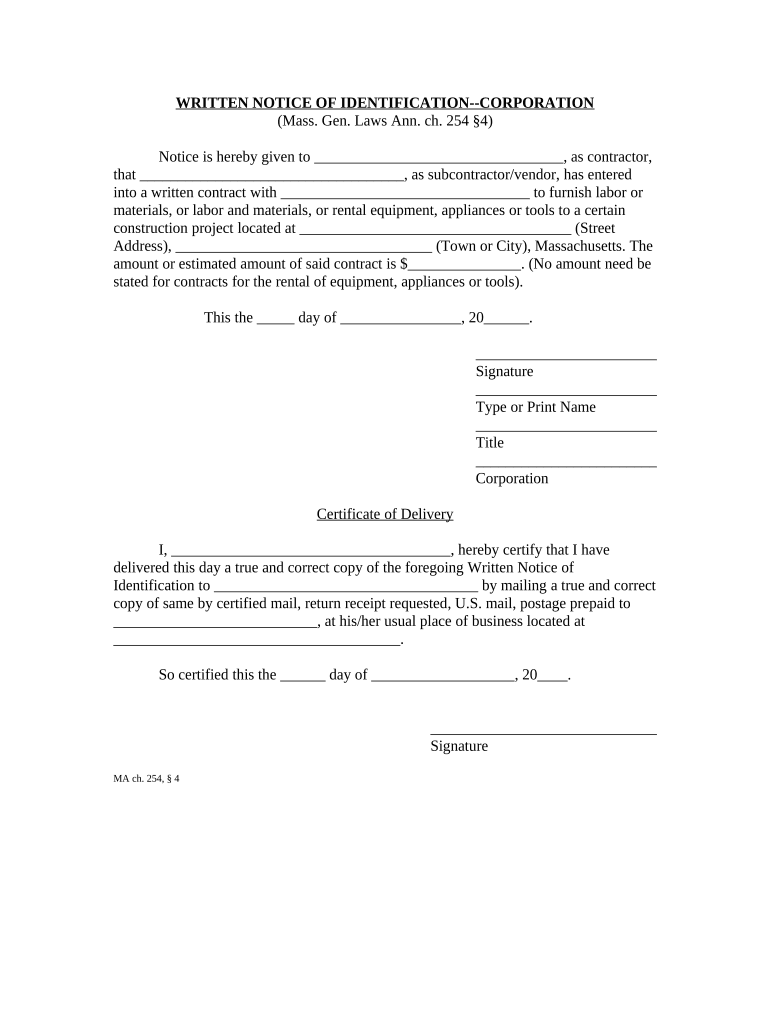

Massachusetts Corporation Company Form

What is the Massachusetts Corporation Company

The Massachusetts Corporation Company refers to a legal entity formed under Massachusetts state law. It provides limited liability protection to its owners, meaning that personal assets are generally shielded from business debts and liabilities. This type of corporation is governed by specific regulations set forth by the Massachusetts Secretary of the Commonwealth. Understanding the structure and function of a corporation limited liability is essential for entrepreneurs looking to establish a business in Massachusetts.

Steps to complete the Massachusetts Corporation Company

Establishing a Massachusetts Corporation Company involves several key steps:

- Choose a unique name for your corporation that complies with state naming requirements.

- Designate a registered agent who will receive legal documents on behalf of the corporation.

- File the Articles of Organization with the Massachusetts Secretary of the Commonwealth, providing necessary details about your corporation.

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

- Draft corporate bylaws to outline the management structure and operating procedures.

- Hold an organizational meeting to adopt the bylaws and appoint officers.

- Comply with ongoing state requirements, such as annual reports and fees.

Legal use of the Massachusetts Corporation Company

The legal framework surrounding the Massachusetts Corporation Company allows businesses to operate under specific statutes that define their rights and responsibilities. These corporations can enter contracts, sue or be sued, and own property in their name. Additionally, they must adhere to state and federal regulations, including tax obligations and employment laws. Understanding these legal aspects is crucial for maintaining compliance and protecting the corporation's limited liability status.

Required Documents

To establish a Massachusetts Corporation Company, several documents are essential:

- Articles of Organization: This foundational document must be filed with the state, detailing the corporation's name, purpose, and registered agent.

- Bylaws: Internal rules governing the management and operation of the corporation.

- Employer Identification Number (EIN): Necessary for tax identification and reporting.

- Meeting Minutes: Records of meetings held by the board of directors and shareholders.

Filing Deadlines / Important Dates

When forming a Massachusetts Corporation Company, it is vital to be aware of specific deadlines:

- Articles of Organization: Must be filed within a timely manner to avoid penalties.

- Annual Reports: Due each year on the anniversary of the corporation's formation.

- Tax Filings: Corporation tax returns are typically due on the fifteenth day of the fourth month following the end of the tax year.

Eligibility Criteria

To form a Massachusetts Corporation Company, certain eligibility criteria must be met:

- The corporation must have at least one director and one shareholder.

- Directors must be at least eighteen years old.

- The corporation's name must be distinguishable from existing entities registered in Massachusetts.

Quick guide on how to complete massachusetts corporation company 497309625

Effortlessly Prepare Massachusetts Corporation Company on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can access the required form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Massachusetts Corporation Company on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Massachusetts Corporation Company with Ease

- Obtain Massachusetts Corporation Company and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Select important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Massachusetts Corporation Company and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is corporation limited liability?

Corporation limited liability refers to the legal protection that shields shareholders from personal losses beyond their investment in the corporation. This means that if the corporation incurs debt or legal issues, the personal assets of shareholders are typically protected. Choosing a corporation limited liability structure can provide security for business owners.

-

How does airSlate SignNow support corporation limited liability businesses?

airSlate SignNow offers streamlined document management solutions tailored for corporation limited liability businesses. With features like electronic signatures and document templates, users can efficiently manage the legal paperwork relevant to maintaining their limited liability status. This helps ensure compliance and security for protecting the corporation's interests.

-

What are the pricing options for airSlate SignNow for corporation limited liability entities?

airSlate SignNow provides various pricing plans suitable for corporation limited liability entities that range from individual to enterprise-level solutions. Each plan offers different features that cater to the particular needs of your business structure. This flexibility allows you to choose the options that best fit your organization’s size and operational requirements.

-

What features does airSlate SignNow offer for managing corporation limited liability documents?

airSlate SignNow includes a range of features ideal for managing documents related to corporation limited liability, such as customizable templates, secure e-signature workflows, and advanced tracking options. These functionalities ensure that all your essential documents are handled efficiently and securely, facilitating compliance with legal requirements.

-

Can airSlate SignNow integrate with other tools for corporation limited liability management?

Yes, airSlate SignNow can seamlessly integrate with various third-party applications essential for corporation limited liability management, like CRM systems and accounting software. These integrations enhance your workflow by centralizing the management of documents and information. This creates a more efficient environment for operating your business.

-

What are the benefits of using airSlate SignNow for corporation limited liability forms?

Utilizing airSlate SignNow for your corporation limited liability forms streamlines the e-signing process, saving both time and resources. It provides a secure platform for signing and storing important documents while ensuring compliance with legal standards. This efficiency is crucial for businesses looking to focus on growth and operational effectiveness.

-

Is airSlate SignNow legally compliant for corporation limited liability usage?

Yes, airSlate SignNow is designed to be legally compliant for use within corporation limited liability contexts. The software adheres to e-signature laws such as the ESIGN Act and UETA, ensuring that electronic signatures are as valid as traditional ones. This compliance gives users confidence in the legality of their signed documents.

Get more for Massachusetts Corporation Company

- Season pass holder agreement form

- Mnd 005 form

- Dyslexia progress report template form

- Lifetime rights to property form

- Occupancy jennings form

- Www athenstownship com files fire applicationfire alarm amp fire suppression permit application form

- Puppy application questions form

- Two 2 ids from the msp airport badge identification requirements list must be presented with this form one must be a photo id

Find out other Massachusetts Corporation Company

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement