Minnesota Corporation Mn Form

Understanding the Minnesota Corporation

The Minnesota Corporation, often referred to as an MN corporation, is a legal entity formed under Minnesota state law. It provides a structure for businesses to operate while offering limited liability protection to its owners. This means that the personal assets of shareholders are generally protected from business debts and liabilities. Establishing a Minnesota corporation involves filing specific documents with the Secretary of State and adhering to state regulations.

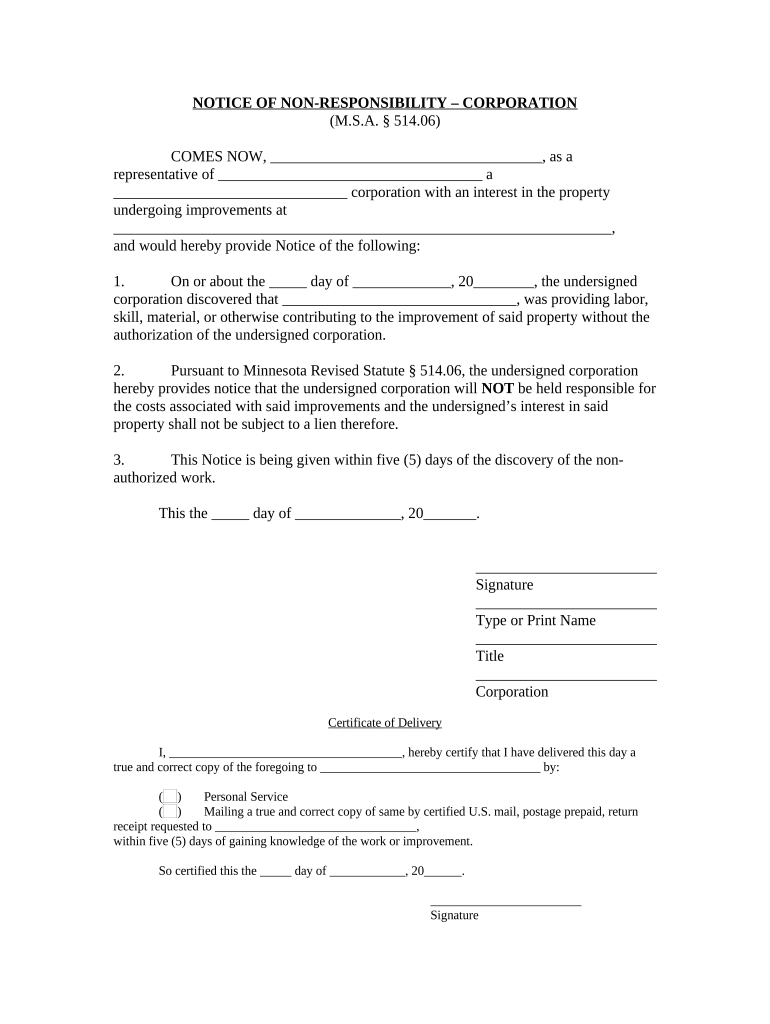

Steps to Complete the Minnesota Notice Form

Completing the Minnesota notice form involves several key steps to ensure compliance and legal validity. First, gather all necessary information, including the corporation's name, address, and the nature of the business. Next, ensure that the form is filled out accurately, as any errors may lead to delays or rejections. After completing the form, review it carefully for completeness and accuracy before submitting it. The final step is to submit the form via the appropriate method, whether online or through mail.

Legal Use of the Minnesota Notice

The Minnesota notice serves as an official declaration regarding the business's status and activities. It is crucial for maintaining transparency and compliance with state regulations. This notice can be used to inform the public of the corporation's existence and any changes in its status. Legal use of the Minnesota notice is essential for protecting the rights of the corporation and its stakeholders, ensuring that all parties are informed of the business's operations.

Key Elements of the Minnesota Notice

Several key elements must be included in the Minnesota notice to ensure its effectiveness and legal standing. These elements typically include the corporation's name, the address of its principal office, the name and address of the registered agent, and a brief description of the business activities. Additionally, the notice should specify the date of incorporation and any amendments made to the original filing. Including these elements helps establish the corporation's legitimacy and compliance with state laws.

Filing Deadlines and Important Dates

Filing deadlines for the Minnesota notice are critical to maintaining compliance with state regulations. Typically, the notice must be filed within a specific timeframe after the corporation's formation or any significant changes to its status. It is essential to stay informed about these deadlines to avoid penalties or legal complications. Keeping a calendar of important dates related to filings and renewals can help ensure that the corporation remains in good standing.

Form Submission Methods

There are various methods for submitting the Minnesota notice form, including online submissions, mail, and in-person filings. Online submissions are often the quickest and most efficient way to file, allowing for immediate confirmation of receipt. Mail submissions should be sent to the appropriate state office, and it is advisable to use a trackable mailing option. In-person filings can be made at designated state offices, providing an opportunity to ask questions and receive assistance if needed.

Penalties for Non-Compliance

Failure to file the Minnesota notice form or to comply with state regulations can result in significant penalties. These may include fines, loss of good standing status, and potential legal actions against the corporation. It is crucial for business owners to understand the implications of non-compliance and to prioritize timely and accurate filings to avoid these consequences. Regularly reviewing compliance requirements can help mitigate risks associated with penalties.

Quick guide on how to complete minnesota corporation mn

Complete Minnesota Corporation Mn effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the correct templates and securely save them online. airSlate SignNow provides all the features necessary to generate, adjust, and eSign your documents promptly without holdups. Manage Minnesota Corporation Mn on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and eSign Minnesota Corporation Mn with ease

- Obtain Minnesota Corporation Mn and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would prefer to share your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Minnesota Corporation Mn to ensure outstanding communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Minnesota notice and why is it important?

A Minnesota notice is a legal document used to inform parties about key information or actions required under Minnesota law. It is crucial for ensuring compliance and can protect your rights in various legal situations. Understanding the nuances of a Minnesota notice can help individuals and businesses avoid legal disputes.

-

How can airSlate SignNow help with sending Minnesota notices?

AirSlate SignNow provides an easy-to-use platform for creating and sending Minnesota notices quickly and efficiently. With our eSigning features, you can ensure that your documents are signed legally and securely. This streamlines the process, allowing you to focus on your business.

-

Is there a cost associated with using airSlate SignNow for Minnesota notices?

Yes, airSlate SignNow offers various pricing plans designed to cater to different business needs. Our plans provide excellent value for sending Minnesota notices and include features like templates and integration options. You can choose the plan that best fits your budget and requirements.

-

Are there features that specifically support Minnesota notices?

Absolutely! AirSlate SignNow has customizable templates that accommodate the requirements of Minnesota notices. You can easily modify these templates to meet your specific needs, ensuring compliance with Minnesota regulations while saving time and effort.

-

Can I integrate airSlate SignNow with other software for Minnesota notices?

Yes, airSlate SignNow offers seamless integrations with various software applications that can enhance your document management process for Minnesota notices. By integrating with your existing tools, you can streamline workflows and enhance productivity. This flexibility allows for better organization and tracking of notices.

-

What are the benefits of using airSlate SignNow for managing Minnesota notices?

Using airSlate SignNow for managing Minnesota notices offers numerous benefits, such as increased efficiency, cost savings, and legal compliance. The platform helps reduce paperwork and manual errors while ensuring that your notices are sent and received promptly. This enhances your overall business operations.

-

How secure is airSlate SignNow when handling Minnesota notices?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like Minnesota notices. We implement industry-leading security measures, including data encryption and secure servers, to protect your information. You can trust us to keep your documents safe throughout the signing process.

Get more for Minnesota Corporation Mn

Find out other Minnesota Corporation Mn

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy