Tax Declaration Fatca Form

What is the Tax Declaration FATCA

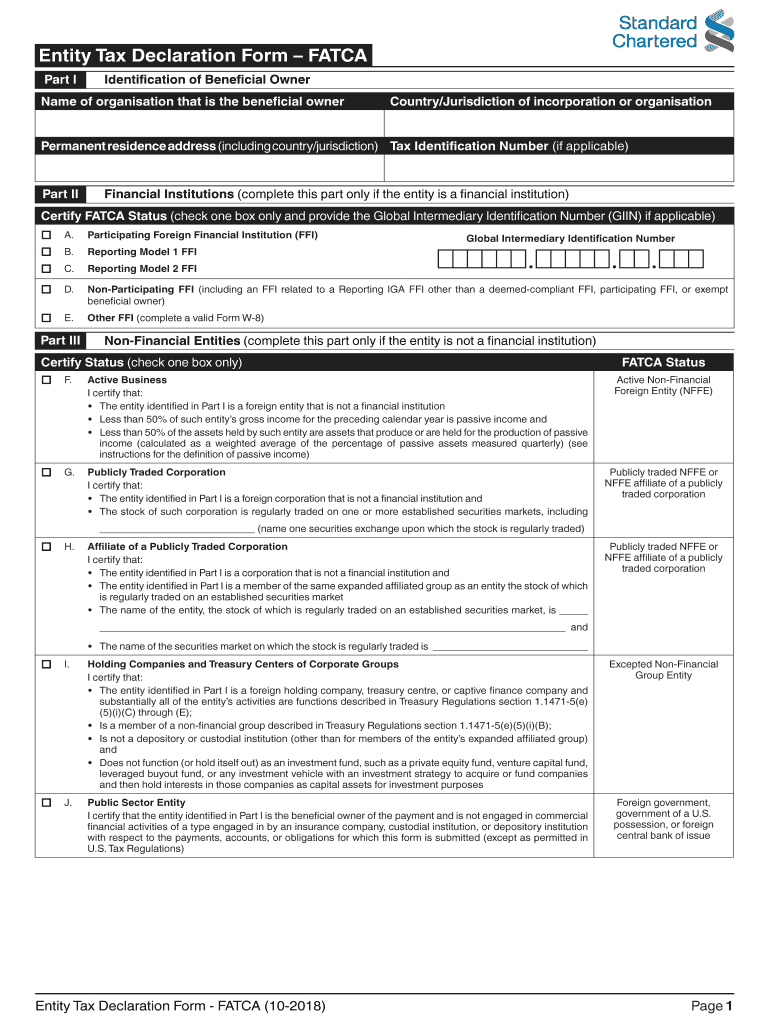

The Tax Declaration FATCA, or Foreign Account Tax Compliance Act, is a U.S. law aimed at combating tax evasion by U.S. persons holding accounts and other financial assets outside the United States. This declaration form is essential for reporting foreign financial accounts and ensuring compliance with U.S. tax obligations. It requires financial institutions to report information about accounts held by U.S. taxpayers, thereby increasing transparency and accountability in international finance.

How to Use the Tax Declaration FATCA

Using the Tax Declaration FATCA involves several steps to ensure accurate reporting of foreign financial assets. First, individuals must determine if they meet the reporting thresholds based on their total foreign assets. Next, they should gather necessary documentation, such as bank statements and account details. The form can be completed electronically or on paper, depending on the preference of the taxpayer. After filling out the form, it must be submitted to the IRS along with any required supporting documents.

Steps to Complete the Tax Declaration FATCA

Completing the Tax Declaration FATCA involves a systematic approach:

- Determine Eligibility: Assess whether your foreign financial assets exceed the reporting threshold.

- Gather Documentation: Collect all relevant financial information, including account balances and identification of financial institutions.

- Fill Out the Form: Accurately complete the declaration form, ensuring all required fields are addressed.

- Review for Accuracy: Double-check all entries to avoid mistakes that could lead to penalties.

- Submit the Form: File the completed form with the IRS by the specified deadline, either electronically or via mail.

Legal Use of the Tax Declaration FATCA

The legal use of the Tax Declaration FATCA is crucial for compliance with U.S. tax laws. Failure to file the form can result in significant penalties, including fines and potential legal action. It is important for taxpayers to understand their obligations under FATCA and to ensure that they are accurately reporting their foreign financial holdings. This form serves not only as a tool for compliance but also as a safeguard against tax evasion.

Required Documents

When completing the Tax Declaration FATCA, several documents are required to support the information provided. These typically include:

- Bank statements from foreign accounts

- Documentation of ownership for foreign financial assets

- Identification details of the financial institutions

- Any previous tax returns that may be relevant

Having these documents ready will streamline the process and help ensure that the form is completed accurately.

Penalties for Non-Compliance

Non-compliance with the Tax Declaration FATCA can lead to severe penalties. Taxpayers who fail to file the form or provide inaccurate information may face fines that can reach thousands of dollars. Additionally, the IRS may impose a penalty of up to ten thousand dollars for each violation. Understanding these consequences emphasizes the importance of timely and accurate reporting of foreign financial accounts.

Quick guide on how to complete tax declaration fatca

Complete Tax Declaration Fatca effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Manage Tax Declaration Fatca on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Tax Declaration Fatca with ease

- Locate Tax Declaration Fatca and click Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign Tax Declaration Fatca and ensure excellent communication at any phase of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax declaration fatca

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is a declaration form FATCA?

A declaration form FATCA is a document used to report certain financial information to the IRS as required by the Foreign Account Tax Compliance Act (FATCA). It helps foreign financial institutions identify U.S. taxpayers and ensure compliance with U.S. tax laws. Using airSlate SignNow for your declaration form FATCA makes the process seamless and legally binding.

-

How can airSlate SignNow assist with the completion of a declaration form FATCA?

airSlate SignNow streamlines the process of completing your declaration form FATCA by providing easy eSigning features and secure document storage. The platform allows users to fill in the necessary details, sign electronically, and share the finished document efficiently. This reduces errors and enhances compliance, ensuring you meet FATCA requirements.

-

Is there a cost associated with using airSlate SignNow for declaration form FATCA?

Yes, airSlate SignNow offers competitive pricing plans tailored to meet various business needs. You can choose a plan that includes unlimited document signing, making it a cost-effective solution for managing your declaration form FATCA and other documents. Check our website for details on pricing options.

-

What features does airSlate SignNow offer for managing declaration form FATCA?

airSlate SignNow offers several features that are ideal for managing your declaration form FATCA, including customizable templates, in-person signing, and automated workflows. Additionally, it provides audit trails and document tracking to ensure transparency during the signing process. These tools enhance efficiency and keep your documents organized.

-

Can I integrate airSlate SignNow with other software for declaration form FATCA?

Absolutely! airSlate SignNow offers integrations with popular software platforms, allowing you to link your declaration form FATCA process with your existing tools. This seamless integration can enhance productivity by automating workflows and simplifying document management. Explore our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for FATCA compliance?

Using airSlate SignNow for FATCA compliance provides several benefits, including enhanced security, legally binding electronic signatures, and improved workflow efficiency. It eliminates paper-related tasks and minimizes the risk of errors in your declaration form FATCA. Businesses can ensure timely submissions and stay compliant with minimal hassle.

-

Is airSlate SignNow secure for handling sensitive declaration form FATCA information?

Yes, airSlate SignNow prioritizes the security of your sensitive information. The platform uses advanced encryption protocols to protect your declaration form FATCA and other documents. Additionally, it complies with industry standards, ensuring that your data remains confidential and secure during the signing and submission process.

Get more for Tax Declaration Fatca

- Csp rlb form

- To obtain an employment application robson communities form

- Form 1023 ez eligibility worksheet national pta pta

- Engg assingment cover page blank form

- California form demand 2012

- Rs 2050 form

- Fill out a kmart application online form

- Driver license liability insurance certification allstar underwriters form

Find out other Tax Declaration Fatca

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors