Quitclaim Deed from Corporation to Individual Michigan Form

What is the Quitclaim Deed From Corporation To Individual Michigan

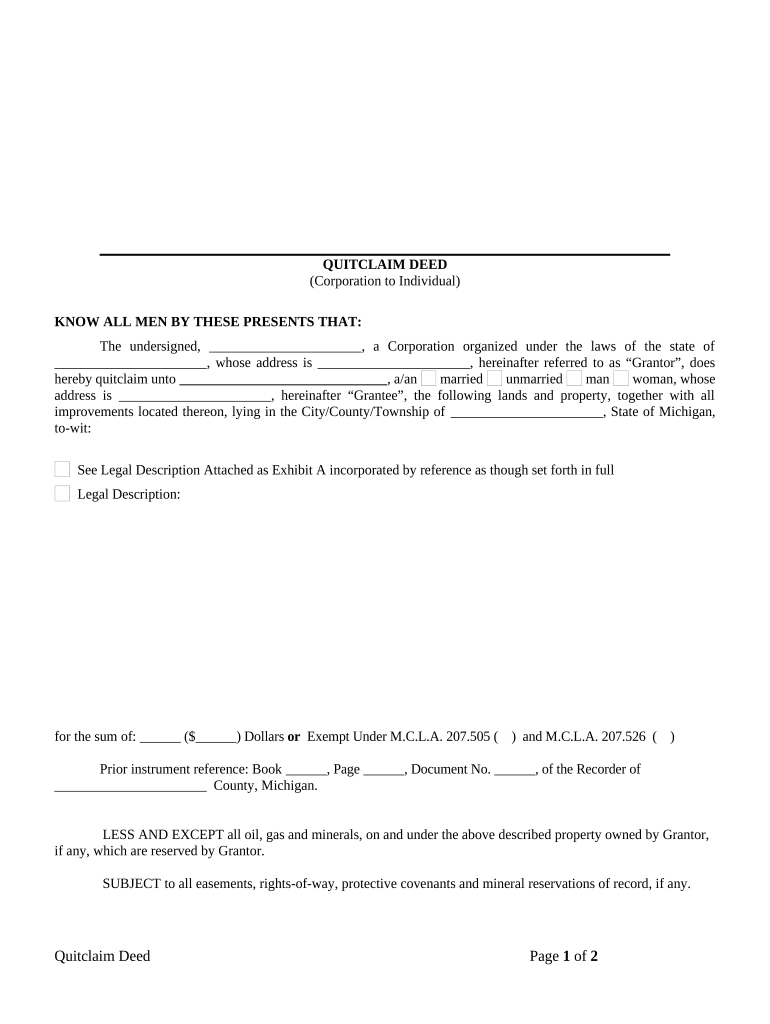

A quitclaim deed from a corporation to an individual in Michigan is a legal document that transfers ownership of property from a corporate entity to a private individual. Unlike a warranty deed, a quitclaim deed does not guarantee that the property title is clear or free of liens. It simply conveys whatever interest the corporation has in the property at the time of transfer. This type of deed is often used in situations where the parties know each other well, such as family transactions or intra-company transfers.

Steps to Complete the Quitclaim Deed From Corporation To Individual Michigan

Completing a quitclaim deed from a corporation to an individual in Michigan involves several important steps:

- Obtain the form: Download the quitclaim deed form specific to Michigan.

- Fill out the form: Include the names of the corporation and the individual, the property description, and any relevant details.

- Sign the document: Ensure that an authorized representative of the corporation signs the deed in front of a notary public.

- Notarization: The signature must be notarized to validate the document legally.

- File the deed: Submit the completed and notarized quitclaim deed to the local county register of deeds for recording.

Legal Use of the Quitclaim Deed From Corporation To Individual Michigan

The quitclaim deed from a corporation to an individual is legally binding once it is signed, notarized, and recorded. It is commonly used in various situations, including property transfers between family members, business transactions, or when a corporation dissolves and transfers its assets. It is essential to ensure that the deed complies with Michigan's legal requirements to avoid future disputes regarding property ownership.

Key Elements of the Quitclaim Deed From Corporation To Individual Michigan

Several key elements must be included in a quitclaim deed from a corporation to an individual in Michigan:

- Grantor and Grantee Information: Full names and addresses of both the corporation (grantor) and the individual (grantee).

- Property Description: A detailed description of the property being transferred, including its legal description.

- Consideration: The amount paid for the property, if applicable, or a statement indicating that the transfer is a gift.

- Signature of Authorized Representative: The deed must be signed by an individual authorized to act on behalf of the corporation.

- Notary Public: A notary's acknowledgment to verify the identity of the signer and the authenticity of the document.

State-Specific Rules for the Quitclaim Deed From Corporation To Individual Michigan

In Michigan, specific rules govern the use of quitclaim deeds. The deed must be in writing, signed by the grantor, and notarized. Additionally, it must be recorded with the county register of deeds to provide public notice of the transfer. Michigan law also requires that the property description be precise and sufficient to identify the property being conveyed. Failure to adhere to these rules may result in challenges to the deed's validity.

Who Issues the Quitclaim Deed From Corporation To Individual Michigan

The quitclaim deed is typically issued by the corporation transferring the property. An authorized representative of the corporation must complete and sign the deed. After the deed is signed and notarized, it is submitted to the local county register of deeds for official recording. This recording process is crucial as it establishes the new ownership in public records.

Quick guide on how to complete quitclaim deed from corporation to individual michigan

Facilitate Quitclaim Deed From Corporation To Individual Michigan effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Quitclaim Deed From Corporation To Individual Michigan on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to alter and electronically sign Quitclaim Deed From Corporation To Individual Michigan without hassle

- Locate Quitclaim Deed From Corporation To Individual Michigan and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Select how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or inaccuracies that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Quitclaim Deed From Corporation To Individual Michigan and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To Individual in Michigan?

A Quitclaim Deed From Corporation To Individual in Michigan is a legal document that transfers ownership of property from a corporation to an individual without any warranty of title. This type of deed is often used in real estate transactions when the corporation wants to convey its interest in a property. It's important to ensure all legal requirements are met when executing this deed.

-

How much does it cost to create a Quitclaim Deed From Corporation To Individual in Michigan?

The cost to create a Quitclaim Deed From Corporation To Individual in Michigan can vary based on legal fees and any associated filing costs. Typically, completing the deed using online services like airSlate SignNow can save on attorney fees, offering a cost-effective solution. Always check for any additional state-specific charges that may apply.

-

What are the benefits of using airSlate SignNow for a Quitclaim Deed From Corporation To Individual in Michigan?

Using airSlate SignNow for a Quitclaim Deed From Corporation To Individual in Michigan provides an easy-to-use platform that simplifies document preparation and signing. This service also offers legal compliance tools, ensuring your deed adheres to Michigan laws. Additionally, the integration of eSigning saves time, making the transaction efficient.

-

Is it mandatory to signNow a Quitclaim Deed From Corporation To Individual in Michigan?

Yes, in Michigan, a Quitclaim Deed From Corporation To Individual must be signNowd to be considered valid. Notarization helps to verify the identities of the signing parties and ensures the deed can be recorded with the county. Always confirm with local regulations to adhere to all legal requirements.

-

Can I customize my Quitclaim Deed From Corporation To Individual using airSlate SignNow?

Absolutely! airSlate SignNow allows you to easily customize your Quitclaim Deed From Corporation To Individual according to your specific needs. You can add clauses, change terms, and ensure that all relevant information is included. This flexibility helps to meet both your corporate and individual requirements.

-

How does airSlate SignNow ensure the security of my Quitclaim Deed From Corporation To Individual?

airSlate SignNow employs advanced security measures to protect your Quitclaim Deed From Corporation To Individual in Michigan. With encryption, secure storage, and compliance with legal standards, your documents are safeguarded throughout the signing process. You can have peace of mind knowing your information is secure.

-

What happens after I complete a Quitclaim Deed From Corporation To Individual in Michigan?

Once you complete a Quitclaim Deed From Corporation To Individual in Michigan, you need to file it with the local county register of deeds. This recording process legally documents the transfer of ownership. Make sure to obtain a copy of the recorded deed for your records.

Get more for Quitclaim Deed From Corporation To Individual Michigan

Find out other Quitclaim Deed From Corporation To Individual Michigan

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template