Arkansas Diamond Deferred Compensation Plan 2012

What is the Arkansas Diamond Deferred Compensation Plan

The Arkansas Diamond Deferred Compensation Plan is a retirement savings program designed to help employees save for their future. This plan allows participants to defer a portion of their salary into a tax-advantaged account, which can grow over time without immediate taxation. The funds can be accessed upon retirement or in certain hardship situations, providing financial flexibility and security for employees. The plan is particularly beneficial for state employees, offering a structured way to enhance their retirement savings beyond traditional pension plans.

How to use the Arkansas Diamond Deferred Compensation Plan

Using the Arkansas Diamond Deferred Compensation Plan involves several key steps. First, employees must enroll in the program, which typically requires completing an application form. Once enrolled, participants can choose how much of their salary to defer and select investment options that align with their financial goals. It is essential to regularly review these choices to ensure they meet changing needs and market conditions. Additionally, understanding the withdrawal options and any potential penalties for early withdrawal is crucial for effective planning.

Steps to complete the Arkansas Diamond Deferred Compensation Plan

Completing the Arkansas Diamond Deferred Compensation Plan involves a series of straightforward steps. Begin by gathering necessary personal and financial information. Next, fill out the enrollment application accurately, ensuring all required fields are completed. After submission, monitor the plan's performance and make adjustments as needed. It is also advisable to consult with a financial advisor to optimize the plan's benefits and ensure compliance with IRS regulations. Regularly check for updates or changes to the plan that could affect your contributions or withdrawals.

Legal use of the Arkansas Diamond Deferred Compensation Plan

The legal use of the Arkansas Diamond Deferred Compensation Plan is governed by federal and state regulations. Participants must adhere to the guidelines set forth by the IRS regarding contribution limits and withdrawal rules. The plan is designed to be compliant with the Employee Retirement Income Security Act (ERISA), ensuring that participants' rights are protected. Understanding these legal frameworks is essential for participants to avoid penalties and maximize the benefits of their deferred compensation.

Eligibility Criteria

Eligibility for the Arkansas Diamond Deferred Compensation Plan typically includes state employees and certain government workers. Specific criteria may vary based on employment status, job classification, and length of service. It is important for potential participants to review the eligibility requirements carefully to determine if they qualify for the plan. In some cases, employees may need to meet minimum service requirements before enrolling.

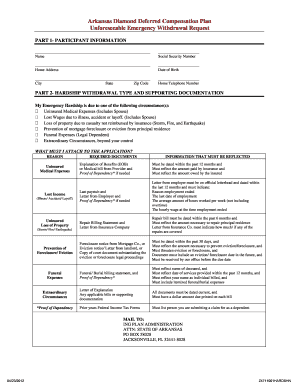

Required Documents

To enroll in the Arkansas Diamond Deferred Compensation Plan, participants must provide specific documents. These may include proof of employment, identification, and any previous retirement plan statements. Additionally, participants might need to submit a completed application form, which outlines their chosen contribution amounts and investment options. Ensuring that all documentation is accurate and complete will facilitate a smoother enrollment process.

Form Submission Methods

Submitting the Arkansas Diamond Deferred Compensation Plan form can typically be done through various methods. Employees may have the option to submit their forms online through a secure portal, by mail, or in-person at designated locations. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits the participant's needs. Online submission often provides quicker processing and confirmation, while in-person submissions allow for immediate assistance if questions arise.

Quick guide on how to complete arkansas diamond deferred compensation plan

Complete Arkansas Diamond Deferred Compensation Plan effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without interruptions. Manage Arkansas Diamond Deferred Compensation Plan on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Arkansas Diamond Deferred Compensation Plan with ease

- Locate Arkansas Diamond Deferred Compensation Plan and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Arkansas Diamond Deferred Compensation Plan and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arkansas diamond deferred compensation plan

Create this form in 5 minutes!

How to create an eSignature for the arkansas diamond deferred compensation plan

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Arkansas Diamond Deferred Compensation Plan?

The Arkansas Diamond Deferred Compensation Plan is a retirement savings option that allows employees to set aside a portion of their salary on a tax-deferred basis. By utilizing this plan, participants can boost their retirement savings while enjoying tax benefits, making it a smart option for long-term financial planning.

-

How does the Arkansas Diamond Deferred Compensation Plan work?

The Arkansas Diamond Deferred Compensation Plan allows participants to choose the amount they want to defer from their paychecks, which is then invested in various options. Employees do not pay income taxes on the deferred amounts until they withdraw the funds during retirement, providing tax advantages and potential growth for their investments.

-

What are the benefits of enrolling in the Arkansas Diamond Deferred Compensation Plan?

Enrolling in the Arkansas Diamond Deferred Compensation Plan provides signNow benefits, including tax savings, potential investment growth, and improved retirement security. Additionally, it helps employees manage their income during retirement, ensuring they have the financial resources needed for a comfortable lifestyle.

-

What features are included in the Arkansas Diamond Deferred Compensation Plan?

The Arkansas Diamond Deferred Compensation Plan offers a range of features such as flexible contribution limits, multiple investment options, and online account management. Participants can customize their investment strategies to align with their individual financial goals, making it a versatile choice for retirement planning.

-

Is there any cost associated with the Arkansas Diamond Deferred Compensation Plan?

The Arkansas Diamond Deferred Compensation Plan typically does not have direct costs for participants, as contributions are deducted from your paycheck before taxes. However, there may be fees associated with specific investment options or services within the plan that participants should review to understand their total costs.

-

How can I integrate the Arkansas Diamond Deferred Compensation Plan with my current retirement accounts?

Integrating the Arkansas Diamond Deferred Compensation Plan with your current retirement accounts can enhance your overall savings strategy. It's essential to consult with a financial advisor who can help coordinate contributions and investment strategies across all accounts to maximize retirement benefits efficiently.

-

Can employers offer the Arkansas Diamond Deferred Compensation Plan to their employees?

Yes, employers can offer the Arkansas Diamond Deferred Compensation Plan as part of their benefits package. This plan can help attract and retain talent by providing employees with additional savings options for their retirement, ultimately benefiting both the employer and the employees.

Get more for Arkansas Diamond Deferred Compensation Plan

- Who fills out kansas department of revenue for pr 74a form

- Proof of summons washington courts form

- Escrow agreement fidelity title company form

- How to fill formimm 5257

- Domestic relations financial affidavit form

- Shippler service patent pdf download form

- Designation of homestead and non homestead affidavit form

- Form 19 776671995

Find out other Arkansas Diamond Deferred Compensation Plan

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template