Md Notice Form

What is the Md Notice

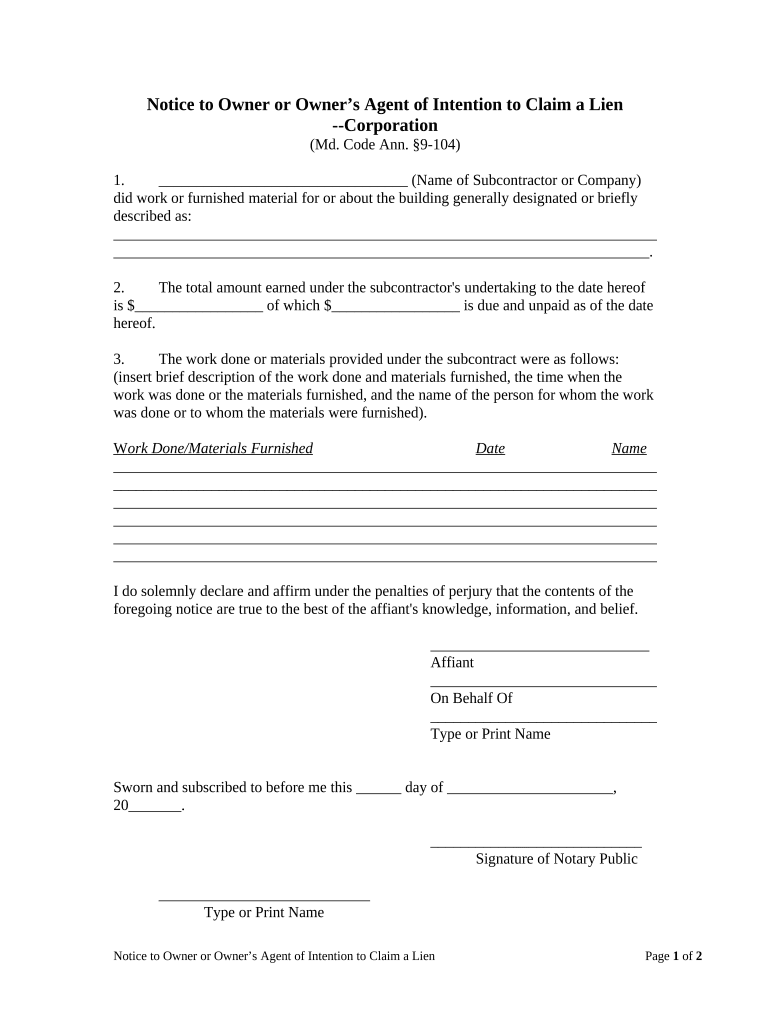

The Md Notice is a specific form used in various legal and administrative contexts. It serves as a notification or declaration that must be completed and submitted to relevant authorities or institutions. Understanding its purpose is crucial for ensuring compliance with applicable regulations. The Md Notice typically includes essential information that may affect legal rights or obligations, making it important for both individuals and businesses.

How to use the Md Notice

Using the Md Notice involves several steps to ensure that the form is completed accurately and submitted correctly. First, gather all necessary information required for the form, such as personal details, dates, and any relevant identification numbers. Next, fill out the form carefully, ensuring that all sections are completed. After completing the Md Notice, review it for accuracy before submission. Depending on the requirements, you may need to submit it online, by mail, or in person.

Steps to complete the Md Notice

Completing the Md Notice requires careful attention to detail. Follow these steps for a successful submission:

- Gather required documents and information.

- Access the Md Notice form through the appropriate channel.

- Fill in all required fields, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified guidelines.

Legal use of the Md Notice

The legal use of the Md Notice is governed by specific regulations that vary by jurisdiction. It is essential to understand the legal implications of submitting this form, as it may affect rights, responsibilities, or compliance with local laws. When completed correctly, the Md Notice can serve as a legally binding document, provided it meets all necessary legal requirements.

Key elements of the Md Notice

The Md Notice contains several key elements that must be included for it to be valid. These elements typically include:

- Identifying information of the individual or entity submitting the form.

- Details relevant to the notification or declaration.

- Signature or electronic signature of the person completing the form.

- Date of completion.

State-specific rules for the Md Notice

Each state may have its own specific rules regarding the Md Notice. These can include variations in the form itself, submission deadlines, and additional requirements for certain types of notifications. It is important to consult state regulations to ensure compliance and avoid potential penalties.

Quick guide on how to complete md notice

Complete Md Notice effortlessly on any device

Web-based document management has gained traction among companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Md Notice on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and electronically sign Md Notice without hassle

- Find Md Notice and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details carefully and then click on the Done button to store your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Modify and electronically sign Md Notice to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an md notice and how can airSlate SignNow help with it?

An md notice, or medical document notice, is essential for communicating important information regarding medical records or advisories. airSlate SignNow streamlines this process by allowing users to create, send, and eSign md notices quickly and securely, ensuring that critical information signNowes its intended recipients efficiently.

-

Is airSlate SignNow cost-effective for sending md notices?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business sizes, making it cost-effective for sending md notices. The platform's user-friendly interface and automation features can signNowly reduce administrative costs and save time for your team.

-

What features does airSlate SignNow offer for md notices?

airSlate SignNow provides features like customizable templates, real-time notifications, and secure eSigning for md notices. Additionally, users can integrate these documents with existing systems, ensuring a seamless workflow while maintaining compliance with industry standards.

-

Can I track the status of my md notice with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of every md notice sent from your account. You can easily monitor whether it has been viewed, signed, or requires further action, ensuring a transparent communication process.

-

What kind of integrations does airSlate SignNow support for managing md notices?

airSlate SignNow supports various integrations with popular CRM, cloud storage, and management systems, enhancing the efficiency of sending md notices. Examples include integrations with Salesforce, Google Drive, and Dropbox, which can simplify your document management workflow.

-

How secure is airSlate SignNow for sending md notices?

airSlate SignNow takes security seriously, employing advanced encryption standards to protect all md notices sent through the platform. Additionally, the solution is compliant with HIPAA, ensuring that your sensitive medical information is handled with the highest levels of security.

-

Can multiple users collaborate on an md notice in airSlate SignNow?

Yes, multiple users can collaborate on an md notice using airSlate SignNow. The collaborative features allow team members to edit, comment, and finalize documents together in real-time, speeding up the turnaround time for important communications.

Get more for Md Notice

Find out other Md Notice

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation