Mn Reconciliation Form

What is the Minnesota Trust Account?

The Minnesota Trust Account is a financial arrangement established to hold and manage funds on behalf of another party, often used in legal and fiduciary contexts. This account ensures that the funds are safeguarded and used according to the specific instructions of the trustor. In Minnesota, these accounts are governed by state laws that outline the responsibilities of trustees and the rights of beneficiaries.

Typically, a Minnesota Trust Account is utilized by attorneys, real estate agents, and financial advisors to manage client funds securely. This can include earnest money deposits in real estate transactions or client retainers in legal practices. The account is designed to provide transparency and accountability, ensuring that funds are only disbursed as authorized.

Steps to Complete the Minnesota Trust Account

Completing the Minnesota Trust Account involves several key steps to ensure compliance with state regulations. First, it is essential to establish the account with a financial institution that offers trust account services. This typically requires providing documentation that outlines the purpose of the trust and the parties involved.

Next, fund the account according to the terms set forth in the trust agreement. It is crucial to maintain accurate records of all transactions, including deposits and withdrawals, to ensure transparency. Regular reconciliations should be performed to verify that the account balance aligns with the records, which is vital for maintaining compliance with legal standards.

Legal Use of the Minnesota Trust Account

The legal use of a Minnesota Trust Account is defined by state laws that govern fiduciary responsibilities. Trustees must act in the best interest of the beneficiaries, adhering to the terms of the trust agreement. This includes proper management of the funds and ensuring that they are used solely for the purposes outlined in the trust documentation.

Failure to comply with these legal standards can result in penalties or legal action against the trustee. It is essential for those managing a Minnesota Trust Account to be familiar with the relevant laws and regulations to avoid any potential issues.

State-Specific Rules for the Minnesota Trust Account

In Minnesota, specific rules govern the operation of trust accounts to ensure proper management and accountability. These rules include requirements for record-keeping, reporting, and the handling of funds. For example, trustees are required to maintain detailed records of all transactions and provide periodic reports to beneficiaries.

Additionally, Minnesota law mandates that trust accounts must be held in a financial institution that is insured and regulated. This provides an added layer of security for the funds held within the account. Understanding these state-specific rules is crucial for anyone involved in managing a Minnesota Trust Account.

Required Documents for the Minnesota Trust Account

To establish a Minnesota Trust Account, several documents are typically required. These may include a trust agreement, which outlines the terms and conditions of the trust, as well as identification documents for the trustee and beneficiaries. Financial institutions may also require proof of the trust's purpose and its compliance with state regulations.

Additionally, maintaining accurate records of all transactions is essential. This includes receipts for deposits and withdrawals, as well as any correspondence related to the trust. Keeping these documents organized and accessible is important for both legal compliance and effective trust management.

Form Submission Methods for the Minnesota Trust Account

When managing a Minnesota Trust Account, there are various methods for submitting required forms and documentation. These can include online submissions through the financial institution's secure portal, mailing physical documents, or delivering them in person. Each method has its advantages, and the choice may depend on the urgency of the submission and the preferences of the parties involved.

It is important to ensure that all submissions are completed accurately and in accordance with the institution's guidelines to avoid delays or complications in managing the trust account.

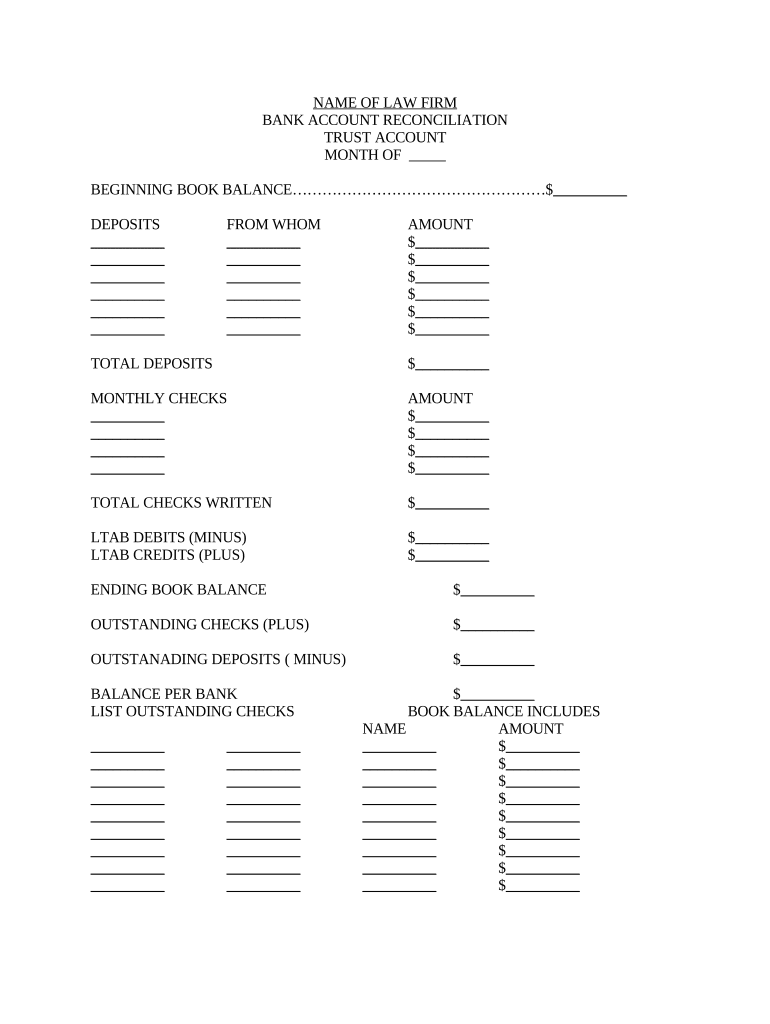

Quick guide on how to complete mn reconciliation

Manage Mn Reconciliation seamlessly on any device

Digital document administration has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to discover the suitable template and securely store it online. airSlate SignNow equips you with all the tools required to design, adjust, and electronically sign your documents swiftly without delays. Handle Mn Reconciliation on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

The simplest way to modify and electronically sign Mn Reconciliation effortlessly

- Find Mn Reconciliation and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight signNow sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign Mn Reconciliation and promote exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Minnesota trust account?

A Minnesota trust account is a financial account that a trustee holds on behalf of a beneficiary, ensuring that funds are managed according to specific legal requirements. Using airSlate SignNow, you can easily create, manage, and eSign documents related to trust accounts, ensuring compliance with Minnesota regulations.

-

How does airSlate SignNow help in managing a Minnesota trust account?

airSlate SignNow simplifies the management of a Minnesota trust account by allowing users to send documents for eSignature and track the signing process in real-time. With our robust features, you can ensure all agreements related to the trust account are securely stored and easily accessible.

-

What are the pricing options for airSlate SignNow for a Minnesota trust account?

airSlate SignNow offers flexible pricing plans tailored for different business needs, including those managing Minnesota trust accounts. Our plans include user-friendly tools and features, all at competitive rates to fit your budget and streamline your document processes.

-

Can I integrate airSlate SignNow with other tools for my Minnesota trust account?

Yes, airSlate SignNow offers seamless integrations with various applications and platforms that can help manage your Minnesota trust account. This includes tools for accounting, document storage, and client management, making your workflow efficient and centralized.

-

What features does airSlate SignNow provide for Minnesota trust accounts?

airSlate SignNow provides essential features for Minnesota trust accounts, including eSignature, document templates, and secure cloud storage. These tools ensure you can efficiently manage both trust documents and their associated signatures while maintaining compliance and security.

-

What are the benefits of using airSlate SignNow for my Minnesota trust account?

Using airSlate SignNow for your Minnesota trust account offers several benefits, including increased efficiency and reduced processing time for legal documents. The platform provides a user-friendly interface that simplifies the signing process, enabling quicker transactions and improved client satisfaction.

-

Is airSlate SignNow legally compliant for Minnesota trust accounts?

Yes, airSlate SignNow is designed with legal compliance in mind, ensuring that all electronic signatures for Minnesota trust accounts meet state and federal regulations. Our platform prioritizes security and authentication, allowing you to manage your trust accounts with confidence.

Get more for Mn Reconciliation

- Hooptax form

- Form 8 irish nationality and citizenship act 1956

- Axis bank dd form

- X ray referral form 278608993

- Lineman school mississippi form

- William c parker scholarship university of kentucky form

- The five step plan for creating personal mission statements form

- Travel guard application form insurance from aig singapore

Find out other Mn Reconciliation

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe