Minnesota Property Form

What is the Minnesota Property Form

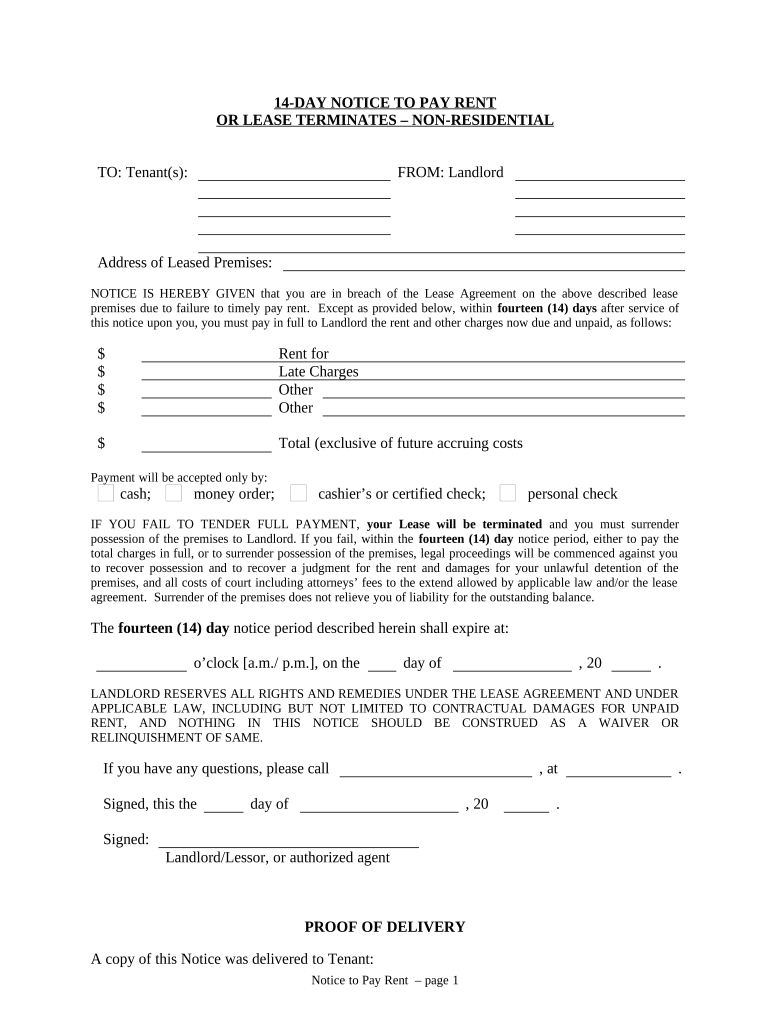

The Minnesota property form is a legal document used primarily in rental situations, specifically for notifying tenants about lease termination or eviction. This form is essential for landlords to communicate their intent to end a tenancy, providing tenants with a clear understanding of their rights and responsibilities. It typically outlines the reasons for the notice and the timeline for vacating the premises, adhering to state laws governing landlord-tenant relationships.

How to use the Minnesota Property Form

Using the Minnesota property form involves several key steps to ensure compliance with legal requirements. First, landlords must fill out the form accurately, including all necessary details such as the tenant's name, property address, and the specific reason for the notice. Once completed, the form should be delivered to the tenant in a manner that complies with state regulations, which may include personal delivery, certified mail, or posting at the rental property. It is crucial for landlords to retain a copy of the notice for their records.

Steps to complete the Minnesota Property Form

Completing the Minnesota property form requires attention to detail. Follow these steps:

- Gather information: Collect all relevant details about the tenant and the property.

- Select the correct form: Ensure you are using the latest version of the Minnesota property form.

- Fill out the form: Provide accurate information, including the reason for the notice and the date by which the tenant must vacate.

- Review for accuracy: Double-check all entries to avoid errors that could delay the process.

- Deliver the form: Send the completed form to the tenant using a legally acceptable method.

Legal use of the Minnesota Property Form

The legal use of the Minnesota property form is governed by state laws that dictate how notices must be issued and the timelines involved. For a notice to be legally binding, it must comply with the Minnesota Statutes, which outline the required notice periods and acceptable reasons for termination. This ensures that tenants are given fair warning and the opportunity to respond or remedy any issues before eviction proceedings can begin.

State-specific rules for the Minnesota Property Form

In Minnesota, specific rules apply to the use of property forms, particularly regarding the notice periods required for different types of tenancy. For example, a fourteen-day notice may be necessary for certain lease violations, while other situations may require a longer notice period. Understanding these state-specific regulations is crucial for landlords to ensure that their notices are valid and enforceable in a court of law.

Examples of using the Minnesota Property Form

Examples of using the Minnesota property form include scenarios such as a landlord notifying a tenant of lease violations, such as non-payment of rent or unauthorized occupants. Another example is when a landlord decides to terminate a month-to-month lease agreement, providing the tenant with the required notice. Each situation may require a different approach, but the fundamental purpose of the form remains the same: to communicate the landlord's intent clearly and legally.

Quick guide on how to complete minnesota property form

Complete Minnesota Property Form seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Minnesota Property Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Minnesota Property Form effortlessly

- Obtain Minnesota Property Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to store your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Minnesota Property Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 'Minnesota 14 day' trial offered by airSlate SignNow?

The 'Minnesota 14 day' trial allows users in Minnesota to explore airSlate SignNow's features without any commitment. During this period, you can send and eSign documents to see how our platform can streamline your workflow. This trial aims to provide you with a risk-free opportunity to test our cost-effective solution.

-

How much does airSlate SignNow cost after the 'Minnesota 14 day' trial?

After the 'Minnesota 14 day' trial, pricing plans for airSlate SignNow vary based on the level of features you need. We offer flexible and affordable options, ensuring that individuals and businesses of all sizes can find a plan that suits their budget. Detailed pricing information can be found on our website.

-

What features are included in the 'Minnesota 14 day' trial of airSlate SignNow?

During the 'Minnesota 14 day' trial, you will have full access to a variety of features including document templates, customizable workflows, and team collaboration tools. This allows you to evaluate how airSlate SignNow can effectively enhance your document management process. Experience the ease of eSigning and document sharing firsthand.

-

Can I integrate airSlate SignNow with other software during the 'Minnesota 14 day' trial?

Yes, during the 'Minnesota 14 day' trial, you can explore how airSlate SignNow integrates with various applications, such as Google Drive, Salesforce, and more. This seamless integration helps you streamline your workflow and enhances productivity. Discover how our solution can fit into your existing tech stack.

-

Is the 'Minnesota 14 day' trial available for teams or just individuals?

The 'Minnesota 14 day' trial of airSlate SignNow is available for both individuals and teams. This allows organizations to assess how our eSigning solution can meet their unique needs. Teams can collaborate effectively during the trial to evaluate its impact on their productivity.

-

What support options are available during the 'Minnesota 14 day' trial?

Throughout the 'Minnesota 14 day' trial, airSlate SignNow offers various support options including live chat, email assistance, and an extensive knowledge base. Our dedicated customer support team is available to help you navigate any questions or technical issues you may encounter. This ensures you get the most out of your trial experience.

-

Are there any limitations in the 'Minnesota 14 day' trial of airSlate SignNow?

The 'Minnesota 14 day' trial of airSlate SignNow provides full access to all features, but there may be limits on the number of documents you can send or sign. This way, you can still evaluate the platform's capabilities while understanding its scalability based on your needs. For specific limitations, refer to the trial terms on our website.

Get more for Minnesota Property Form

- Air commercial real estate blank form rmtn 0 8 03e

- Flydubai visa application form

- 800 241 5308 form

- Oc bus promo code form

- Donation request form if you are a non profit toys for tots toysfortots

- Payloadsdirectory list 2 3 small txt at master github form

- Ipc plumbing exam john white johnrwhite form

- Pell city dental center pc new patient forms pell city dental center pc new patient forms

Find out other Minnesota Property Form

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now