Mn Worksheet Form

What is the Mn Worksheet

The Mn worksheet is a specific form used primarily for tax purposes in the state of Minnesota. It is designed to assist taxpayers in calculating their tax liabilities and ensuring compliance with state tax regulations. The form collects essential information regarding income, deductions, and credits that apply to the taxpayer's situation. Understanding the Mn worksheet is crucial for accurate tax reporting and to avoid potential penalties.

How to use the Mn Worksheet

Using the Mn worksheet involves several steps that guide taxpayers through the process of reporting their income and calculating their tax obligations. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, follow the instructions provided on the worksheet, entering your income figures and applicable deductions in the designated sections. It is important to double-check all entries to ensure accuracy before submission.

Steps to complete the Mn Worksheet

Completing the Mn worksheet requires careful attention to detail. Here are the key steps:

- Collect all necessary documents, including income statements and receipts for deductions.

- Fill out your personal information at the top of the worksheet.

- Report your total income in the appropriate section.

- List any deductions you qualify for, ensuring to follow the guidelines provided.

- Calculate your total tax liability based on the information entered.

- Review the completed worksheet for accuracy before submission.

Legal use of the Mn Worksheet

The Mn worksheet must be filled out and submitted in accordance with Minnesota state tax laws to be considered legally valid. This includes adhering to deadlines for submission and ensuring that all information provided is accurate and complete. Failure to comply with these regulations can result in penalties, including fines or increased scrutiny from tax authorities.

Key elements of the Mn Worksheet

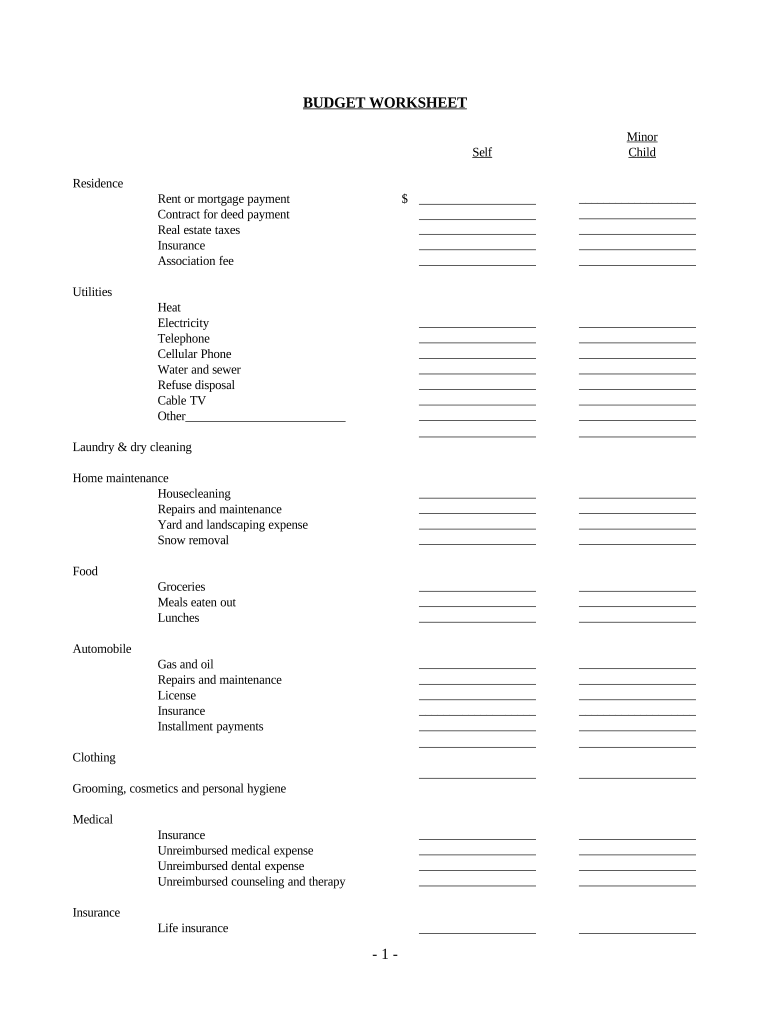

Several key elements are essential to the Mn worksheet, including:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Income Reporting: Taxpayers must report all sources of income, including wages, interest, and dividends.

- Deductions and Credits: This part allows taxpayers to claim deductions and credits that may reduce their overall tax liability.

- Final Tax Calculation: This section summarizes the total tax owed or refund expected based on the information provided.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines associated with the Mn worksheet. Typically, the deadline for submitting the worksheet aligns with the federal tax deadline, which is usually April fifteenth. However, taxpayers should verify specific dates each year as they may change. Late submissions can incur penalties, so timely filing is essential.

Quick guide on how to complete mn worksheet

Complete Mn Worksheet effortlessly on any device

Digital document management has become increasingly preferred by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents swiftly without delays. Manage Mn Worksheet on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric tasks today.

How to modify and electronically sign Mn Worksheet with ease

- Find Mn Worksheet and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Mn Worksheet and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an MN worksheet and how does it work with airSlate SignNow?

An MN worksheet is a document designed for organizing and managing important information in the state of Minnesota. With airSlate SignNow, you can easily upload your MN worksheet and utilize our eSigning features to collect signatures electronically, making the process more efficient and secure.

-

How can I create an MN worksheet using airSlate SignNow?

Creating an MN worksheet with airSlate SignNow is simple. Start by uploading your existing document or use our template library to find an appropriate MN worksheet template. After customization, you can invite others to eSign directly within the platform.

-

What are the pricing options for using airSlate SignNow for MN worksheets?

airSlate SignNow offers flexible pricing plans that cater to various business needs. You can choose from options like a monthly subscription or annual billing, which conveniently allows you to manage your MN worksheet expenses while benefiting from unlimited eSigning.

-

Are there any specific features of airSlate SignNow that support MN worksheets?

Yes, airSlate SignNow includes several features tailored to enhance your MN worksheet experience. You can annotate documents, add text fields, and utilize automated workflows, streamlining the signing process for you and your recipients.

-

Can I integrate airSlate SignNow with other tools to manage my MN worksheets?

Absolutely! airSlate SignNow easily integrates with popular tools such as Google Drive, Salesforce, and Dropbox. This allows you to store and manage your MN worksheets efficiently while leveraging the features of multiple platforms.

-

What are the benefits of using airSlate SignNow for MN worksheets?

Using airSlate SignNow for your MN worksheets accelerates document turnaround time and minimizes paperwork errors. The eSignature functionality ensures secure and legally binding approvals, enhancing both productivity and compliance with local regulations.

-

Is airSlate SignNow secure for handling sensitive MN worksheets?

Yes, airSlate SignNow prioritizes security by implementing advanced encryption protocols to protect your MN worksheets and data. With features such as multi-factor authentication, you can trust that your documents remain safe during the signing process.

Get more for Mn Worksheet

- Buildbase credit account form

- Angle relationships and solving equations 3 daniels math danielsmath form

- Worksheet elements of art vocabulary los angeles unified form

- Medicare part b fax cover sheet form

- Mutual rescission of lease 414531090 form

- Confirmation of cooperation and representation form 320 blank

- Guide report ars 17 362 amp r12 4 208 form

- Solicitud de afiliacion como asegurado cssorgpa form

Find out other Mn Worksheet

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form