Maryland Request Form

What is the Maryland Request Form

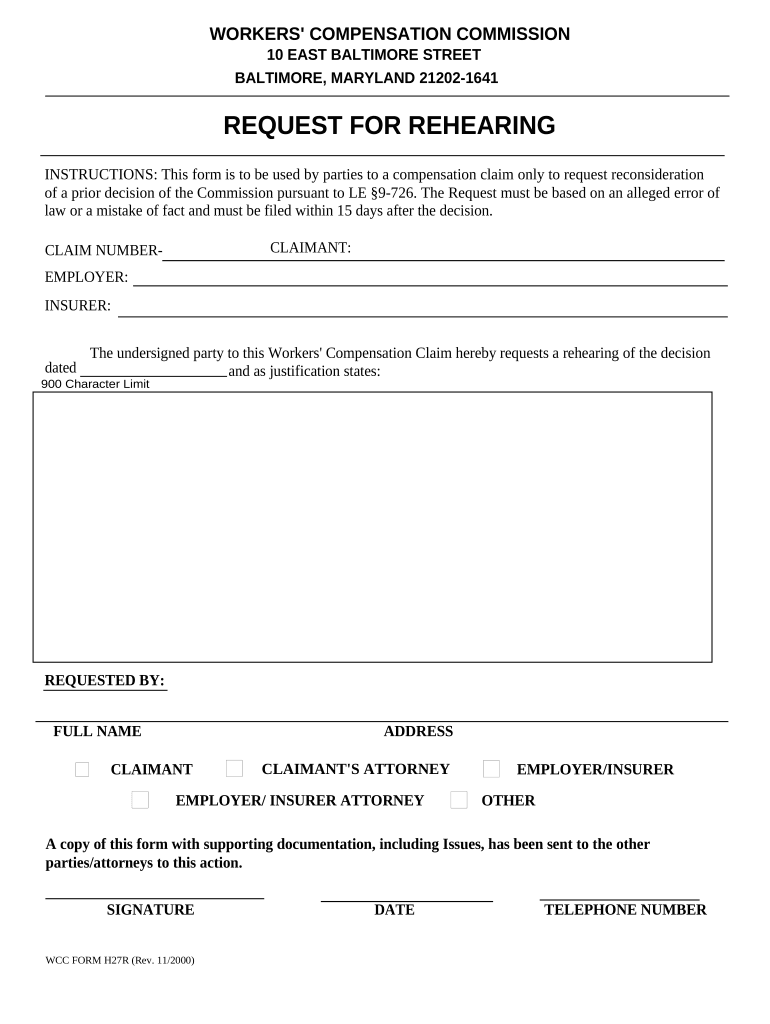

The Maryland Request Form is a legal document used to formally request a rehearing in the state of Maryland. This form is essential for individuals seeking to challenge a decision made by a court or administrative agency. It outlines the reasons for the request and provides the necessary details to support the case. Understanding the purpose and requirements of this form is crucial for ensuring that your request is processed effectively.

Steps to complete the Maryland Request Form

Completing the Maryland Request Form involves several key steps to ensure accuracy and compliance with legal standards. Begin by gathering all relevant information, including case details and the specific grounds for your rehearing request. Next, fill out the form carefully, ensuring that all sections are completed. It is important to provide clear and concise explanations for your request. After completing the form, review it for any errors or omissions before submitting it to the appropriate court or agency.

Legal use of the Maryland Request Form

The legal use of the Maryland Request Form is governed by specific regulations and guidelines. To be considered valid, the form must be filled out in accordance with Maryland law, including any relevant court rules. Submitting a properly completed request form can lead to a reconsideration of the original decision, provided that it meets the necessary legal criteria. Familiarizing yourself with these legal requirements is essential to ensure your request is taken seriously.

Key elements of the Maryland Request Form

Several key elements must be included in the Maryland Request Form to ensure its validity. These elements typically include:

- Case Information: Details about the original case, including case number and court name.

- Grounds for Rehearing: A clear explanation of why a rehearing is being requested.

- Signature: The signature of the individual making the request, affirming the truthfulness of the information provided.

- Date: The date on which the request is being submitted.

Including these elements accurately is essential for the form to be accepted by the court.

Form Submission Methods

The Maryland Request Form can be submitted through various methods, depending on the preferences of the individual and the requirements of the court. Common submission methods include:

- Online: Many courts in Maryland allow for electronic submission of forms through their official websites.

- Mail: The form can be mailed to the appropriate court address, ensuring that it is sent with sufficient time to meet any deadlines.

- In-Person: Individuals may also choose to submit the form in person at the court clerk's office.

Choosing the right submission method is important for ensuring timely processing of your request.

Eligibility Criteria

To submit a Maryland Request Form, individuals must meet certain eligibility criteria. Generally, the requester must be a party to the original case or have a legitimate interest in the matter. Additionally, the request must be based on valid legal grounds, such as new evidence or procedural errors in the original hearing. Understanding these criteria helps ensure that your request is valid and stands a better chance of being granted.

Quick guide on how to complete maryland request form

Complete Maryland Request Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without interruptions. Manage Maryland Request Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Maryland Request Form with ease

- Obtain Maryland Request Form and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Maryland Request Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for submitting a Maryland request rehearing using airSlate SignNow?

Submitting a Maryland request rehearing with airSlate SignNow is straightforward. You can easily create, sign, and send your documents electronically, ensuring that you follow the requirements imposed by Maryland's legal framework. The platform's intuitive design allows you to track your request status in real-time, making the process smooth and efficient.

-

How does airSlate SignNow ensure the security of my Maryland request rehearing documents?

AirSlate SignNow prioritizes the security of your Maryland request rehearing documents by employing advanced encryption methods and secure access controls. Our platform complies with industry standards and regulations to keep your sensitive information safe while allowing you to manage and eSign documents confidently.

-

What features does airSlate SignNow offer for managing a Maryland request rehearing?

AirSlate SignNow provides a variety of features tailored for managing your Maryland request rehearing efficiently. This includes customizable templates, automated workflows, and integration with popular applications to streamline your document management process. Additionally, multi-party signing allows you to collaborate with multiple stakeholders effortlessly.

-

Are there any integrations with other software tools for managing a Maryland request rehearing?

Yes, airSlate SignNow integrates seamlessly with a variety of software tools to enhance your experience when handling a Maryland request rehearing. Our platform connects with popular applications like Google Drive, Salesforce, and more, enabling you to incorporate electronic signature solutions into your existing workflow without any hassles.

-

Can I track the status of my Maryland request rehearing after sending it for signature?

Absolutely! With airSlate SignNow, you can track the status of your Maryland request rehearing in real time. Our platform provides notifications and updates as your document moves through the signing process, ensuring that you always have visibility over your requests and can act promptly as needed.

-

What are the pricing options for using airSlate SignNow for a Maryland request rehearing?

AirSlate SignNow offers flexible pricing options to accommodate different needs when preparing a Maryland request rehearing. Our competitive pricing structures allow businesses to choose a plan that fits their budget, whether they need basic functionalities or advanced features for efficient document management.

-

What are the benefits of using airSlate SignNow for a Maryland request rehearing?

Using airSlate SignNow for a Maryland request rehearing brings numerous benefits, including increased efficiency and reduced turnaround times. Our electronic signature solution simplifies the document preparation process, allowing you to focus more on your case rather than the paperwork. Additionally, our user-friendly interface ensures that you can manage your requests easily and effectively.

Get more for Maryland Request Form

Find out other Maryland Request Form

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free