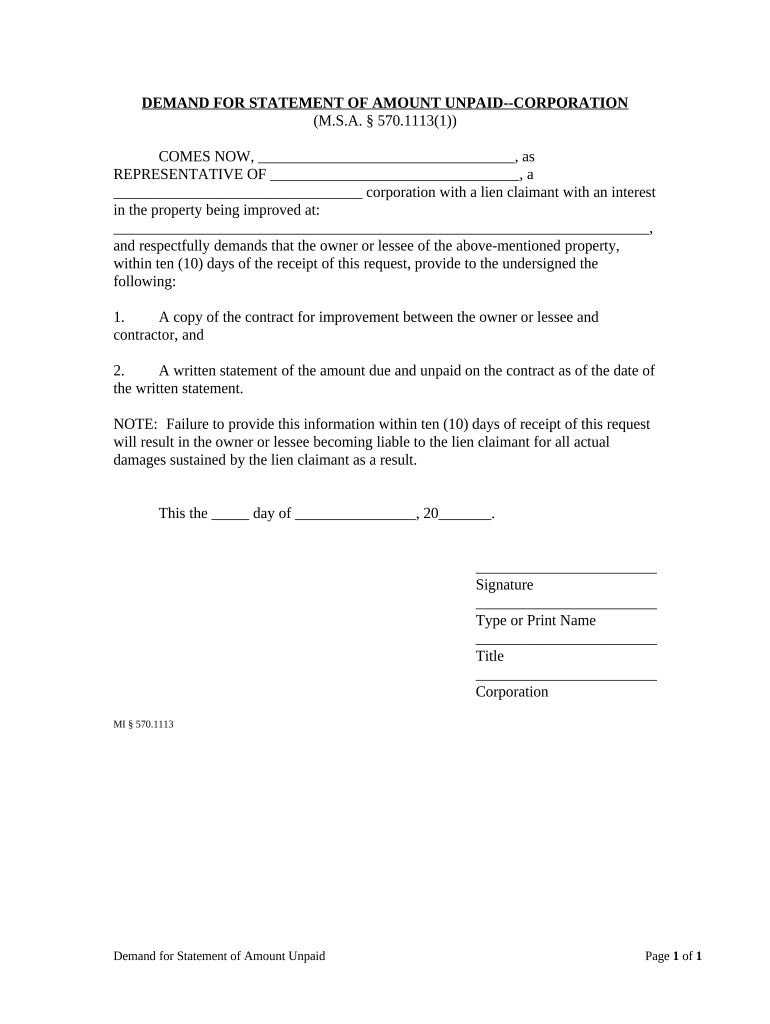

Amount Corporation Michigan Form

What is the Amount Corporation Michigan

The Amount Corporation Michigan is a legal entity established under Michigan state law. It serves various purposes, including conducting business, holding assets, or facilitating transactions. This corporation type is essential for individuals and businesses seeking to operate in a formalized manner within the state. Understanding its structure and function is crucial for compliance with local regulations.

Steps to complete the Amount Corporation Michigan

Completing the Amount Corporation Michigan involves several key steps:

- Determine the purpose of your corporation.

- Choose a unique name that complies with Michigan naming requirements.

- File the Articles of Incorporation with the Michigan Department of Licensing and Regulatory Affairs.

- Obtain an Employer Identification Number (EIN) from the IRS.

- Draft corporate bylaws that outline the governance of your corporation.

- Hold an organizational meeting to adopt the bylaws and appoint officers.

Legal use of the Amount Corporation Michigan

The legal use of the Amount Corporation Michigan is defined by state laws and regulations. This corporation type provides limited liability protection to its owners, meaning personal assets are generally protected from business debts. It can be used for various purposes, including operating a business, holding investments, or managing real estate. Compliance with state laws is essential to maintain its legal status.

Required Documents

To establish the Amount Corporation Michigan, several documents are required:

- Articles of Incorporation

- Bylaws

- Employer Identification Number (EIN)

- Meeting minutes from the organizational meeting

These documents ensure that the corporation is legally recognized and operates within the framework of Michigan law.

Form Submission Methods (Online / Mail / In-Person)

Submitting the necessary forms for the Amount Corporation Michigan can be done through various methods:

- Online: Use the Michigan Department of Licensing and Regulatory Affairs website to file electronically.

- Mail: Send completed forms to the appropriate state office via postal service.

- In-Person: Visit the local office to submit documents directly.

Choosing the right submission method can streamline the process and ensure timely processing of your corporation's formation.

Eligibility Criteria

To qualify for establishing the Amount Corporation Michigan, several eligibility criteria must be met:

- The corporation must have a unique name that complies with state regulations.

- At least one incorporator must be at least eighteen years old.

- The purpose of the corporation must be lawful and clearly stated in the Articles of Incorporation.

Meeting these criteria is essential for successful incorporation and operation within Michigan.

Quick guide on how to complete amount corporation michigan

Complete Amount Corporation Michigan effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Amount Corporation Michigan on any platform with airSlate SignNow Android or iOS applications and streamline any document-based tasks today.

How to modify and eSign Amount Corporation Michigan with ease

- Obtain Amount Corporation Michigan and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal authenticity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about missing or lost files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign Amount Corporation Michigan and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Michigan demand trial?

A Michigan demand trial refers to a legal proceeding requested in the state of Michigan where parties seek a trial after a certain point in litigation. This process is often initiated when there is a disagreement over facts that need to be resolved in a formal court setting. Understanding this procedure is vital for those involved in legal disputes.

-

How can airSlate SignNow assist with Michigan demand trial documentation?

airSlate SignNow streamlines the process of preparing, sending, and eSigning documents required for a Michigan demand trial. By using our platform, you can easily secure signatures and manage your trial documents effectively, ensuring you're organized as you navigate the litigation process. Our user-friendly interface makes it simple to stay compliant with legal standards.

-

What pricing plans does airSlate SignNow offer for handling Michigan demand trials?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes managing Michigan demand trials. You can choose from various tiers that include features tailored to ease your document management and eSigning needs. Our cost-effective solutions ensure that you get premium services without breaking the bank.

-

What features does airSlate SignNow provide to support Michigan demand trials?

Key features of airSlate SignNow include customizable document templates, robust eSignature capabilities, and secure document storage. These tools facilitate the preparation and completion of necessary documentation for a Michigan demand trial, streamlining the legal process signNowly. Additionally, real-time tracking ensures you're always aware of document statuses.

-

How do integrations improve the experience for Michigan demand trial users?

Integrations are crucial for users involved in Michigan demand trials as they allow seamless connectivity with other platforms, such as CRM or document management systems. airSlate SignNow's integrations enhance productivity by synchronizing information across tools you already use, simplifying your workflow for trial preparation and documentation. This interconnected approach minimizes errors and saves valuable time.

-

What are the benefits of using airSlate SignNow for Michigan demand trials?

Utilizing airSlate SignNow for Michigan demand trials provides numerous benefits, including increased efficiency in document handling and improved compliance with legal requirements. The platform's ease of use will help you navigate complex legal documents with confidence, while its secure eSigning features help protect sensitive information. Overall, it enhances collaboration among parties involved in litigation.

-

Can airSlate SignNow help with the automation of processes related to Michigan demand trials?

Yes, airSlate SignNow can signNowly enhance automation in processes related to Michigan demand trials. By automating repetitive tasks involved in document preparation and signing, you can focus more on the strategic aspects of your case management. Automation helps streamline workflows, reduce manual errors, and expedite the resolution process.

Get more for Amount Corporation Michigan

- Connect your care health claim form uhr umd

- Active reading freshwater ecosystems answer key form

- Event attendance list form

- Inspection checklist energy star modular home prescripti research alliance form

- Form 16aa

- Prospetto liquidazione imposte successione editabile form

- Pdf tica statement ampamp privacy act acknowledgement form palace

- Form antigua amp barbuda prime ministers scholarship

Find out other Amount Corporation Michigan

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word