. Additionally, the state has regulations regarding interest rates, late fees, and collection practices that must be followed. It is advisable for both borrowers and lenders to familiarize themselves with these rules to ensure compliance and avoid potential legal issues.

Quick guide on how to complete louisiana unsecured installment payment promissory note for fixed rate louisiana

Complete Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to amend and eSign Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana without hassle

- Find Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to apply your changes.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Amend and eSign Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana?

A Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana is a legal document that outlines the borrowing terms between a lender and a borrower without requiring collateral. It specifies the fixed interest rate, payment schedule, and other essential details of the loan agreement. This type of note is perfect for businesses seeking flexible financing options.

-

How can I create a Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana using airSlate SignNow?

Creating a Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana with airSlate SignNow is straightforward. Simply use our user-friendly templates to input your loan details, customize it according to your needs, and eSign it electronically. Our platform simplifies the entire process, allowing for quick and efficient document management.

-

What are the benefits of using a Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana?

Using a Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana provides numerous benefits, including transparency, a fixed payment schedule, and the absence of collateral requirements. This arrangement allows borrowers to have a clear understanding of their repayment obligations without the risk of losing assets. It is an ideal solution for those needing financial support without substantial security.

-

Is there a cost associated with generating a Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana?

Yes, there may be associated costs depending on the specific features you choose while using airSlate SignNow. The platform offers competitive pricing for document creation and eSigning services. We recommend reviewing our pricing page for detailed information on the costs related to generating a Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana.

-

Can I customize the Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana template?

Absolutely! With airSlate SignNow, you can easily customize a Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana template to suit your specific needs. You can modify the terms, add relevant clauses, or adjust the payment schedule. Our platform ensures that your document reflects your unique circumstances accurately.

-

Are the signatures on a Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana legally binding?

Yes, the signatures obtained through airSlate SignNow on a Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana are legally binding. Our electronic signature solution complies with U.S. federal and state laws regarding electronic signatures, ensuring that your document holds up in legal scenarios. This provides peace of mind for both lenders and borrowers.

-

What integrations does airSlate SignNow offer for managing a Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana?

airSlate SignNow offers various integrations with popular business tools such as Google Drive, Salesforce, and Dropbox. This facilitates seamless document management and storage for your Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana. These integrations enhance productivity by allowing users to manage all their documents within their existing workflows.

Get more for Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana

- Ny state disability forms

- Program form

- Otr d 40 printable form

- Montana board of outfitters 301 s park avenue 4th floor bsd dli mt form

- Fiscal closeout report for state and federal grant programs form

- Madison river srp use report sheet foam mtorg form

- Cascade city county health departmenthuman services form

- Dhrd childcare block grant application confederated salish and cskt form

Find out other Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate Louisiana

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors