Personal Debt Schedule Template Form

What is the personal debt schedule template

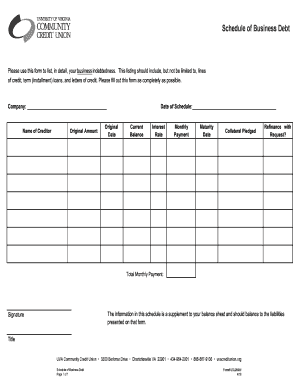

The personal debt schedule template is a structured document that outlines an individual's or business's outstanding debts. This template typically includes details such as the creditor's name, the total amount owed, interest rates, payment terms, and due dates. By organizing this information, the template helps users gain a clear understanding of their financial obligations, enabling better management of cash flow and debt repayment strategies.

How to use the personal debt schedule template

Using a personal debt schedule template involves several straightforward steps. First, gather all relevant financial documents, including loan agreements and credit card statements. Next, fill in the template with accurate information about each debt, such as the creditor's name, total amount owed, and payment details. Regularly updating the schedule as payments are made or new debts incurred ensures that it remains an effective tool for monitoring financial health.

Key elements of the personal debt schedule template

A well-structured personal debt schedule template should include key elements that facilitate comprehensive tracking of debts. Essential components often consist of:

- Creditor Name: The name of the lender or financial institution.

- Account Number: Unique identifier for the debt account.

- Total Amount Owed: The current balance of the debt.

- Interest Rate: The percentage charged on the outstanding balance.

- Minimum Monthly Payment: The least amount due each month.

- Due Date: The date by which payments must be made.

- Status: Current status of the debt, such as paid, active, or in default.

Steps to complete the personal debt schedule template

Completing the personal debt schedule template involves a systematic approach. Start by listing all debts, ensuring to include personal loans, credit cards, and any other financial obligations. For each entry, input the creditor's name, account number, and total amount owed. Next, add the interest rate and minimum monthly payment for each debt. Finally, review the completed schedule for accuracy and make adjustments as necessary to reflect any changes in your financial situation.

Legal use of the personal debt schedule template

The personal debt schedule template can serve various legal purposes, particularly in financial planning and bankruptcy proceedings. When properly filled out, it may be used to demonstrate an individual's financial obligations to creditors or during negotiations for debt settlements. It is important to ensure that all information is accurate and up-to-date, as discrepancies could lead to legal complications or misunderstandings with creditors.

Examples of using the personal debt schedule template

There are numerous scenarios where a personal debt schedule template can be beneficial. For instance, individuals preparing for a loan application may use the template to present their current debt situation to lenders. Similarly, someone considering debt consolidation can utilize the template to compare existing debts against potential new terms. Additionally, financial advisors often recommend using a debt schedule to help clients develop effective repayment strategies.

Quick guide on how to complete personal debt schedule template

Prepare Personal Debt Schedule Template effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, alter, and electronically sign your documents quickly and efficiently. Manage Personal Debt Schedule Template on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and electronically sign Personal Debt Schedule Template effortlessly

- Locate Personal Debt Schedule Template and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Personal Debt Schedule Template and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal debt schedule template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a business debt schedule template?

A business debt schedule template is a structured tool designed to help businesses effectively track and manage their debts. It outlines the amounts owed, payment terms, and due dates, giving a clear overview of financial obligations. Using a business debt schedule template can enhance financial planning and decision-making.

-

How can airSlate SignNow help with my business debt schedule template?

airSlate SignNow simplifies the process of sending and eSigning your business debt schedule template. Our platform allows you to create, manage, and collaborate on your debt template directly from the cloud, ensuring you always have access to your financial data. With our secure solution, tracking and updating your debt obligations becomes hassle-free.

-

What features are included in airSlate SignNow for managing debt schedules?

airSlate SignNow offers a variety of features suitable for managing your business debt schedule template, including document templates, electronic signatures, workflow automation, and real-time collaboration. These features streamline the process and improve accuracy when dealing with financial documents. Our platform is intuitive, making it easy for users to create and modify their debt schedules.

-

Is airSlate SignNow cost-effective for small businesses needing a debt schedule template?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their business debt schedule template. Our competitive pricing plans offer various options that cater to different business needs without compromising on essential features. This makes it accessible for businesses of all sizes to handle their financial documents efficiently.

-

Can I customize my business debt schedule template in airSlate SignNow?

Absolutely! With airSlate SignNow, you can customize your business debt schedule template to reflect your unique financial structure and needs. Our platform allows you to edit, add fields, and adjust layouts, ensuring your template serves your specific requirements effectively. This flexibility enhances your ability to manage debt accurately.

-

What benefits does using a digital business debt schedule template provide?

Using a digital business debt schedule template with airSlate SignNow provides numerous benefits, including easy access, enhanced collaboration, and real-time updates. This digital approach minimizes errors and keeps your financial information up-to-date, reducing the risk of missing payments. Ultimately, it supports better financial management and planning.

-

Does airSlate SignNow integrate with other financial tools for debt management?

Yes, airSlate SignNow seamlessly integrates with various financial management tools and software, enhancing the functionality of your business debt schedule template. This integration allows for streamlined data transfer and better collaboration with your accounting systems. By connecting with your existing tools, you can optimize your financial management processes.

Get more for Personal Debt Schedule Template

- Administrative staff performance appraisal form human

- Declination of venture offer form

- Amount owed due to destruction of sign form

- Sample goals for difference roles msu human resources form

- Assignment of lease secgov form

- Web site evaluation worksheet form

- 5 factors to use when evaluating a business opportunity form

- Worksheet contingent worker form

Find out other Personal Debt Schedule Template

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney