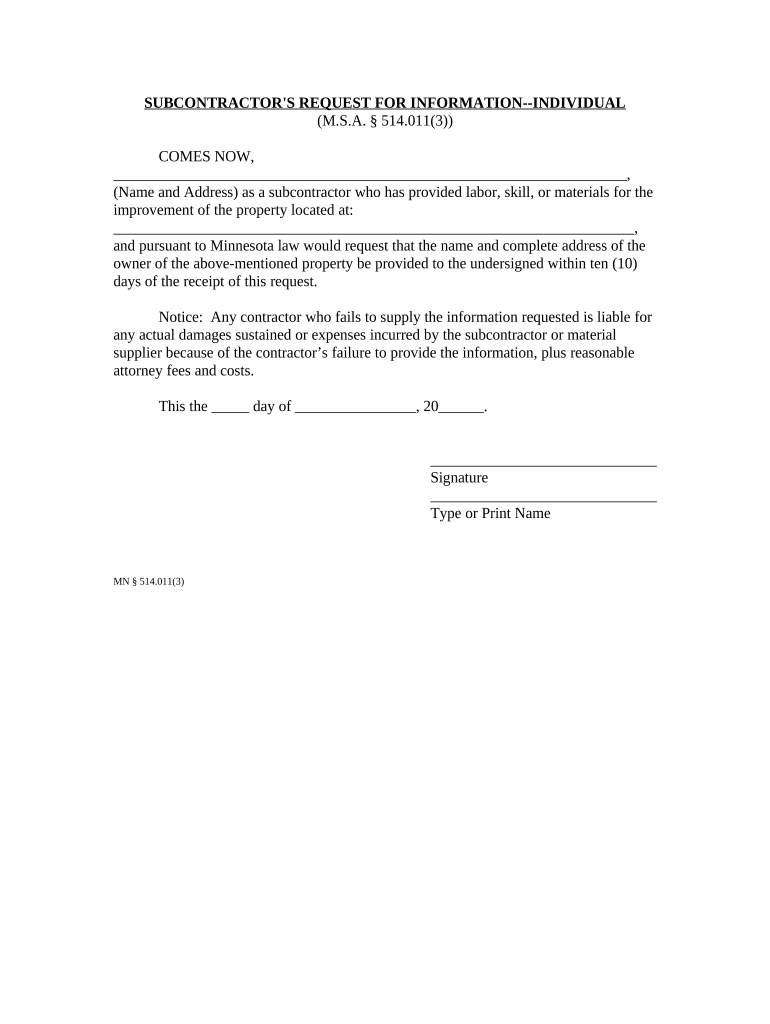

Minnesota Subcontractor Form

What is the Minnesota Subcontractor

The Minnesota subcontractor form is a legal document used by contractors to outline the terms and conditions of work performed by subcontractors in the state of Minnesota. This form serves to establish a formal agreement between the primary contractor and the subcontractor, detailing the scope of work, payment terms, and responsibilities of each party. It is essential for ensuring that all parties are aware of their obligations and rights under the contract.

How to use the Minnesota Subcontractor

Using the Minnesota subcontractor form involves several key steps. First, the primary contractor must fill out the form with accurate details regarding the project and the subcontractor's responsibilities. This includes specifying the work to be completed, the timeline for completion, and the payment structure. Once the form is completed, both the contractor and subcontractor should review it carefully to ensure all terms are clear and agreeable. After both parties sign the document, it becomes legally binding.

Steps to complete the Minnesota Subcontractor

Completing the Minnesota subcontractor form requires a systematic approach:

- Gather necessary information about the project and subcontractor.

- Clearly outline the scope of work to be performed.

- Specify payment terms, including amounts and due dates.

- Include any relevant deadlines or milestones.

- Ensure both parties review the document for accuracy.

- Obtain signatures from both the contractor and subcontractor.

Legal use of the Minnesota Subcontractor

The legal use of the Minnesota subcontractor form hinges on compliance with state laws regarding contracts. It must include essential elements such as clear terms, mutual consent, and lawful purposes. Both parties should retain a signed copy of the form for their records. In case of disputes, having a well-documented subcontractor agreement can provide critical evidence in legal proceedings.

Key elements of the Minnesota Subcontractor

Key elements of the Minnesota subcontractor form include:

- Scope of Work: A detailed description of the tasks to be performed.

- Payment Terms: Clearly defined payment schedules and amounts.

- Timeline: Specific deadlines for project completion.

- Responsibilities: Outline of each party's obligations.

- Signatures: Required signatures from both parties to validate the agreement.

State-specific rules for the Minnesota Subcontractor

In Minnesota, specific rules apply to subcontractor agreements, including compliance with state licensing requirements and adherence to labor laws. It is important for contractors to ensure that subcontractors are properly licensed and insured. Additionally, contractors should familiarize themselves with Minnesota's construction laws, which may affect the terms of the subcontractor agreement.

Quick guide on how to complete minnesota subcontractor

Effortlessly prepare Minnesota Subcontractor on any device

The management of online documents has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary forms and store them securely online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents quickly and without hassle. Manage Minnesota Subcontractor on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to modify and electronically sign Minnesota Subcontractor with ease

- Locate Minnesota Subcontractor and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using specific tools provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or errors that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Minnesota Subcontractor to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it benefit a Minnesota subcontractor?

airSlate SignNow is an eSignature solution designed for efficiency. For a Minnesota subcontractor, it streamlines the signing process, saving time and reducing paperwork. By automating document workflows, subcontractors can focus more on their core tasks.

-

How much does airSlate SignNow cost for Minnesota subcontractors?

The pricing for airSlate SignNow is competitive and tailored for Minnesota subcontractors. Plans start as low as $8 per user per month, ensuring that subcontractors of all sizes can afford this essential tool. Additionally, a free trial is available to help you explore its features.

-

What features make airSlate SignNow ideal for Minnesota subcontractors?

Key features of airSlate SignNow include customizable templates, real-time tracking, and cloud storage. For Minnesota subcontractors, these features help manage contracts efficiently, ensuring important documents are always accessible and secure. This enhances productivity and collaboration.

-

Is airSlate SignNow secure for Minnesota subcontractors to use?

Absolutely! airSlate SignNow employs industry-leading security protocols to protect sensitive documents. Minnesota subcontractors can rest assured that their data is encrypted and stored safely, meeting compliance requirements and industry standards.

-

Can airSlate SignNow integrate with other tools used by Minnesota subcontractors?

Yes, airSlate SignNow offers seamless integrations with various applications commonly used by Minnesota subcontractors. Tools like Google Drive, Salesforce, and Dropbox can be connected easily, promoting efficiency and centralizing document management.

-

How does airSlate SignNow improve contract turnaround for Minnesota subcontractors?

With airSlate SignNow, Minnesota subcontractors can expect signNowly faster contract turnaround times. The platform allows for instant sending, signing, and storage of documents, minimizing delays associated with traditional paper processes. This enhances client satisfaction and project timelines.

-

What customer support options are available for Minnesota subcontractors using airSlate SignNow?

airSlate SignNow offers robust customer support, including live chat, email assistance, and extensive online resources. Minnesota subcontractors can access help at any time, ensuring they can effectively utilize all features of the platform without interruption.

Get more for Minnesota Subcontractor

- Ecvo eye test form

- Power of attorney georgia form

- Ups claim form 247375330

- Como llenar el formato sf 001 323502390

- Non resident alien nra certification statement 206699518 form

- Renunciation form has to fill on line

- Enrollment form for group dhmo benefits a metlife

- Ice cream shop employee handbook form

Find out other Minnesota Subcontractor

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement