Minnesota Mortgage Foreclosure Form

Understanding the Minnesota Mortgage Foreclosure

The Minnesota mortgage foreclosure process involves legal proceedings initiated by lenders to reclaim property when homeowners default on their mortgage payments. This process is governed by state laws and can vary depending on the type of foreclosure, which may be either judicial or non-judicial. In Minnesota, most foreclosures are non-judicial, meaning they do not require court involvement. Understanding the specifics of this process is crucial for homeowners facing potential foreclosure, as it outlines their rights and responsibilities.

Steps to Complete the Minnesota Mortgage Foreclosure

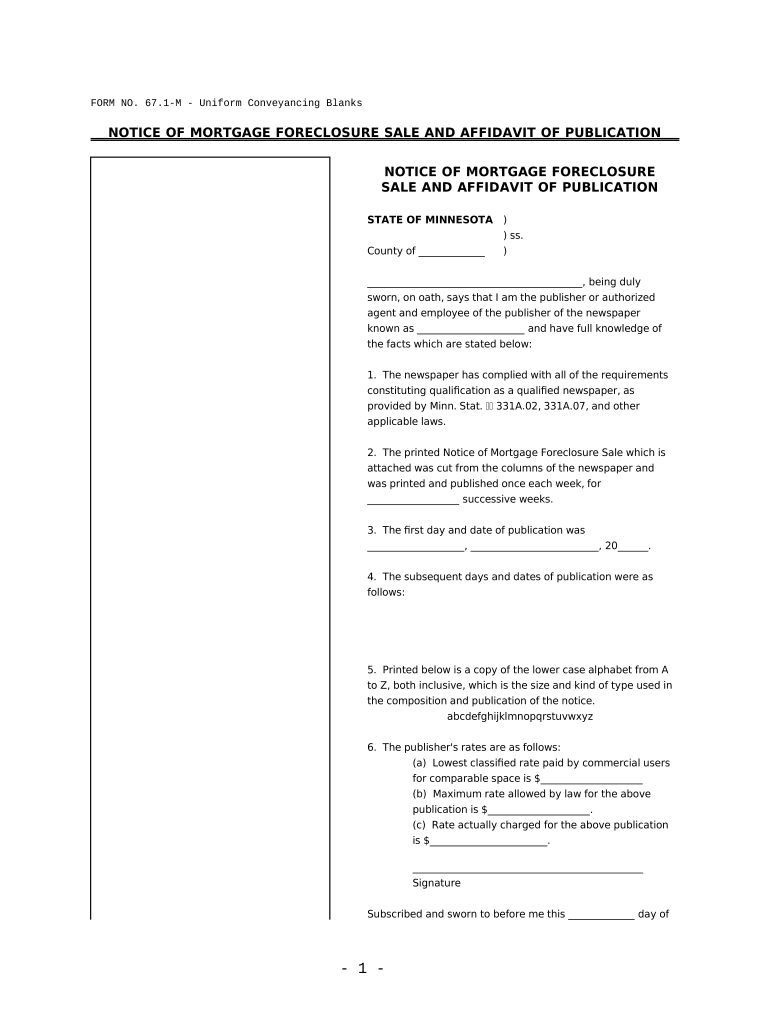

Completing the Minnesota mortgage foreclosure process requires several important steps. Initially, the lender must send a notice of default to the borrower, informing them of the missed payments. Following this, the lender may initiate the foreclosure process by filing a notice of mortgage foreclosure sale with the county recorder. This notice must include details such as the property description, the amount due, and the date of the foreclosure sale. Homeowners have the right to redeem their property by paying off the debt within a specified redemption period, which can vary based on the type of foreclosure.

Key Elements of the Minnesota Mortgage Foreclosure

Several key elements define the Minnesota mortgage foreclosure process. These include the notice requirements, the redemption period, and the auction process. The notice must be sent to the borrower at least four weeks before the sale, providing them with ample opportunity to address the default. The redemption period typically lasts for six months, allowing the homeowner to reclaim their property by settling the outstanding debt. If the homeowner fails to redeem the property, it will be sold at auction to the highest bidder.

Legal Use of the Minnesota Mortgage Foreclosure

Legal compliance is essential in the Minnesota mortgage foreclosure process. Both lenders and borrowers must adhere to state laws governing foreclosures to ensure that the process is valid and enforceable. This includes proper notice requirements, adherence to timelines, and the right to contest the foreclosure in court if necessary. Homeowners should be aware of their legal rights, such as the ability to negotiate with lenders or seek assistance from housing counselors, which can provide support during this challenging time.

Required Documents for Minnesota Mortgage Foreclosure

Several documents are necessary for the Minnesota mortgage foreclosure process. These typically include the mortgage agreement, the notice of default, and the notice of mortgage foreclosure sale. Additionally, any correspondence between the lender and borrower regarding missed payments should be documented. Having these documents organized and readily available can help streamline the process and ensure that all legal requirements are met.

Filing Deadlines and Important Dates

Timeliness is critical in the Minnesota mortgage foreclosure process. Key deadlines include the notice of default, which must be sent within a specific timeframe after the first missed payment. The notice of mortgage foreclosure sale must also be filed within a designated period before the auction date. Homeowners should be aware of these important dates to safeguard their rights and explore options for preventing foreclosure.

Quick guide on how to complete minnesota mortgage foreclosure

Accomplish Minnesota Mortgage Foreclosure seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as a perfect eco-conscious alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without interruptions. Manage Minnesota Mortgage Foreclosure on any device using airSlate SignNow Android or iOS applications and simplify your document-related processes today.

The most effective way to modify and eSign Minnesota Mortgage Foreclosure effortlessly

- Locate Minnesota Mortgage Foreclosure and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or redact confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Minnesota Mortgage Foreclosure and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is MN foreclosure and how does it work?

MN foreclosure refers to the legal process by which a lender can reclaim property due to unpaid mortgage obligations in Minnesota. Understanding MN foreclosure is crucial for property owners, and the process involves several steps including default notices and auctions. It is essential to stay informed to protect your financial interests.

-

How can airSlate SignNow assist in the MN foreclosure process?

airSlate SignNow provides an efficient way to manage documents related to MN foreclosure, allowing users to send and eSign contracts and agreements swiftly. Our platform ensures that all necessary paperwork can be completed efficiently, reducing the time it takes to handle foreclosure documents. This helps both lenders and borrowers streamline the process.

-

What features does airSlate SignNow offer for handling MN foreclosure documents?

Our platform offers features such as templates, secure eSigning, and document tracking, which are crucial for the MN foreclosure process. Users can create customized foreclosure notices and agreements that comply with Minnesota laws. Additionally, our intuitive interface makes it easy to use these features without extensive training.

-

Is airSlate SignNow affordable for those dealing with MN foreclosure?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for individuals and businesses managing MN foreclosure situations. Our competitive rates ensure that you have access to essential documentation tools without overspending. This affordability makes it easier to manage the financial aspects associated with a foreclosure.

-

Can airSlate SignNow integrate with other tools for managing MN foreclosure?

Absolutely! airSlate SignNow offers seamless integrations with various CRM and document management systems that can aid in the MN foreclosure process. This integration ensures that all your documents are organized and accessible across platforms, enhancing your efficiency and workflow during challenging times.

-

What benefits does using airSlate SignNow provide for MN foreclosure documentation?

Using airSlate SignNow simplifies the creation and management of MN foreclosure documents, providing quicker turnaround times for eSignatures. This efficiency helps to reduce the stress and complexity often associated with foreclosure. Additionally, our platform enhances accuracy and compliance, ensuring that you meet all legal requirements.

-

How do I get started with airSlate SignNow for MN foreclosure needs?

Getting started with airSlate SignNow is simple! Just sign up for an account, and you'll have access to our suite of tools tailored for MN foreclosure documents. Our user-friendly interface makes it easy to upload documents, create templates, and send them for eSignature.

Get more for Minnesota Mortgage Foreclosure

Find out other Minnesota Mortgage Foreclosure

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free