Business Credit Application Maryland Form

What is the Business Credit Application Maryland

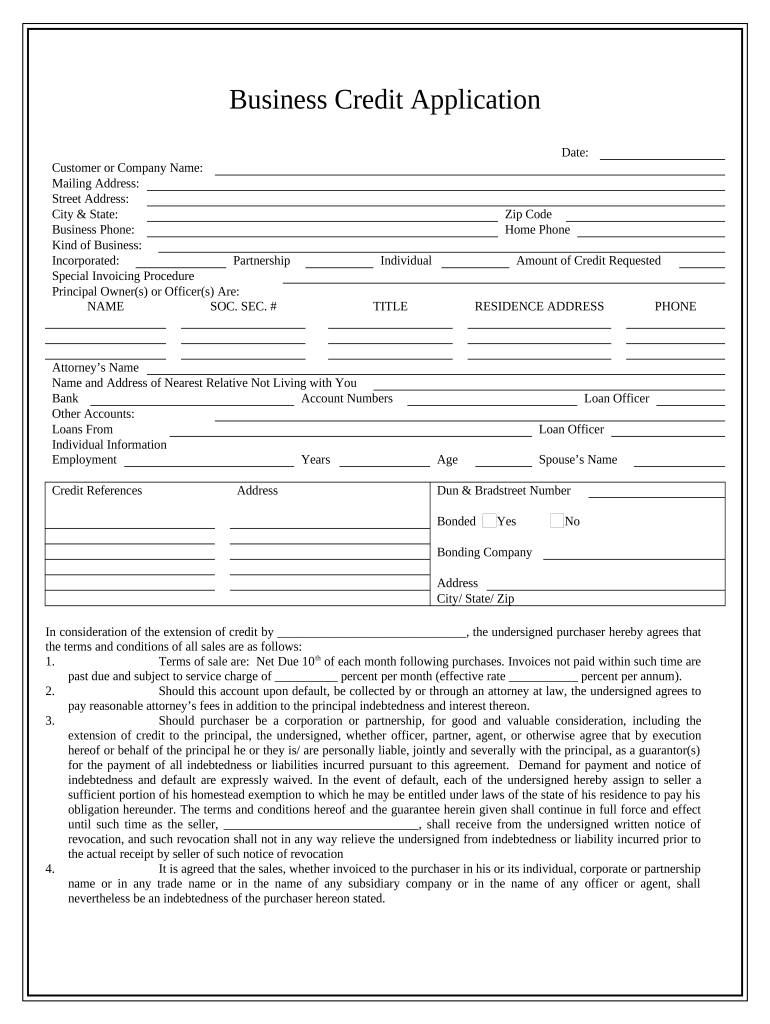

The Business Credit Application Maryland is a formal document that businesses in Maryland use to apply for credit from lenders or suppliers. This application typically requires detailed information about the business, including its legal structure, financial history, and creditworthiness. The purpose of this form is to help lenders assess the risk associated with extending credit to a business, ensuring that they have the necessary information to make informed decisions.

Key elements of the Business Credit Application Maryland

When completing the Business Credit Application Maryland, several key elements must be included to ensure its effectiveness:

- Business Information: This includes the legal name, address, and contact details of the business.

- Ownership Structure: Details about the owners or partners, including their names and ownership percentages.

- Financial Information: This section typically requires the submission of financial statements, such as balance sheets and income statements.

- Credit History: Information regarding the business's credit history, including any existing debts and payment history.

- Purpose of Credit: A brief description of how the business intends to use the credit being applied for.

Steps to complete the Business Credit Application Maryland

Completing the Business Credit Application Maryland involves several important steps:

- Gather necessary documentation, including financial statements and ownership details.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application, either electronically or via traditional mail, depending on the lender's requirements.

Legal use of the Business Credit Application Maryland

The Business Credit Application Maryland is legally binding once completed and signed. It is essential to ensure compliance with relevant laws and regulations governing credit applications in Maryland. This includes adhering to the requirements set forth by the Equal Credit Opportunity Act, which prohibits discrimination in lending practices. Properly executed, this application serves as a formal request for credit and can be used in legal proceedings if necessary.

Eligibility Criteria

To qualify for credit through the Business Credit Application Maryland, businesses typically must meet certain eligibility criteria, which may include:

- Having a valid business license and registration in Maryland.

- Demonstrating a stable financial history and creditworthiness.

- Providing accurate and complete information on the application form.

- Meeting any specific requirements set by the lender or supplier.

Form Submission Methods

The Business Credit Application Maryland can be submitted through various methods, depending on the lender's preferences:

- Online Submission: Many lenders offer an online platform for submitting applications electronically, which can expedite the review process.

- Mail: Businesses may also choose to print the application and send it via postal mail.

- In-Person: Some lenders may allow businesses to submit applications in person at their offices.

Quick guide on how to complete business credit application maryland

Complete Business Credit Application Maryland effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed paperwork, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Business Credit Application Maryland on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Business Credit Application Maryland with ease

- Obtain Business Credit Application Maryland and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, exhausting form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device of your choosing. Modify and eSign Business Credit Application Maryland and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application in Maryland?

A Business Credit Application in Maryland is a formal request for credit from a lender, typically an institution or bank. This application generally requires business details, financial information, and personal guarantees. By utilizing tools like airSlate SignNow, you can efficiently eSign and manage your Business Credit Application in Maryland.

-

How does airSlate SignNow streamline the Business Credit Application process in Maryland?

airSlate SignNow simplifies the Business Credit Application process in Maryland by allowing users to eSign documents electronically, eliminating paperwork and reducing processing time. With user-friendly features, businesses can easily send, receive, and manage applications from any device. This enhances efficiency and provides a secure method for handling sensitive information.

-

What are the pricing plans for using airSlate SignNow for Business Credit Applications in Maryland?

airSlate SignNow offers flexible pricing plans designed to cater to various business needs, including those for managing Business Credit Applications in Maryland. Plans range from basic to advanced, each incorporating essential features for document management and eSigning. For specific pricing details, it's recommended to visit our website or contact our sales team.

-

Are there any integrations available with airSlate SignNow for Business Credit Applications in Maryland?

Yes, airSlate SignNow integrates with various apps and platforms to enhance the efficiency of your Business Credit Application in Maryland. You can connect with popular CRM systems, cloud storage services, and financial software, thereby streamlining your workflow. This capability ensures that all parts of your business operate seamlessly together.

-

What are the benefits of using airSlate SignNow for Business Credit Applications in Maryland?

Using airSlate SignNow for Business Credit Applications in Maryland provides numerous benefits, including faster turnaround times, enhanced security, and reduced paperwork. The platform's eSigning functionality allows businesses to finalize applications quickly, improving cash flow and responsiveness. Additionally, it fosters a professional image by providing a modern approach to document handling.

-

Can I track the status of my Business Credit Application in Maryland using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Business Credit Application in Maryland in real-time. Users receive notifications when documents are opened and signed, helping you stay informed and organized throughout the application process. This transparency is crucial for timely follow-ups and decision-making.

-

Is my business information secure when using airSlate SignNow for Business Credit Applications in Maryland?

Yes, your business information is secure when using airSlate SignNow for Business Credit Applications in Maryland. The platform employs robust encryption and adheres to strict compliance standards to protect sensitive data. This gives businesses peace of mind when handling financial applications and confidential documents.

Get more for Business Credit Application Maryland

- Breckland council bus pass form

- Aqs 39 form hawaii

- Duplicate cosmetology license nj form

- Officer candidate regulations form

- Ccpoa benefit trust fund change of address form

- Form 5a transmission application

- Construction management plan checklist kingston city council form

- D0992 order form rap mobility functional support products

Find out other Business Credit Application Maryland

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive