Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children Maryland Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland

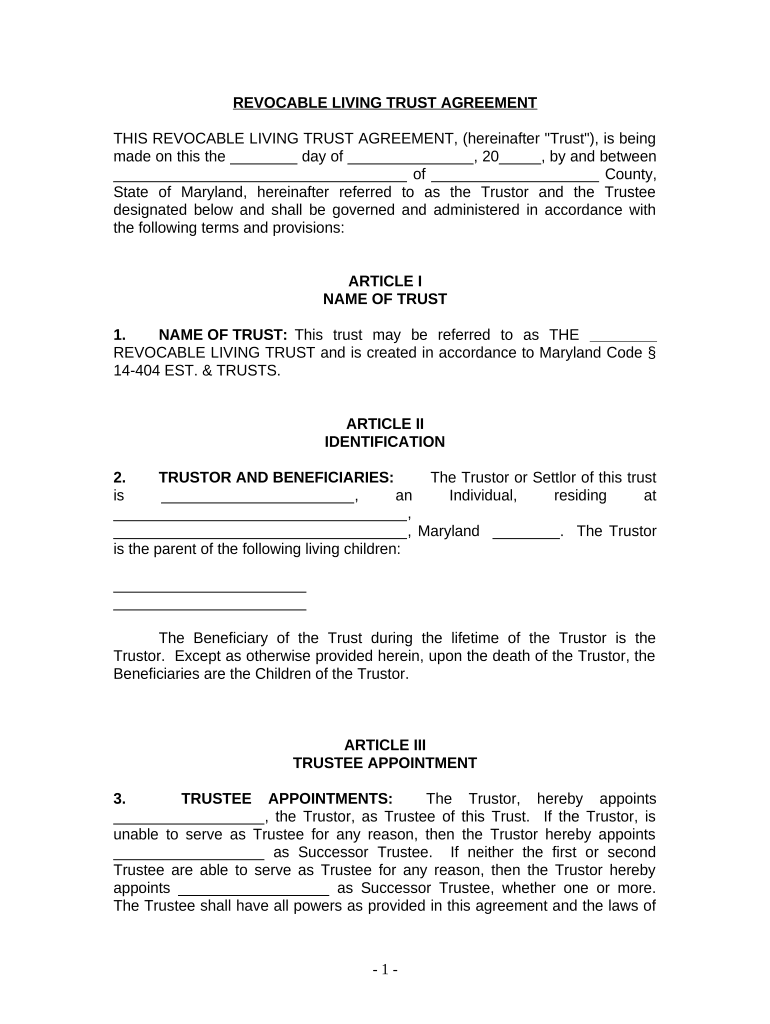

A living trust for individuals who are single, divorced, or widowed with children in Maryland is a legal document that allows a person to manage their assets during their lifetime and determine how those assets will be distributed after their death. This type of trust can help avoid probate, which is the legal process of distributing a deceased person's estate. By establishing a living trust, individuals can ensure that their children are taken care of and that their wishes are followed regarding asset distribution.

How to use the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland

Using a living trust involves several key steps. First, the individual must create the trust document, outlining the terms and conditions of the trust. Next, they need to transfer their assets into the trust, which may include real estate, bank accounts, and personal property. It is essential to designate a trustee, who will manage the trust, and to name beneficiaries, typically the children. Regular reviews of the trust are advisable to ensure it remains aligned with any changes in personal circumstances or laws.

Steps to complete the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland

Completing a living trust involves several steps:

- Identify the assets to be included in the trust.

- Draft the trust document, specifying the terms and conditions.

- Designate a trustee to manage the trust.

- Transfer ownership of assets into the trust.

- Review and update the trust as necessary to reflect changes in circumstances.

Key elements of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland

Key elements of a living trust include:

- Trustee: The individual or institution responsible for managing the trust.

- Beneficiaries: The individuals or entities designated to receive the trust assets.

- Terms of the trust: Specific instructions on how the assets should be managed and distributed.

- Asset transfer: The process of moving ownership of assets into the trust.

State-specific rules for the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland

In Maryland, specific rules govern the creation and management of living trusts. It is important to comply with state laws regarding the drafting of the trust document, asset transfer procedures, and the designation of trustees and beneficiaries. Additionally, Maryland law may have unique requirements for notarization and witness signatures, which must be adhered to for the trust to be considered valid.

Legal use of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland

The legal use of a living trust in Maryland allows individuals to manage their assets effectively while providing for their children. This type of trust can be particularly beneficial for single parents or those who have experienced divorce or widowhood, as it ensures that their children are the primary beneficiaries of their estate. Properly executed, a living trust can simplify the distribution of assets and reduce the likelihood of disputes among heirs.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with children maryland

Complete Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without delays. Manage Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland with ease

- Find Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Spotlight relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland is a legal document that helps you manage your assets during your lifetime and facilitates the transfer of those assets after your death. It can address unique concerns for individuals in these situations, ensuring that your children are taken care of according to your wishes.

-

How can a Living Trust benefit me as a single, divorced, or widowed parent in Maryland?

Creating a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland can provide peace of mind, knowing that your assets will be distributed as you intend. It can help avoid probate, simplify asset management, and offer financial security for your children.

-

What are the costs associated with setting up a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland?

The costs of establishing a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland can vary based on complexity and whether you seek legal assistance. Generally, you may expect to pay for attorney fees, notary services, and any applicable filing fees, but this investment can save costs in the long run by avoiding probate.

-

Does a Living Trust replace a will for single, divorced, or widowed parents?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland does not entirely replace a will, but it works in conjunction with one. While a trust handles asset distribution during your lifetime and after death, a will is important for addressing any assets outside the trust and appointing guardians for your children.

-

How does a Living Trust help in providing for my children in Maryland?

A Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland allows you to designate specific provisions for your children's care and education. You can set conditions on distribution, ensuring they receive financial support at appropriate ages or milestones.

-

Can I make changes to my Living Trust after it's created?

Yes, one of the advantages of a Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland is that it remains flexible. You can amend or revoke it at any time as your circumstances or wishes change.

-

What integrations does airSlate SignNow offer for managing my Living Trust documents?

airSlate SignNow offers seamless integrations with various applications that can help you manage your Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland. These integrations facilitate document storage, eSignature, and sharing, making it easier to handle your estate planning.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children Maryland

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter