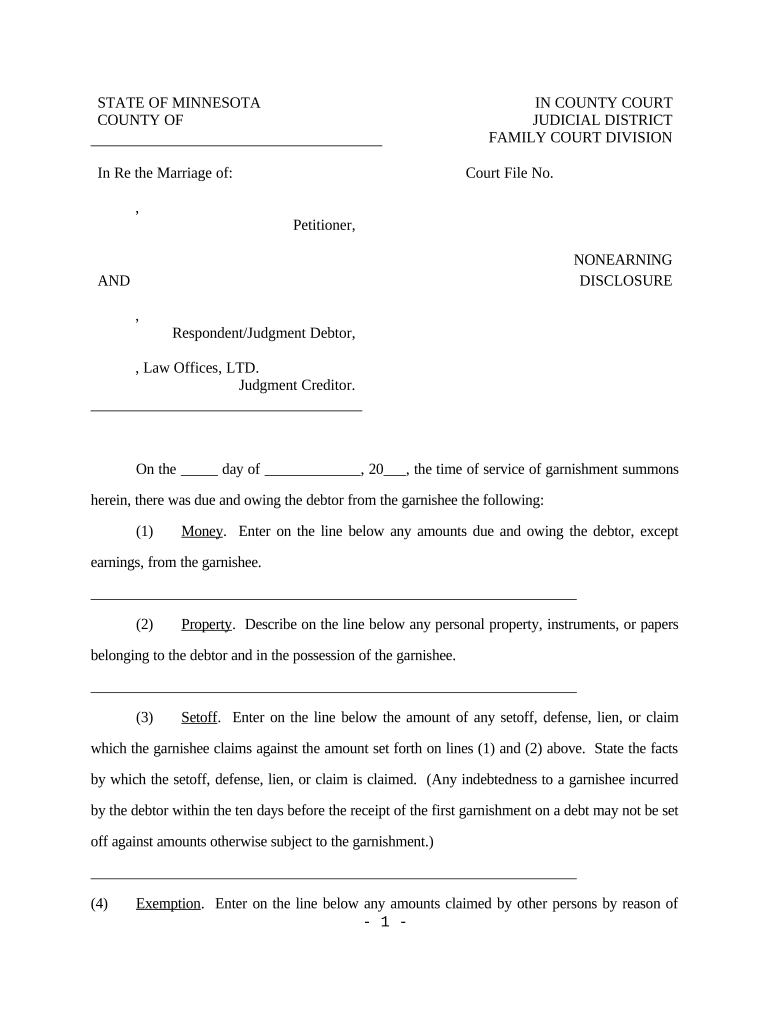

Nonearning Disclosure Minnesota Form

What is the Nonearning Disclosure Minnesota

The Nonearning Disclosure Minnesota is a specific form used primarily for reporting income status in the state of Minnesota. This form is essential for individuals who do not earn income and need to disclose their financial situation for various administrative purposes. It serves as a formal declaration that can be required for applications related to government assistance, tax exemptions, or other financial considerations. Understanding the purpose and implications of this form is crucial for ensuring compliance with state regulations.

How to use the Nonearning Disclosure Minnesota

Using the Nonearning Disclosure Minnesota involves several steps to ensure accurate completion and submission. First, gather all necessary personal information, including identification details and any relevant financial history. Next, fill out the form carefully, ensuring that all sections are completed truthfully. Once the form is filled out, it can be submitted electronically or in paper form, depending on the requirements of the requesting agency. Utilizing an electronic signature tool can enhance the process, making it more efficient and secure.

Steps to complete the Nonearning Disclosure Minnesota

Completing the Nonearning Disclosure Minnesota requires attention to detail. Follow these steps to ensure proper submission:

- Obtain the form from the appropriate state agency or website.

- Fill in your personal information, including name, address, and contact details.

- Clearly indicate your income status, confirming that you have no earnings.

- Review the form for accuracy and completeness.

- Sign the form electronically or manually, depending on your submission method.

- Submit the completed form to the designated agency, ensuring you follow any specific submission guidelines.

Legal use of the Nonearning Disclosure Minnesota

The legal use of the Nonearning Disclosure Minnesota is governed by state laws that dictate its applicability and requirements. This form is recognized as a legitimate document for reporting income status and must be completed accurately to avoid legal repercussions. Failing to disclose income correctly can lead to penalties or disqualification from benefits. It is important to understand the legal framework surrounding this form to ensure compliance and protect your rights.

Key elements of the Nonearning Disclosure Minnesota

Key elements of the Nonearning Disclosure Minnesota include the following:

- Personal Information: Full name, address, and contact details.

- Income Status: A clear declaration of no earnings.

- Signature: Required to validate the form.

- Date of Submission: Important for record-keeping and compliance.

Ensuring that these elements are accurately represented is vital for the form's acceptance by the relevant authorities.

State-specific rules for the Nonearning Disclosure Minnesota

State-specific rules for the Nonearning Disclosure Minnesota outline the requirements and processes unique to Minnesota residents. These rules may include deadlines for submission, specific agencies to which the form must be submitted, and any additional documentation that may be required. Familiarity with these rules is essential for ensuring that the form is processed without delays or complications.

Quick guide on how to complete nonearning disclosure minnesota

Effortlessly Manage Nonearning Disclosure Minnesota on Any Device

Digital document management has gained traction with businesses and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and store them securely online. airSlate SignNow provides all the features you need to create, edit, and eSign your documents quickly without any delays. Handle Nonearning Disclosure Minnesota on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to Modify and eSign Nonearning Disclosure Minnesota with Ease

- Obtain Nonearning Disclosure Minnesota and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your updates.

- Select how you want to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Alter and eSign Nonearning Disclosure Minnesota and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Nonearning Disclosure in Minnesota?

A Nonearning Disclosure in Minnesota is a financial document that outlines the absence of income for a specific period. This disclosure is important for various financial applications, including loans and leases, helping to provide transparency about your financial status.

-

How can airSlate SignNow help with Nonearning Disclosure in Minnesota?

airSlate SignNow streamlines the process of creating and signing your Nonearning Disclosure in Minnesota. Our platform allows you to quickly fill out templates and securely send documents for electronic signatures, ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for managing Nonearning Disclosures?

airSlate SignNow offers a variety of features tailored for Nonearning Disclosures in Minnesota, including customizable templates, document tracking, and seamless eSignature capabilities. These features ensure that your disclosures are created accurately and delivered promptly.

-

Is there a cost associated with using airSlate SignNow for Nonearning Disclosures?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for managing Nonearning Disclosures in Minnesota. Our plans simplify budgeting and provide great value for document handling.

-

Can I integrate airSlate SignNow with other tools for my Nonearning Disclosure processes?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, making it easy to manage Nonearning Disclosures in Minnesota alongside your favorite tools. This integration enhances workflow efficiency and keeps all your documents in sync.

-

What benefits does electronic signing provide for Nonearning Disclosures in Minnesota?

Electronic signing for Nonearning Disclosures in Minnesota ensures a faster turnaround time and eliminates the need for physical paperwork. This convenience not only saves time but also provides a secure and legally binding method of signing documents.

-

How secure is airSlate SignNow when handling my Nonearning Disclosure?

Security is a top priority at airSlate SignNow. When using our platform for your Nonearning Disclosure in Minnesota, you can trust that your documents are protected with advanced encryption and secure access controls, ensuring your data remains confidential.

Get more for Nonearning Disclosure Minnesota

Find out other Nonearning Disclosure Minnesota

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement