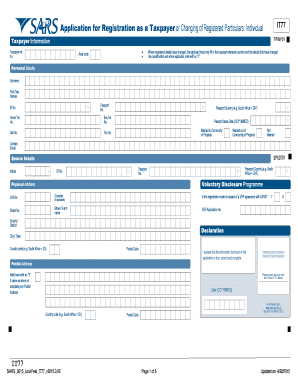

Tax Number Application Form 2015-2026

What is the Tax Number Application Form

The Tax Number Application Form is a crucial document for individuals and businesses seeking to obtain a tax identification number. This number is essential for various tax-related activities, including filing tax returns, opening bank accounts, and applying for loans. The form collects vital information about the applicant, such as their name, address, and Social Security number or Employer Identification Number. Understanding this form is the first step in ensuring compliance with tax regulations.

Steps to Complete the Tax Number Application Form

Completing the Tax Number Application Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including identification and proof of residency. Next, fill out the form with accurate information, ensuring that all fields are completed. It is important to double-check the entries for any errors. After completing the form, sign it and prepare it for submission. Depending on the method chosen, you may need to send it online, by mail, or submit it in person.

Required Documents

When applying for a tax number, specific documents are required to support your application. Typically, you will need to provide a government-issued identification, such as a driver's license or passport, to verify your identity. Additionally, proof of residency, such as a utility bill or lease agreement, may be necessary. If you are applying as a business entity, documentation related to your business formation, such as articles of incorporation, is also required.

Legal Use of the Tax Number Application Form

The Tax Number Application Form serves a legal purpose, establishing your identity and tax status with the Internal Revenue Service (IRS). It is important to complete the form accurately, as providing false information can lead to penalties and legal repercussions. Once submitted, the information is used to issue a unique tax identification number, which is essential for compliance with federal and state tax laws.

Form Submission Methods

There are several methods to submit the Tax Number Application Form, allowing flexibility based on your preferences. You can complete the form online through the IRS website, which is often the fastest method. Alternatively, you may choose to print the form and mail it to the appropriate IRS address. In-person submission is also an option at designated IRS offices. Each method has its own processing times, so consider your needs when choosing a submission method.

Eligibility Criteria

Eligibility for obtaining a tax number through the Tax Number Application Form varies based on your status as an individual or business entity. Individuals must provide valid identification and meet residency requirements. Businesses must be legally registered and provide documentation proving their formation. Understanding these criteria is essential to ensure a smooth application process and avoid delays.

Quick guide on how to complete tax number application form 75190407

Effortlessly Complete Tax Number Application Form on Any Device

Digital document management has gained traction among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed files, as you can easily locate the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Tax Number Application Form from any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The Most Effective Method to Alter and Electronically Sign Tax Number Application Form with Ease

- Locate Tax Number Application Form and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant portions of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Tax Number Application Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax number application form 75190407

Create this form in 5 minutes!

How to create an eSignature for the tax number application form 75190407

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is sars registration taxpayer and why is it important?

SARS registration taxpayer refers to the process of registering with the South African Revenue Service as a taxpayer. This is important as it allows individuals and businesses to comply with tax laws, avoid penalties, and access various tax benefits. Successful sars registration taxpayer ensures you are eligible for tax deductions and exemptions.

-

How can airSlate SignNow assist with the sars registration taxpayer process?

AirSlate SignNow can streamline the sars registration taxpayer process by enabling you to electronically sign and send required documents quickly. With our secure platform, you can ensure that all submission documents are accurate and submitted on time, minimizing the risk of delays or issues with SARS.

-

Is airSlate SignNow a cost-effective solution for managing sars registration taxpayer documents?

Yes, airSlate SignNow offers a cost-effective solution for managing your sars registration taxpayer documents through affordable pricing plans. We provide various subscription options suitable for individuals and businesses, ensuring that you get excellent value while efficiently handling your tax-related documentation.

-

What features does airSlate SignNow offer to enhance my sars registration taxpayer experience?

AirSlate SignNow offers features like customizable templates, real-time tracking, and secure document storage to enhance your sars registration taxpayer experience. These tools help you manage your documents effectively, ensuring you can easily access, edit, and finalize your tax-related submissions without stress.

-

Are there any integrations with other software for sars registration taxpayer management?

Absolutely! AirSlate SignNow integrates seamlessly with popular software solutions, enhancing your sars registration taxpayer management capabilities. We support integrations with CRM systems, document management tools, and other applications, making it easier to incorporate electronic signatures into your existing workflow.

-

What benefits can I expect when using airSlate SignNow for my sars registration taxpayer needs?

By using airSlate SignNow for your sars registration taxpayer needs, you can expect increased efficiency, reduced turnaround time, and higher compliance levels. Our electronic signing solution helps you avoid common paperwork delays and ensures you meet all the requirements set by SARS quickly and effectively.

-

Is airSlate SignNow user-friendly for those unfamiliar with digital tools for sars registration taxpayer?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for everyone, including those unfamiliar with digital tools for sars registration taxpayer. Our intuitive interface guides you through the signing process and provides helpful resources for support whenever needed.

Get more for Tax Number Application Form

- Instructions for application for determination of moral character and calbar ca form

- Agreement to purchase and sell lots or vacant land form

- Superannuation standard choice form

- Florida enhanced life estate deed individual to individual form

- Cml disclosure of incentives bformb consultations rics

- Tender form for non gst registered entities australia post

- Critical observation report rules regulations and columbus form

- Farm income amp expense worksheet form

Find out other Tax Number Application Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors