Minnesota Exemption Form

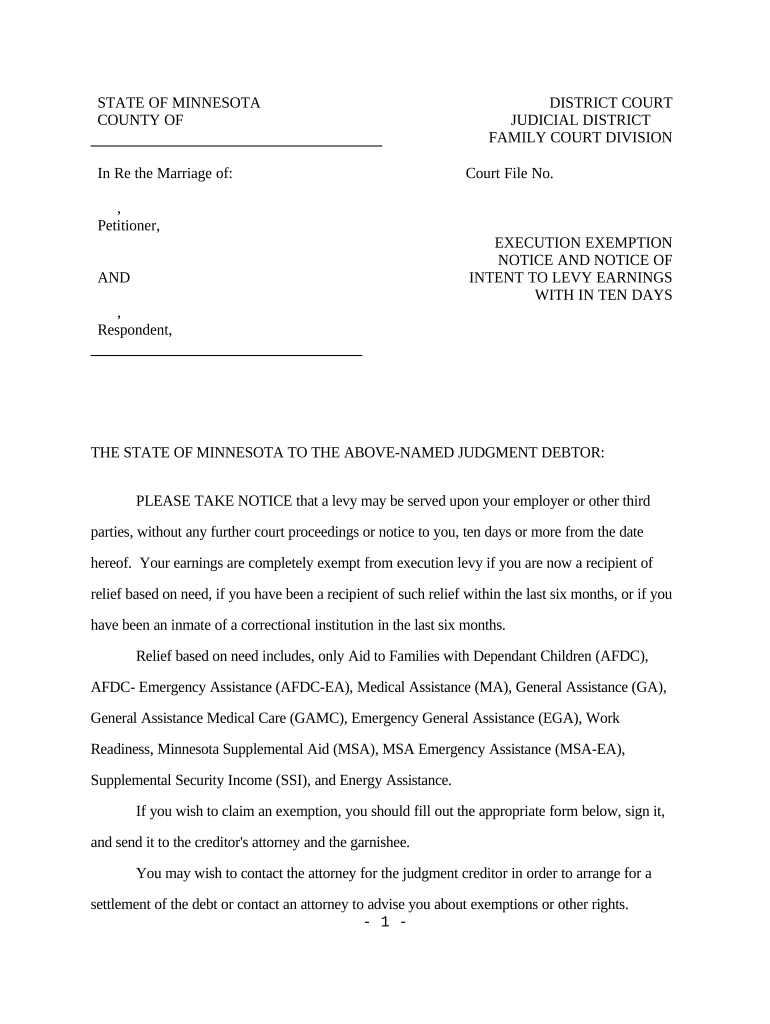

What is the Minnesota Exemption Form

The Minnesota exemption form is a legal document used to claim certain exemptions from garnishment or levy actions. This form is essential for individuals seeking to protect their income or assets from being seized to satisfy a debt. By completing this form, individuals can assert their rights under Minnesota law, which allows for specific exemptions based on income levels, types of income, and personal circumstances. Understanding the purpose and implications of the Minnesota exemption form is crucial for anyone facing potential garnishment.

How to use the Minnesota Exemption Form

Using the Minnesota exemption form involves several key steps. First, individuals must determine their eligibility based on their income and the nature of the debt. Next, they should accurately fill out the form, providing all required information, such as personal details and specifics about the income or assets they wish to protect. Once completed, the form must be filed with the appropriate court or agency, depending on the context of the garnishment. It is advisable to keep a copy of the submitted form for personal records and future reference.

Steps to complete the Minnesota Exemption Form

Completing the Minnesota exemption form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including proof of income and any relevant financial statements.

- Obtain the Minnesota exemption form from a reliable source, such as a legal aid office or the court's website.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for errors or omissions before submission.

- Submit the form to the appropriate court or agency, adhering to any specific filing instructions.

Key elements of the Minnesota Exemption Form

Several key elements must be included in the Minnesota exemption form for it to be valid. These elements typically include:

- Personal Information: Full name, address, and contact details of the individual filing the form.

- Income Details: Information regarding the type and amount of income being claimed as exempt.

- Signature: A signature affirming the accuracy of the information provided and the intent to claim the exemption.

- Supporting Documentation: Any required attachments that substantiate the claims made on the form.

Eligibility Criteria

Eligibility for claiming exemptions using the Minnesota exemption form is determined by several factors, including:

- Income level: Individuals must meet specific income thresholds to qualify for exemptions.

- Type of income: Certain types of income, such as Social Security benefits or disability payments, may be exempt from garnishment.

- Personal circumstances: Factors such as dependents or financial hardship can impact eligibility.

Legal use of the Minnesota Exemption Form

The legal use of the Minnesota exemption form is governed by state laws that outline the rights of individuals facing garnishment. Properly completing and submitting the form can protect individuals from unlawful seizure of their income or assets. It is important to understand the legal framework surrounding the exemption process, as failure to comply with these regulations can result in the loss of rights to claim exemptions.

Quick guide on how to complete minnesota exemption form

Complete Minnesota Exemption Form effortlessly on any gadget

Online document administration has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Minnesota Exemption Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Minnesota Exemption Form without hassle

- Find Minnesota Exemption Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of missing or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Minnesota Exemption Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Minnesota notice levy?

A Minnesota notice levy is a legal document that allows a creditor to collect a debt by seizing a debtor's property. This process ensures that the creditor is formally notifying the debtor of their intentions, which is crucial in the levy process. Understanding the intricacies of Minnesota notice levy can help businesses navigate their collections effectively.

-

How can airSlate SignNow assist with Minnesota notice levy documentation?

airSlate SignNow streamlines the process of creating and sending documents related to a Minnesota notice levy. Our easy-to-use platform allows users to quickly generate legally compliant documents, ensuring that all necessary information is included. This efficiency not only saves time but also reduces the risk of errors in important legal communications.

-

What are the benefits of using airSlate SignNow for legal document management?

Using airSlate SignNow for managing documents like Minnesota notice levy brings numerous benefits, such as increased efficiency, reduced paper usage, and enhanced security. The platform allows for electronic signatures, making it easier to obtain necessary approvals quickly. Additionally, our cloud-based solution ensures that documents are always accessible from anywhere, improving overall workflow.

-

Is airSlate SignNow cost-effective for managing Minnesota notice levy documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing all types of legal documents, including Minnesota notice levy forms. Our pricing plans are competitive and flexible, allowing businesses of all sizes to find a solution that fits their budget. By using our service, businesses can save on printing and mailing costs, further enhancing their financial efficiency.

-

Does airSlate SignNow integrate with other software for handling Minnesota notice levy cases?

Absolutely! airSlate SignNow offers integrations with various software platforms that can help streamline the workflow for handling Minnesota notice levy cases. Whether you are using CRM systems, project management tools, or document storage solutions, our platform can connect seamlessly to enhance efficiency. These integrations help ensure that all relevant information is easily accessible and organized.

-

What features does airSlate SignNow offer for document security related to Minnesota notice levy?

airSlate SignNow prioritizes document security with features such as encryption, two-factor authentication, and secure cloud storage. For sensitive documents like a Minnesota notice levy, these measures ensure that information is protected from unauthorized access. Additionally, our platform provides audit trails, allowing users to track document history and access, which is crucial for legal compliance.

-

Can I customize templates for Minnesota notice levy with airSlate SignNow?

Yes, airSlate SignNow allows users to customize templates specifically for Minnesota notice levy documents. This feature enables businesses to tailor their documents according to their specific requirements and legal standards. Customizable templates help save time and ensure consistency across all legal communications.

Get more for Minnesota Exemption Form

Find out other Minnesota Exemption Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors