Mn Filing Form

What is the Mn Filing

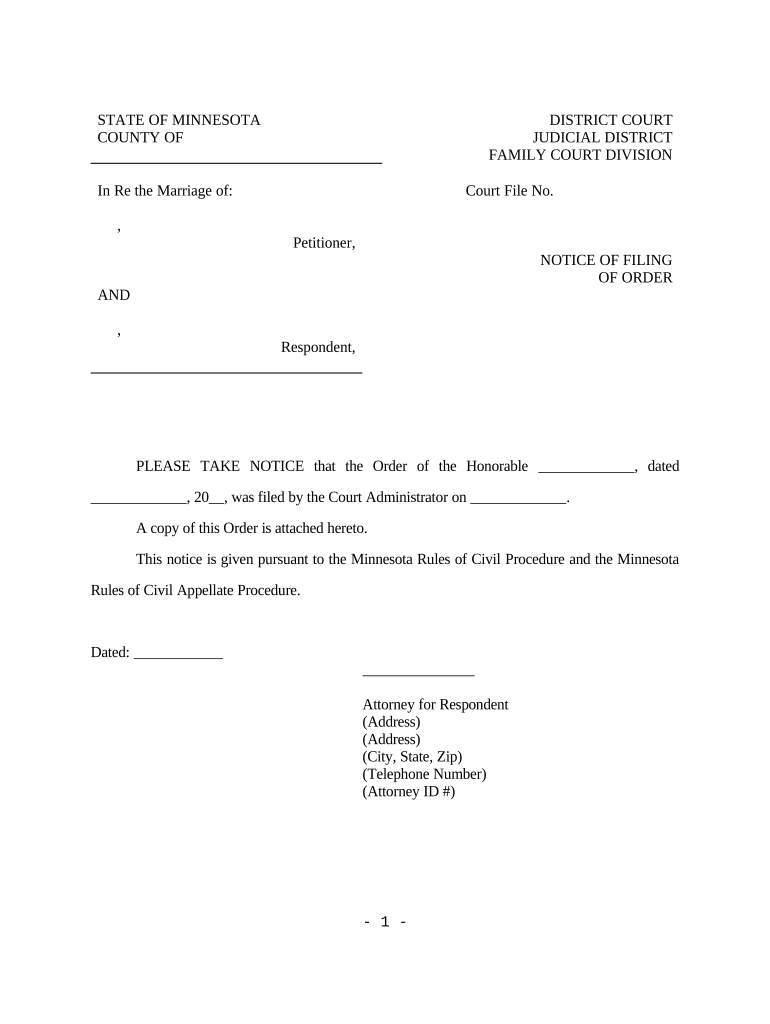

The Mn filing refers to the official documentation required for various legal and administrative purposes in Minnesota. This filing can encompass a range of documents, including notices, applications, and other forms that need to be submitted to state authorities. Each type of Mn filing serves a specific purpose, such as compliance with state regulations or legal requirements.

Steps to Complete the Mn Filing

Completing the Mn filing involves several key steps to ensure accuracy and compliance. First, gather all necessary information and documents relevant to your filing. Next, fill out the required forms, ensuring that all fields are completed accurately. After completing the forms, review them for any errors or omissions. Finally, submit the forms either online, by mail, or in person, depending on the specific requirements for your filing.

Legal Use of the Mn Filing

The legal use of the Mn filing is crucial for ensuring that documents are recognized by state authorities and courts. To be legally binding, the filing must comply with specific regulations and standards set forth by Minnesota law. This includes proper signatures, dates, and any required supporting documents. Utilizing a reliable electronic signature platform can enhance the legal standing of your Mn filing by ensuring compliance with eSignature laws.

Required Documents

When preparing for the Mn filing, certain documents may be required. These can include identification, proof of residency, and any relevant supporting documents specific to the nature of the filing. It is essential to check the specific requirements for your type of Mn filing to ensure that you include all necessary documentation.

Form Submission Methods

There are various methods for submitting the Mn filing, including online, by mail, or in person. Online submissions are often the most efficient, allowing for quicker processing times. Mail submissions require careful attention to ensure that documents are sent to the correct address and received by the appropriate deadline. In-person submissions may be necessary for certain filings that require immediate verification or additional documentation.

State-Specific Rules for the Mn Filing

Each state, including Minnesota, has specific rules governing the filing process. These rules can dictate everything from deadlines to the types of documents required. It is important to familiarize yourself with Minnesota's regulations to ensure compliance and avoid potential penalties. Consulting with a legal professional or using a trusted electronic filing service can help navigate these rules effectively.

Quick guide on how to complete mn filing

Easily Prepare Mn Filing on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without issues. Manage Mn Filing on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The Simplest Way to Modify and Electronically Sign Mn Filing Effortlessly

- Obtain Mn Filing and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you want to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Mn Filing, ensuring outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is MN filing and how does airSlate SignNow help?

MN filing refers to the electronic submission of documents with the Minnesota Secretary of State. With airSlate SignNow, users can easily prepare, sign, and send important documents needed for MN filing quickly and reliably, streamlining the submission process.

-

Are there costs associated with using airSlate SignNow for MN filing?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. These plans are designed to be cost-effective while providing comprehensive features necessary for efficient MN filing and document management.

-

What features does airSlate SignNow offer for MN filing?

airSlate SignNow includes features such as customizable templates, secure e-signatures, and document tracking, all essential for effective MN filing. These tools make it easier to manage the filing process and ensure compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for MN filing?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and more, enhancing your workflow efficiency for MN filing. This allows you to access and manage documents seamlessly across different platforms.

-

How does airSlate SignNow ensure the security of MN filing documents?

Security is a top priority for airSlate SignNow, which uses advanced encryption standards to protect your documents during MN filing. Additionally, it complies with industry regulations to safeguard sensitive information throughout the signing process.

-

Is airSlate SignNow suitable for small businesses needing MN filing solutions?

Yes, airSlate SignNow is an ideal solution for small businesses looking for an efficient and affordable MN filing system. Its user-friendly interface and robust features are tailored to meet the needs of businesses of all sizes.

-

What are the benefits of using airSlate SignNow for MN filing?

Using airSlate SignNow for MN filing helps you save time and minimize errors by automating document workflows. The platform also enhances collaboration among stakeholders, ensuring that all parties can easily participate in the filing process.

Get more for Mn Filing

Find out other Mn Filing

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile