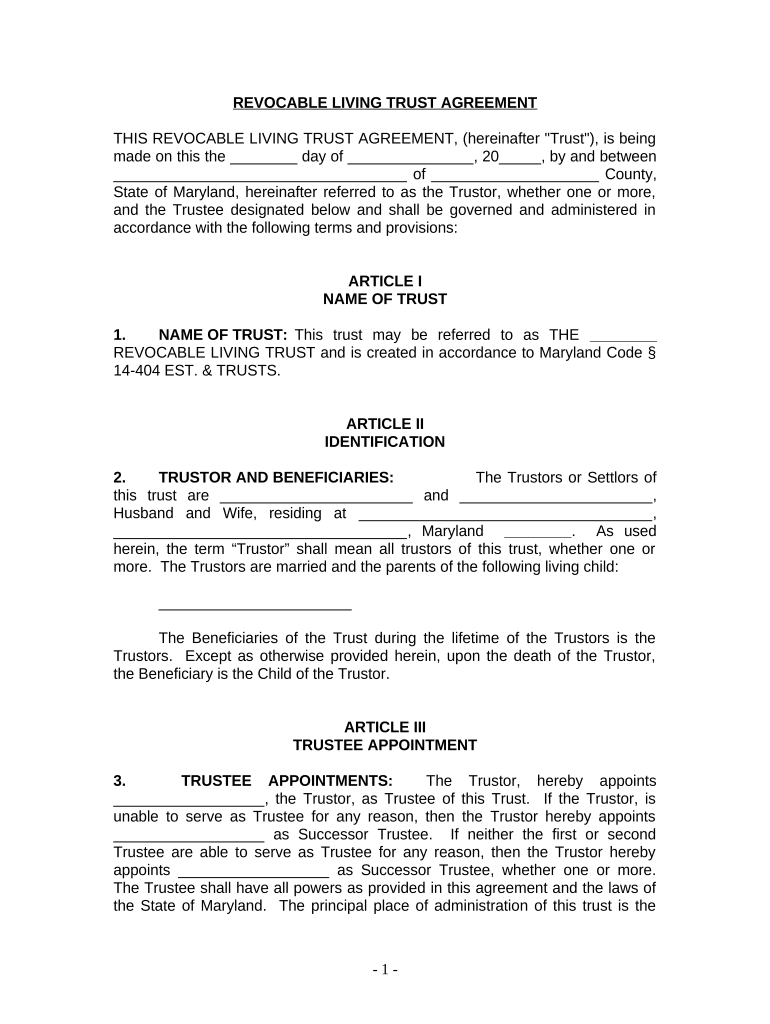

Living Trust for Husband and Wife with One Child Maryland Form

What is the Living Trust For Husband And Wife With One Child Maryland

A living trust for husband and wife with one child in Maryland is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets should be distributed after their passing. This type of trust can help avoid probate, ensuring a smoother transition of assets to the surviving spouse and child. It provides flexibility, allowing the couple to make changes as their circumstances or wishes evolve. The trust becomes effective immediately upon creation, allowing for the seamless management of assets.

Key Elements of the Living Trust For Husband And Wife With One Child Maryland

Several key elements define a living trust for husband and wife with one child in Maryland:

- Grantors: The couple who creates the trust and transfers their assets into it.

- Trustee: The individual or entity responsible for managing the trust assets. Typically, the couple serves as trustees during their lifetime.

- Beneficiaries: The individuals or entities who will benefit from the trust. In this case, the surviving spouse and child are the primary beneficiaries.

- Revocability: Most living trusts are revocable, meaning the couple can alter or dissolve the trust at any time while they are alive.

- Asset Protection: The trust can provide a level of protection against creditors, depending on the structure of the trust.

Steps to Complete the Living Trust For Husband And Wife With One Child Maryland

Completing a living trust for husband and wife with one child in Maryland involves several important steps:

- Identify Assets: List all assets that will be included in the trust, such as real estate, bank accounts, and investments.

- Choose a Trustee: Decide who will manage the trust, typically one or both spouses.

- Draft the Trust Document: Create a legal document outlining the terms of the trust, including how assets will be managed and distributed.

- Transfer Assets: Officially transfer ownership of the identified assets into the trust.

- Sign and Notarize: Both spouses must sign the trust document, and it may need to be notarized to ensure its legal validity.

State-Specific Rules for the Living Trust For Husband And Wife With One Child Maryland

In Maryland, specific rules govern the creation and management of living trusts. The trust must comply with state laws regarding the execution of legal documents, including the requirement for witnesses or notarization. Additionally, Maryland law allows for the inclusion of specific provisions that can address unique family situations, such as guardianship for minor children. Understanding these regulations is essential to ensure the trust is valid and enforceable.

Legal Use of the Living Trust For Husband And Wife With One Child Maryland

The legal use of a living trust for husband and wife with one child in Maryland includes asset management during the couple's lifetime and distribution of assets upon death. The trust can be used to specify how assets should be divided, provide for the care of minor children, and minimize estate taxes. It is crucial to ensure that the trust is properly funded and maintained to uphold its legal standing and effectiveness.

How to Obtain the Living Trust For Husband And Wife With One Child Maryland

To obtain a living trust for husband and wife with one child in Maryland, couples can consult with an estate planning attorney who specializes in trusts. An attorney can provide tailored advice, draft the trust document, and ensure compliance with state laws. Alternatively, couples may use reputable online legal services that offer templates and guidance for creating a living trust. It is important to ensure that any chosen method adheres to Maryland's legal requirements for trusts.

Quick guide on how to complete living trust for husband and wife with one child maryland

Complete Living Trust For Husband And Wife With One Child Maryland effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without delays. Manage Living Trust For Husband And Wife With One Child Maryland on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Living Trust For Husband And Wife With One Child Maryland seamlessly

- Locate Living Trust For Husband And Wife With One Child Maryland and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from a device of your choice. Modify and eSign Living Trust For Husband And Wife With One Child Maryland and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child in Maryland?

A Living Trust for Husband and Wife with One Child in Maryland is a legal document that allows couples to manage their assets during their lifetime and ensure a smooth transfer of those assets to their child upon their passing. It offers flexibility in managing property and can help avoid probate, ensuring a more efficient process for your family's needs.

-

How does a Living Trust benefit couples in Maryland?

The primary benefits of a Living Trust for Husband and Wife with One Child in Maryland include avoiding probate, providing clearer asset distribution, and reducing estate taxes. It also allows for greater control over how and when assets are distributed to your child, which can be essential in protecting their financial future.

-

What are the costs associated with setting up a Living Trust in Maryland?

The costs for establishing a Living Trust for Husband and Wife with One Child in Maryland can vary depending on complexity and the service provider you choose. Generally, you can expect to pay a few hundred to a few thousand dollars for professional assistance. airSlate SignNow offers cost-effective solutions to streamline the creation of your trust.

-

Can we modify our Living Trust after it's been established?

Yes, a Living Trust for Husband and Wife with One Child in Maryland is revocable, which means you can make changes or revoke it at any time during your lifetime. This adaptability allows you to adjust your estate planning strategy as your circumstances change, such as the addition of new children or changes in financial situations.

-

Is a Living Trust better than a Will for couples in Maryland?

For many, a Living Trust for Husband and Wife with One Child in Maryland can offer more advantages than a traditional Will. Living Trusts help avoid the lengthy probate process, provide privacy in asset distribution, and can be funded during your lifetime, making it easier to manage assets for your child.

-

What documents are needed to create a Living Trust in Maryland?

To create a Living Trust for Husband and Wife with One Child in Maryland, you generally need personal identification, asset documentation, and details about beneficiaries. Depending on your situation, additional documents may be required, and it's advisable to consult with a legal professional to ensure everything is in order.

-

Can I integrate airSlate SignNow with other legal software?

Yes, airSlate SignNow can integrate with several legal and business software applications to enhance the document signing and management process. This makes it easier for you to set up your Living Trust for Husband and Wife with One Child in Maryland while keeping all your estate planning documents organized and accessible.

Get more for Living Trust For Husband And Wife With One Child Maryland

- Killer kitties worksheet answer key form

- Dc cv 082 form

- Vr 451 maryland motor vehicle administration maryland gov mva maryland form

- Hipaa form b pediatric associates request to release copy

- Builders risk quote form

- Boarder agreement template form

- Board of directors confidentiality agreement template form

- Boarding agreement template form

Find out other Living Trust For Husband And Wife With One Child Maryland

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later